Debunking the Money Myth: Keynes's Challenge to Traditional Money Creation (How money is created ?)

Debunking the Money Myth: Keynes's Challenge to Traditional Money Creation (How money is created Beyond Printing: How Keynes Saw Banks as the True Engines of Money Creation The Creation of Bank Money

Key Takeaways:

The main contribution of this book to monetary theory lies in its criticism of quantity theory. The book's approach to the money supply is also shaped on the basis of the rejection of quantity theory

Keynes abandoned the assumption of the exogenous of money and defined the money supply as an endogenous variable that is not under the full control of the monetary authority.

Keynes indicated and highlighted that all civilised money is the chartalist.

He stated that with the emergence of a money of account (unit of account), debt contracts and money were born, leading to the creation of bank money through the exchange of these debt contracts.

Banks create deposits by buying assets or making loans.

In the first three chapters of Keynes' 1930 work "A Treatise on Money1", Keynes defines money and gives his views on how money is created. I will make a brief summary of these three chapters for you.

In the introduction to the Turkish translation of this book, Prof. Dr. Ahmet Haşim Köse wrote the following note.

The main contribution of this book to monetary theory lies in its criticism of quantity theory. The book's approach to the money supply is also shaped on the basis of the rejection of quantity theory; Keynes, abandoning the assumption of the exogenous of money in this theory, emphasizes the role of capital needs and credit demands of firms on the money supply and defines the money supply as an endogenous variable that is not under the full control of the monetary authority. The impact of great works is undoubtedly not limited to their own period. A Treatise on Money occupies such a position within the Keynesian tradition; it has a very important place in the ongoing debate on the endogeneity of the money supply, especially in post-Keynesian economics, Keynes' successor2.

Money of Account (Unit of Account)

Keynes opens the book by defining the concept of money of account.

Money of account is the basic monetary theory concept by which debt and price contracts and general purchasing power are expressed. To simplify the concept a bit, we use money, the unit of account, to express all transactions in terms of value.

Keynes has defined the characteristics of the money of account and its relationships with the money.

If the money of account is a definition, money is the content that corresponds to this definition. After making these two basic definitions, Keynes brings the state into the picture. The state is both the unit that decides what the money of account will be and the unit that decides what the money will be.

This state even has the right to go one step further and change the money itself. Keynes says here that the Chartalist tradition has dominated monetary theory for 4,000 years. The term "chartalist"3 refers to the economic theory that money's value is derived from its status as a legal tender by the state, rather than its intrinsic value or backing by a physical commodity

State Money and Bank Money

Keynes indicated and highlighted that all civilised money is the chartalist. He stated that with the emergence of a money of account (unit of account), debt contracts and money were born, leading to the creation of bank money through the exchange of these debt contracts.

There are 2 different forms of money.

One is state money (money proper) and the other is bank money (private debt)( acknowledgments of debt).

If the state itself similarly attributes a monetary value to papers that are debt contracts, this money is called the representative money. Banknotes or paper money are of this nature.

In the above order, Keynes describes the two forms that state money can take.

He adds a new unit. These are: "commodity money", "fiat money" and "managed money". The last two of these qualify as sub-types of "representative money".

Commodity money is the ancestor of the coins we now carry in our wallets. We need to take into account that these coins contain precious metals. The most important thing to know is that the supply of this money depends on its scarcity and production costs.

Fiat money is representative (or token) money (i.e. something the intrinsic value of the material substance of which is divorced from its monetary face value)—now generally made of paper except in the case of small denominations—which is created and issued by the State, but is not convertible by law into anything other than itself, and has no fixed value in terms of an objective standard.4

Managed money is money whose creation by the state is subject to certain conditions.

To simplify, commodity money is equivalent to the precious metal it contains, while fiat money has no equivalent. You take a piece of paper and that piece of paper has no precious metal equivalent. Managed money is a hybrid of the two. The paper money here has a precious metal equivalent. The Bretton Woods system is an example of this.

The result we get from this tree is ;

Money = State Money + Bank Money

State money = Commodity money + Managed money + Fiat money

The second chapter of this book is entitled "Bank Money". The title of the first subtitle is interesting. The Creation of Bank Money

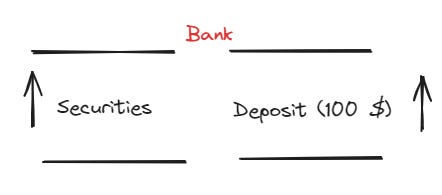

Keynes explains how bank money (deposits) is created through the balance sheets of banks. I will use the term deposits instead of bank money in this article.

The Passive Way to Generate Deposits

According to Keynes, the first way in which deposits are created in a bank is by bringing (depositing) cash into the bank or by entering an existing deposit into the bank's balance sheet through a check.

When Customer A brings $100 in cash to Bank X, a deposit of $100 is created in the liability section in the name of the customer.

When Customer A brings to Bank X a check for 100 TL from Customer B, who works with the same bank, Bank X deducts this amount from Customer B's deposit account and writes it to Customer A. In fact, there is an exchange of deposit ownership rather than a creation of deposits.

The Active Way to Generate Deposits

The active way of generating deposits is realized in 2 different ways.

It may itself purchase assets, i.e. add to its investments, and pay for them, in the first instance at least, by establishing a claim against itself. Or the bank may create a claim against itself in favour of a borrower, in return for his promise of subsequent reimbursement; i.e. it may make loans or advances.5

Banks create deposits by buying assets or making loans. We see that Keynes had very clear ideas about how money is created and was certainly not confused about it.

Bank X buys a bond from a customer.

Bank X grants a loan to Customer.

Keynes examined the relationship between active and passive ways of generating deposits. His conclusion is that deposits created in the active way are more likely to leave the bank. As a result, the person who takes out a loan will give this money to someone else. This will cause deposit outflows from the bank. On the other hand, he thinks that deposits created through the passive way will be more permanent.

This was misinterpreted by economists of the time to mean that "banks could not lend more than the cash and deposits brought to them (including those transferred)". Keynes vowed to put an end to this nonsense.

Conclusion

Banks create deposits by buying assets or making loans. We see that Keynes had very clear ideas about how money is created and was certainly not confused about it.

Engin YILMAZ (

)Who Creates the Money? (Unveiling the Secrets of Money Creation)

Welcome to a thought-provoking exploration of one of the most intricate aspects of our modern economy: the creation of money. For decades, the mechanisms of money creation have been shrouded in complexity and often misunderstood by the public. This b

Sources

John Maynard Keynes - Para Üzerine Bir İnceleme, Sunuş, viii, Ahmet Haşim Köse

A Treatise on Money, 1930, Page 7

A Treatise on Money, 1930, Page 21