Critiques of Modern Monetary Theory

I will share 2 important criticisms of the Modern Monetary Theory. If government spending exceeds taxes, overall bank reserves grow and Without government spending, citizens cannot pay their taxes

Are you familiar with Modern Monetary Theory (MMT)? This controversial economic framework challenges traditional views on government spending and taxation. Proponents argue that without government spending, citizens would not have the resources to pay their taxes. Proponents also argue that government spending exceeds taxes, overall bank reserves grow. In this article, we will delve deeper into the critiques of Modern Monetary Theory, exploring the validity of these arguments. Join us as we analyze the strengths and weaknesses of MMT and its potential implications for the future.

What are the criticism of modern money theory?

Critism 1:

False:If government spending exceeds taxes, overall bank reserves grow.

Let us analyse the following statement of the Modern Monetary Theory.

If government spending exceeds taxes, overall bank reserves grow and if fiscal deficits are of any significant size, excess reserves in the banking system will result.

I said that expenditures may exceed taxes, but that this does not necessarily imply an increase in bank reserves.

To give an example;

This is the last Daily Treasury Statement from 04.12.2023

Total Expenditure (Withdrawals) : 13.776 million USD

Total Revenues (Deposits) : 26.944 million USD

Net Borrowing : 1.841—1.515= 326 million USD

26.944+326-13.776-=+13.994 Net operating Cash Balance increases

In this example, since revenues exceeded expenditures, the surplus was transferred to the Treasury's account (TGA) at the Fed. This means that bank reserves have decreased.

Now we analysis 01.12.2023 Daily Treasury Statement

Total Expenditure (Withdrawals) : 118.560 million USD

Total Revenues (Deposits) : 31.514 million USD

Net Borrowing : 1.550—5.157= -3.607 million USD

31.514-3.607-118.560-=-90.653 Net operating Cash Balance decreases

In this example, since expenditures exceeded revenues, the deficit amount was withdrawn from the Treasury's account at the Fed. This means that bank reserves have increased.

Now we analysis 25.11.2022 Daily Treasury Statement

Total Expenditure (Withdrawals) : 18.292 million USD

Total Revenues (Deposits) : 12.841 million USD

Net Borrowing : 132.452-109.223= 23.229 million USD

12.841 +23.229-18.292-=17.778 Net operating Cash Balance increases

In this case, expenditures exceeded revenues, BUTTTT the deficit was covered by net borrowing. The surplus was transferred to the Treasury's account (TGA) at the Fed. This means that bank reserves have decreased.

In conclusion, no comment can be made without looking at three factors that determine the state of bank reserves.

Criticism 2:

False: Without government spending, citizens cannot pay their taxes.

MMT argues that the state must spend in order to pay taxes. They argue that without government spending, citizens cannot pay their taxes.

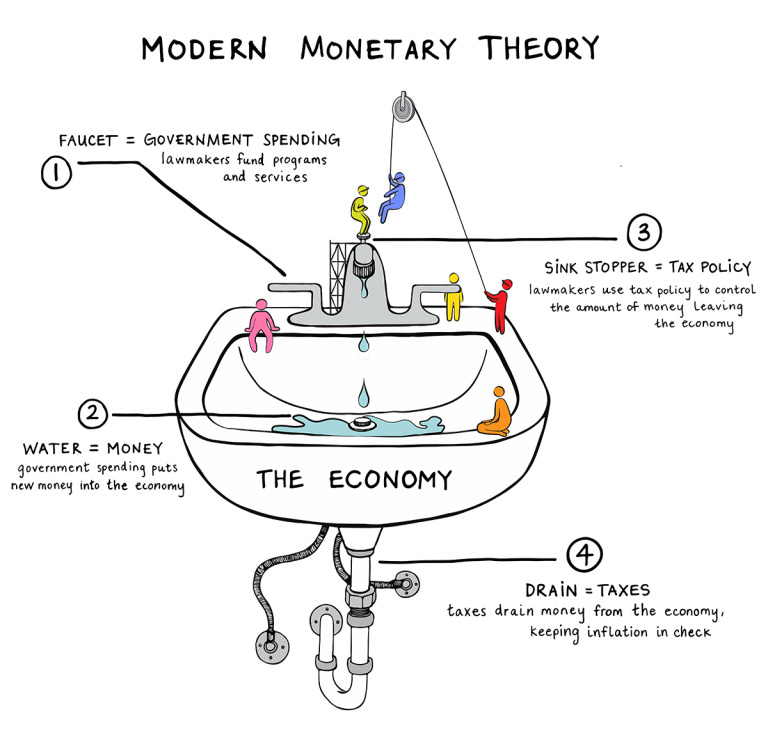

Let's start with the graph.

1- The government opens the tap (public expenditures)

2-The government opens the tap and injects money into the economy.

3-The government controls the amount of money it injects through the spigot (through tax policy)

4-Taxes, as a whole, are a withdrawal of money that the government injects into the economy.

I say this:

This would be true if only the state created the money supply. In an economy, 94 per cent of the money supply is created by banks. The state creates only 6 per cent.

Let's say you work in the private sector. You have a company. And you don't have any credits and debits with the state. Now, are you going to wait for the government to spend on you to pay taxes? Of course not. With the money created by the banks, you will pay your taxes to the state.

Engin YILMAZ (

)Source:

“Modern Monetary Theory and Practice:An Introductory Text”, William Mitchell, L. Randall Wray and Martin Watts

“Modern Money Theory A Primer on Macroeconomics for Sovereign Monetary Systems”,L. Randall Wray

“Modern Monetary Theory and the Birth of the People's Economy”, Stephanie Kelton

Regarding your 2 critiques

Critism 1: You are just looking at daily moves in the Treasury Statement to reach your conclusion. Daily moves are “noise” You should instead look at the fiscal year end totals.

https://www.fiscal.treasury.gov/files/reports-statements/financial-report/2022/02-16-2023-FR-(Final).pdf

Criticism 2: “94 per cent of the money supply is created by banks” - True. But banks create “bank money” which are liabilities of banks that are denominated in U.S. Dollars. The primary reason we accept “bank money” is because of the promise to convert them to “government’s money” on demand and on par. US Treasury does not deal with “bank money” ever. It only transacts using Reserves via the Federal Reserve.

1. https://youtu.be/EMEhE-WJFQA?si=OwdBURzVqgsoSZhN

2. https://fedguy.com/two-tiered-monetary-system/