Who Creates the Money? (Unveiling the Secrets of Money Creation)

Who Creates the Money? (Unveiling the Secrets of Money Creation) The Great Money Illusion: Who Pulls the Strings and Why You Should Care Rethinking Power and Money Creation in the 21st Century #money

Welcome to a thought-provoking exploration of one of the most intricate aspects of our modern economy: the creation of money. For decades, the mechanisms of money creation have been shrouded in complexity and often misunderstood by the public. This blog post aims to unveil these mysteries, bringing to light the intriguing processes behind how money comes into being.

It is perhaps well enough that the people of the Nation do not know or understand our banking and monetary system, for if they did I believe there would be a revolution before tomorrow morning.1 The quote often attributed to Henry Ford about the banking system and revolution was actually a paraphrase by Charles Binderup. On March 19, 1937, in the House of Representatives.

Since 1948, mainstream economics has diligently ingrained the concepts of fractional reserve banking and its extension, the money multiplier, into the public consciousness. This series of untruths has been repeated so often that it has come to be accepted as truth.

Mainstream economics argues that money is created by central banks and replicated by banks, while many heterodox economic ideas (post Keynesian, MMT, etc.) argue that money is created directly by banks. Mainstream economics takes the view that central banks directly determine the money supply and therefore money is created in a controlled manner. The heterodox thesis, on the other hand, argues that money is created directly by banks and that central banks only set the price of money (interest rate) in this process.

What forms does money in everyday life take?

There are 3 forms of money.

-Cash (banknote and coin) money created by the state, (M0)

-Deposits created by banks.(M1 and M2)

Table 12 shows that in the US, the money created by the government(M0) corresponds to 8% of the broad money supply(M2). As of July 2022, while the amount of cash in circulation is 2.278 billion $, and adding the deposits to this amount results in a total of 21.703 trillion $. Simply put, while the government-created cash is 2.278 billion $, the money created by banks amounts to 19 trillion 425 billion $.

The result is that most of the money you use during the day (that debit card in your pocket) is created by banks. As can be seen, a large part of the money supply is composed of bank money (deposits). Having understood the importance of bank money, we can now examine the classical theory of how bank money is created.

The Thesis of Neo-Classical Economics

What is written in economics textbooks about how money is created is based entirely on the theses of neo-classical economics. The dominance of neo-classical economics is so strong that you will not find an alternative account in textbooks. The thesis of this view on how money is created is based on fractional reserve banking and its extension, the money multiplier. The earliest and most concrete form of this view that we can trace in economics textbooks is in Samuelson's3 1948 book on economics.

Since then, economics textbooks have tried to explain it by quoting the chapter on how money is created. On page 323 of his book, the author explained the subject under the title "How bank deposits are created". The author starts to explain the subject with the creation of cash in the bank and refers to goldsmiths.

According to the author, it is impossible for banks to create deposits by lending. Banks receive cash from their customers, set aside a portion of this cash as reserve requirements and lend the rest.

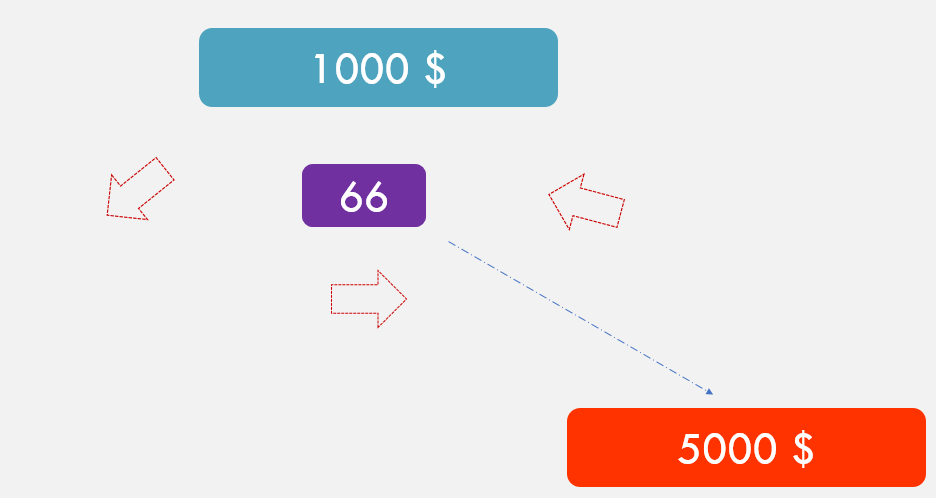

A customer brings 1000 dollars to the bank, the bank lends 800 dollars to a new customer, reserving 20% of it as reserve requirements. The borrower uses this money to pay another person. This other person deposits the money in his own bank. The new bank lends 640 dollars to a new customer with a 20% reserve requirement.

