Critiques of Modern Monetary Theory (II)

MMT authors respond to MMT criticisms. #MMT #MMTCritiques

What are the criticism of modern money theory?

What are the disadvantages of MMT?

What is the problem with MMT?

What are the limits of modern monetary theory?

Are you familiar with Modern Monetary Theory (MMT)? This controversial economic framework challenges traditional views on government spending and taxation. Proponents argue that budget deficits were not covered by borrowing, the benchmark interest rate in the US (fed funds rate) would fall. Proponents also argue that government spending exceeds taxes, overall bank reserves grow. In this article, we will delve deeper into the critiques of Modern Monetary Theory, exploring the validity of these arguments. Join us as we analyze the strengths and weaknesses of MMT and its potential implications for the future.

Kelton's last post on the blog page had the above statement. According to Mosler, if budget deficits were not covered by borrowing, the benchmark interest rate in the US (fed funds rate) would fall.

Dear friends, there are two huge logic errors in this sentence.

Firstly, in the United States, as regulated by law, "In order for the Treasury to spend, the same amount of money must enter its accounts that day through taxation and borrowing". If the sum of these two items does not equal the expenditure, that expenditure cannot be made. I repeat, this is the law!

Secondly, let's say Mosler's dream comes true. The law is repealed. When the budget deficit increases (under the assumption that borrowing remains unchanged), bank reserves will increase. This is true, but in order for the increased reserves to reduce the benchmark rate, the Fed would have to be in the pre-2008 corridor regime (with scarce reserves).

Kelton liked Mosler's post. 🙂

Mosler still thinks he's a mandatory reserve in the US. Sabri Öncü gave him a lesson.

Mosler wrote this at one point. I didn't share it because I didn't want to cause an outcry.

Coppola made it very clear.

I have tried to explain this many times. The MMT recognises that money is created by banks, yet it assigns divine power to reserves. This stems from their misinterpretation of the monetary pyramid. Friends, reserves are used for settlement.

The controversy flared up again this morning. I couldn't resist, so I lit the fuse.

This is figure 15.3 from page 331 of "Modern Monetary Theory and Practice"

The reason why the MMT places so much emphasis on reserves lies in this absurd graph. What they write as HPM is reserve money. MMT concludes that banks create money through reserve money. This is actually the thesis of neo-classicals and monetarists.

[I think they are trying to reinforce the thesis that public deficit will create savings for the private sector (national income equation)].

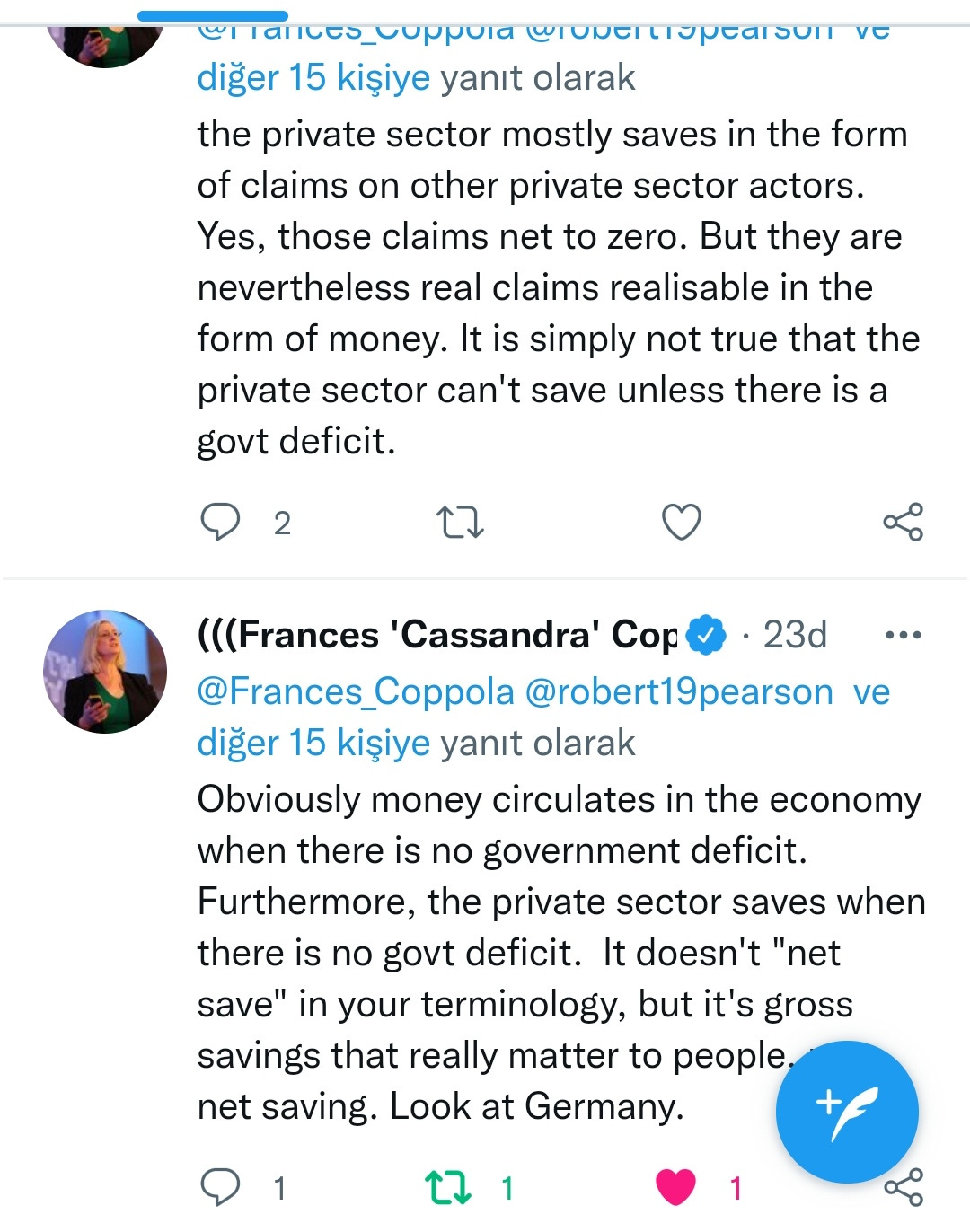

Coppola came into the debate hard. Remember the national income equation. MMT's view is that for the private sector to have a surplus in this equation, the public sector must run a deficit and the country must have a trade surplus.

In short, Coppola says that the private sector's savings are largely composed of its receivables from the private sector, and in this sense, we should look at this transaction cumulatively rather than net. Even if the public sector does not run a deficit, the private sector will be able to save. Most of the savings of the private sector arise from receivables from the private sector and some of them arise from public expenditures.

Engin YILMAZ (Veridelisi)

Source:

“Modern Monetary Theory and Practice:An Introductory Text”, William Mitchell, L. Randall Wray and Martin Watts

“Modern Money Theory A Primer on Macroeconomics for Sovereign Monetary Systems”,L. Randall Wray

“Modern Monetary Theory and the Birth of the People's Economy”, Stephanie Kelton

“money must enter its accounts that day through taxation and borrowing” - Treasury does not spend without coordination with the Fed. That’s what Open market operations is all about. The Fed will ensure the banks have enough reserves to buy Treasury’s debt offerings.

The debt ceiling is a self imposed constraint on Treasury.

In financial terms, Treasury always has the financial ability to spend. The debt ceiling imposes a legal authority to spend on the Treasury. IOW, there is no financial constraint on Treasury’s ability to spend without taxing or borrowing first. Spending comes first, taxation and borrowing are following operations that happens after the fact.