What is the Modern Monetary Theory? (I)

This is a first summary of the course "Modern Monetary Theory" given by Bill Mitchell on EDX . You learn MMT basics from my summary. #financialconstraint, #sovereigncountry #fallacyofcomposition #MMT

What is Modern Monetary Theory (MMT)?

Key Principles of MMT

Welcome to the world of Modern Monetary Theory (MMT), where traditional notions of financial constraint are challenged.

In this article, we will delve into the core principles of MMT and shed light on what it means for a sovereign country's fiscal policy.

MMT argues that a currency-issuing sovereign government, such as the United States or the United Kingdom, is not constrained by the same budgetary restrictions as households or businesses.

By understanding the fallacy of composition, MMT suggests that these countries can use their fiscal policy to pursue full employment and control inflation, without the fear of bankruptcy.

Join us as we explore the key tenets and implications of this controversial economic theory. Get ready to challenge your preconceived notions and delve into the world of MMT.

The course given by Bill Mitchell on EDX is completely free of charge. The login page of the course is as follows.

Week 1 / 1.2 Household Analogy

One of the biggest mistakes people make is to equate the household economy with the economic policy of the state. In simple terms, it is a case of equating "a household managing its own budget with a state managing its own budget". If you hold this view, you think that "the state should do the same things as households do in managing their budgets".

In order to spend as a household, you need to have an income. Let's say you do not have any income. Respectively; you use your savings you have made before, you sell whatever you have, you look at it, you go and borrow. When you consider all of these as a whole, you realise that you are in a financial constraint.

Week 1 – Achieving Economic Literacy/1.3 Ground Zero 01:44

Very good, you realise that households have financial constraints.

The problem starts when you think that this constraint also applies to the state.

Of course, what we are talking about here is a strong state (sovereign countries). A strong state is a state that manages to use its currency in all monetary transactions within its borders. The official currency of the Mexican state is the peso. If Mexicans use this currency in all their transactions (including investment), this state is a strong state.

States that fall into this class of strong states do not have "financial constraints" (of course, they are not infinite).

Week 1 – Achieving Economic Literacy/1.3 Ground Zero 02:20

States do not have to have a resource/income like households. Governments do not have to collect taxes or borrow to spend (My rejection: they collect taxes and borrow because there is a legal constraint).

Stephanie Kelton / Deficit Myth, p:99

On this subject, I recommend Stephanie Kelton's Deficit Myth. Who would have thought that a book by a heterodox economist would become a best seller. The constant emphasis in Kelton's book can be explained with the simple graph above. The US Treasury can spend first and then collect what it spends from the market through taxes. (Note that in US practice, due to the law, spending requires tax collection and borrowing) Kelton wants the state to be more active in the economy by abolishing this article of law.

Week 1 / 1.3 The Fallacy of Composition

It is stated why the classical arguments for the solution of the 1929 crisis are wrong.

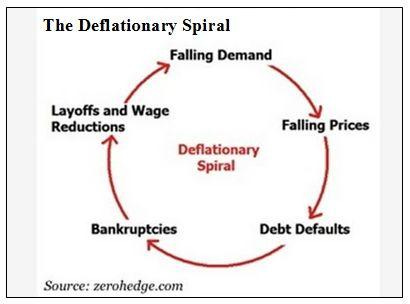

Keynes calls the view that what is valid for the individual will be valid for the sum of all individuals an error of composition. He explains this with the paradox of saving. The solution of classical economists in the face of crises is to reduce wages and less spending by the state. According to classical economists with this idea; if the individual spends less (saving), his income will increase. Unfortunately, if all individuals start saving, income will not increase. Because one person's income is another person's expenditure. Or let's simplify; let's say all individuals start saving, the demand for goods produced by firms will fall and firms will start laying off workers.

When this nonsense of the classics reaches the level of the state, things get out of hand. The state should do the same. It should spend less (austerity). Keynes explained that you cannot get out of the crisis with this mentality. According to Keynes, this logic puts the economy into a spiral . In fact, let's call it "a deflationary spiral".

Week 1 / 1.4 The stylised facts in macroeconomics

In this section, the example of Japan is given in response to the general fallacies of mainstream economists.

Japan's budget deficit to GDP ratio is 14 per cent.

The ratio of Japan's gross public debt to national income is 255 per cent.

The Bank of Japan bought 45% of government bonds.

So what did the mainstream economics books say? INFLATION HAPPENS, INTEREST RATE INCREASES, THE EXCLUSION EFFECT WORKS, YOU CANNOT BORROW, YOU GO BANKRUPT.

Now let's see what happened to inflation?

The green line is inflation. ????

Let's look at interest rates.

Interest is negative. ????

Week 1 / 1.9 Reading between the lines

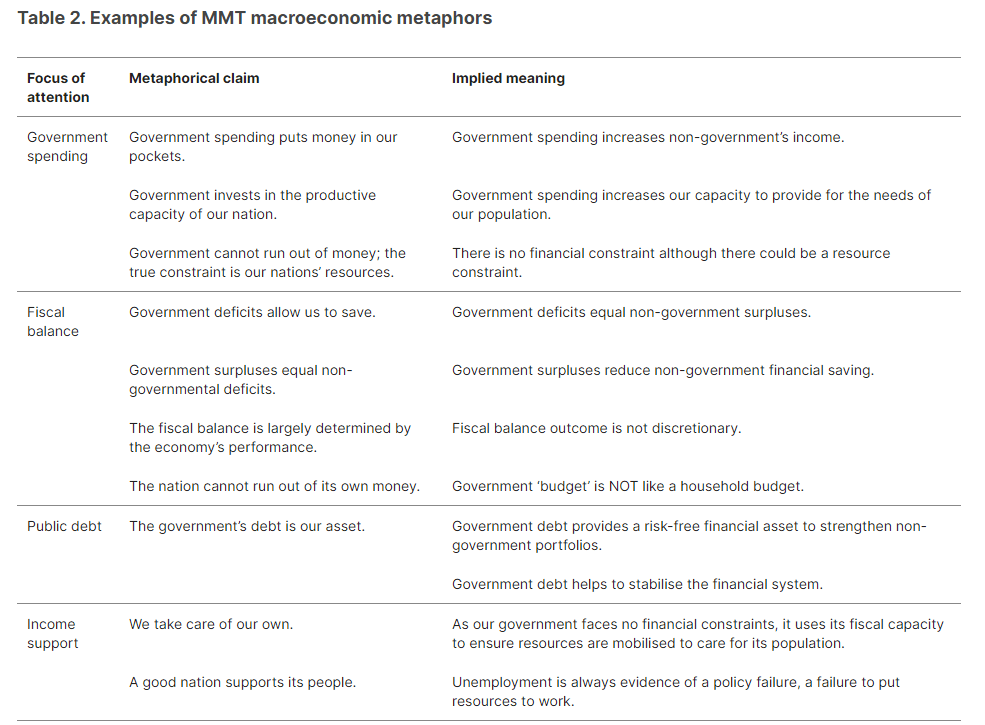

This episode discusses how neo-classical theory permeates our minds and how the jargon they use affects our entire lives.

Engin YILMAZ (

)Source:

“Modern Monetary Theory and Practice:An Introductory Text”, William Mitchell, L. Randall Wray and Martin Watts

“Modern Money Theory A Primer on Macroeconomics for Sovereign Monetary Systems”,L. Randall Wray

“Modern Monetary Theory and the Birth of the People's Economy”, Stephanie Kelton