Under Samuelson's assumptions, the above table will emerge. 66 times, if the following assumptions are realized, 1000 dollars of cash will generate 5000 dollars of deposits through a loan of 4000 dollars. These assumptions are respectively;

Banks must have some amount of money deposited with them in order to grant loans,

Borrowers must spend,

Those who sell goods or services subject to expenditure must keep the money they receive in their banks.

According to the author, the most important element of this process is that not all the money coming into the banks should be reserved against reserve requirements. If all of the money brought to the bank is set aside as reserve requirements, no new loans can be extended. This system is called fractional reserve banking because of the lack of full reserve against the money brought in by the customer. The concept of money multiplier is used to express that the cash initially brought to the bank will generate deposits at a certain multiple of the reserve requirement ratio. In simple terms, an initial deposit of $1000 will generate deposits equal to $1000 * (1/reserve ratio) if all the above-mentioned conditions are met. In the example, since the reserve requirement ratio is 20%, $1000 * (1/0.20) creates $5000 in deposits.

CRITIQUE OF NEO-CLASSICAL ECONOMICS

Fractional reserve banking is based on a simple chain. Money has to be created in the bank, the money created has to be loaned, the borrower has to spend it and the new owner of the money has to deposit it in the bank. When $1000 is deposited in the bank, the chain must be repeated exactly 66 times without a shortfall. If this happens, a deposit of $5000 will be created. It is impossible for this chain to continue 66 times without a shortfall.

How does the customer bring $1000 in deposits to the bank? According to the theory, the central bank buys bonds from citizens and deposits them in the citizens' bank in return. This is a problematic assumption. Because central banks do not buy and sell bonds directly with citizens. In New Zealand, Canada and the United States, reserve requirements are "0". This suggests that we should throw out the money multiplier theory.

Post-Keynesian Economics' View on How Money is Created

The views of post-keynesian economics started to emerge concretely in the 70s, increased their visibility in the 90s and finally started to appear on the economic agenda with the major crises in the 2000s. Post Keynesian economics advocates the endogeneity of money. Those who argue that money is exogenous believe that the central bank is the only institution that determines the money supply by controlling the amount of reserves. Money is injected into the economy from outside (the central bank). The post-Keynesian view, on the other hand, argues that money is injected into the economy by the banks themselves. The simple implication of this view is that the central bank has no power to directly control the money supply.

The post-Keynesian view that money is endogenous can be explained simply by the diagram above. The upper right panel shows the equilibrium situation in which the demand for credit by customers is sensitive to interest rates but the supply of credit by banks is not (infinite supply of credit). At the intersection of the two curves is the amount of credit granted. In the bottom right panel, it is shown that deposits are created equal to the amount of credit extended. In this way, the amount of money supply emerges. The lower left panel shows that if the reserve requirement is not "0", the bank borrows reserves from the central bank at the reserve requirement ratio. The upper left panel shows the cost of the borrowed reserves. Note that the interest rate on banks' loans is higher than the interest rate on the reserves borrowed from the central bank.

The accounting representation of this transaction is simply as follows.

When a loan is granted to a customer by the bank, the above accounting transaction is performed. A loan account in the name of the customer is opened in the assets of the bank and a deposit account for the same customer is opened in the liabilities. For this transaction to take place, the bank does not need to borrow from any person or the central bank.

Post-Keynesian explanations on how money is created have been frequently included in the studies of the world's central banks in recent years. In 2014, the Bank of England became a leader in this regard with its study titled 'How Money is Created' 4 study. This was followed by the central banks of France5, Germany6 and Switzerland7, IMF8 , Fed9, Netherlands10 and BIS11 published a study on this subject.

Engin YILMAZ(

)Sources

Charles Binderup Congressional Record—House vol. 81, p. 2528.

Paul A. Samuelson, Economics An Introductory Analysis, Birinci Baskı, Birleşik Devletler, McGraw-Hill Book Company, 1948, s.328

Michael McLeay (Radia Amar ve Thomas Ryland), “Money Creation in the Modern Economy”, The Bank of England Quarterly Bulletin, Mart 2014.