What is the Modern Monetary Theory? (II)

This is a second summary of the course "Modern Monetary Theory" given by Bill Mitchell on EDX . #MMT #BrettonWoods #FiatCurrency #Constraint

Welcome to our insightful guide on the Modern Monetary Theory (MMT). In this second article, we will delve into the fascinating world of MMT and explore its implications for the economy. MMT challenges conventional economic thinking by putting forward the idea that countries with fiat currencies, like the United States, aren't constrained by budget deficits in the same way countries under the Bretton Woods system were. By understanding MMT, you'll gain valuable insights into the role of government spending, taxes, and inflation. Join us on this journey as we break down the key principles of the Modern Monetary Theory and examine its potential impact on the global economy.

Large nations convened at Bretton Woods after the end of World War II to establish order in international payments and, consequently, to establish stable exchange rates. In this meeting, a fixed exchange rate system was adopted. So, how does the fixed exchange rate system work?

All currencies would be directly tied to the dollar, and the dollar, in turn, would be tied to gold. The value of 35 dollars would be equivalent to 1 ounce of gold. Under this system, when you purchase 35 dollars at the specified exchange rate, there is a guarantee that the U.S. Treasury will provide you with 1 ounce of gold.

According to this agreement, central banks have the right to intervene (buying and selling dollars) to keep the exchange rate within a 1% band above or below the established parity.

This system was believed to create stability worldwide, based on the limited supply of gold and the cautious approach of the U.S. Treasury and banks in creating dollars.

What challenges were faced:

Countries experiencing a current account deficit faced issues with the value of their currencies. As an analogy, consider this as a pool where a country provides its own currency extensively to the system, especially in comparison to other currencies, leading to a decrease in the value of its currency. This happens because, when engaging in imports, the country pays with its own currency, but when it exports, it receives other countries' currencies. The disproportionate contribution of its own currency to the system contributes to the devaluation of its currency against others.

As a solution to this, contractionary monetary and fiscal policies are implemented. However, the consequence of these policies is the emergence of unemployment. For a more detailed article on this matter, refer to the following link.

Nowadays, fiat currencies have emerged that are not linked to any value, unlike the previous system where currencies were connected through the dollar (which was also linked to gold).

Under the Bretton Woods system, both central banks and treasuries limited themselves in terms of money creation because an excessive increase in money supply could lead to the depreciation of exchange rates. Hence, any surplus liquidity injected into the market through spending was withdrawn through mechanisms like increased taxes or borrowing. The government operates under financial constraints. (I believe the fundamental idea here is based on the concept that liquidity is injected into the market through spending and withdrawn through taxation/borrowing.)

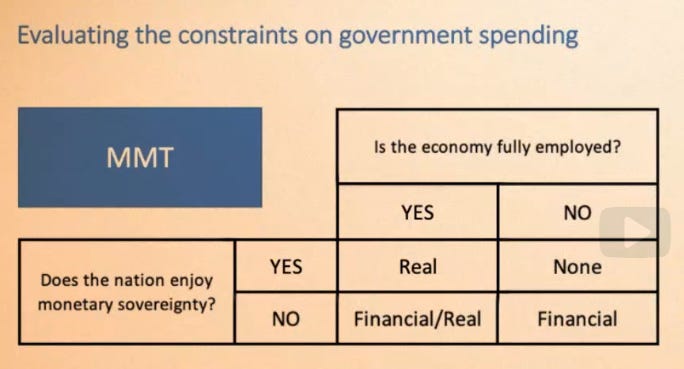

In the fiat currency system, this constraint has been completely eliminated for some states, particularly those with strong currencies. A strong currency is simply the currency widely used by everyone within the country for any purpose, eliminating the need for another currency. Here, it's worth emphasizing that the sole constraint on the government is the quantity of real resources (labor, land, capital) in the economy. Since the amount of resources needed for production is limited, an increase in money beyond this point will lead to inflation.

In the fiat currency system, money is not backed by a tangible commodity like gold. So, how do governments ensure that a piece of paper is accepted by people? They achieve this by collecting taxes and conducting expenditures using this currency. Bill Mitchell argues that without citizens having this money in their hands, they cannot pay taxes. The conclusion drawn here is that the government should first spend money, providing it to citizens, who would then use that money to pay taxes. This challenges the mainstream notion that the government must collect taxes before spending, emphasizing that this sequence of the government first spending is essential.

A strong state and full employment: You have a real resource constraint.

A strong state and insufficient employment: You don't have a real resource constraint.

A weak state and full employment: You have both financial and real resource constraints.

A weak state and insufficient employment: You have a financial resource constraint.

Engin YILMAZ (

)Source:

“Modern Monetary Theory and Practice:An Introductory Text”, William Mitchell, L. Randall Wray and Martin Watts

“Modern Money Theory A Primer on Macroeconomics for Sovereign Monetary Systems”,L. Randall Wray

“Modern Monetary Theory and the Birth of the People's Economy”, Stephanie Kelton

“Modern Monetary Theory and the Birth of the People's Economy”, Stephanie Kelton