Understanding the Natural Rate of Interest and its Implications for Monetary Policy (How do you believe the natural rate is working?)

Understanding the Natural Rate of Interest and its Implications for Monetary Policy Unveiling the Mystery: The Natural Rate & the Fed's Tightrope Walk #rstar #taylorrule

CNBC reporter Steve Liesman asked the following question to Powell in the last FOMC meeting.1

How do you believe the natural rate is working?

We focus on the following questions

What is the natural interest rate?

How do you calculate natural interest rate?

Who calculates the natural interest rate?

History

To understand where the concept of the natural rate of interest was first used or coined, we need to go back to 1898. This year marks a significant point in the history of economic thought2.

The current value of the natural rate of interest, according to Knut Wicksell's analysis, is determined by the relationship between the supply of savings and the demand for investment funds. This interest originates in the goods market and affects the economy through its relationship with the money market interest rate.

In short, Wicksell posited that the natural rate of interest is the rate at which the demand for loanable funds (for investment) equals the supply of savings, without causing inflation. This rate is not directly observable; it's a theoretical construct. The market rate of interest set by central banks is lower than the natural rate, it would lead to increased investment and potentially cause inflation. Conversely, if the market rate is higher than the natural rate, it would discourage investment, leading to deflation.

John H. Williams wrote the following paragraph in 1931.

The natural rate is an abstraction; like faith, it is seen by its works. One can only say that if the bank policy succeeds in stabilizing prices, the bank rate must have been brought into proper line with the natural rate, but if it does not, it must not have been.3

Taylor Rule

John Taylor's (1993) famous description of a monetary policy rule that incorporated an assumption of a natural rate of 2 percent.4

2% is the Fed’s long-run inflation target, r is the long-run real federal funds rate (It refers to as the natural interest rate), p is the current rate of inflation. This rule concludes that the inflation rate and real GDP are on target, then the federal funds rate would equal 4 percent, or 2 percent in real terms. These numbers are related to the observed path of the U.S. federal funds rate5 in the late 1980s and early 1990s6. "I think these numbers are more related to the entire '90s.

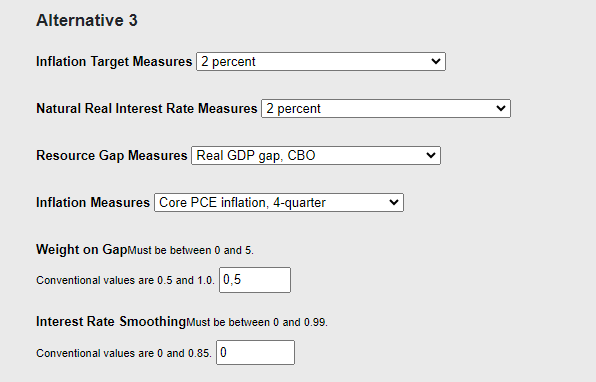

Since 1993, alternative versions of Taylor's original equation have been used and called "simple (monetary) policy rules" (see here and here), "modified Taylor rules," or just "Taylor rules." Atlanta Fed web page7 allows users to generate fed funds rate prescriptions for their own Taylor rules based on a generalization of Taylor’s original formula.

Under the default settings, "Alternative 3" in the chart corresponds closely with Taylor's original 1993 rule apart from utilizing a different inflation measure as well as a time varying estimate of the natural (real) interest rate instead of the 2 percent originally used by Taylor.

I have chosen the natural real interest rate to be 2. This graph gives the results for Taylor’s original rule and actual Fed funds rate.

R-STAR

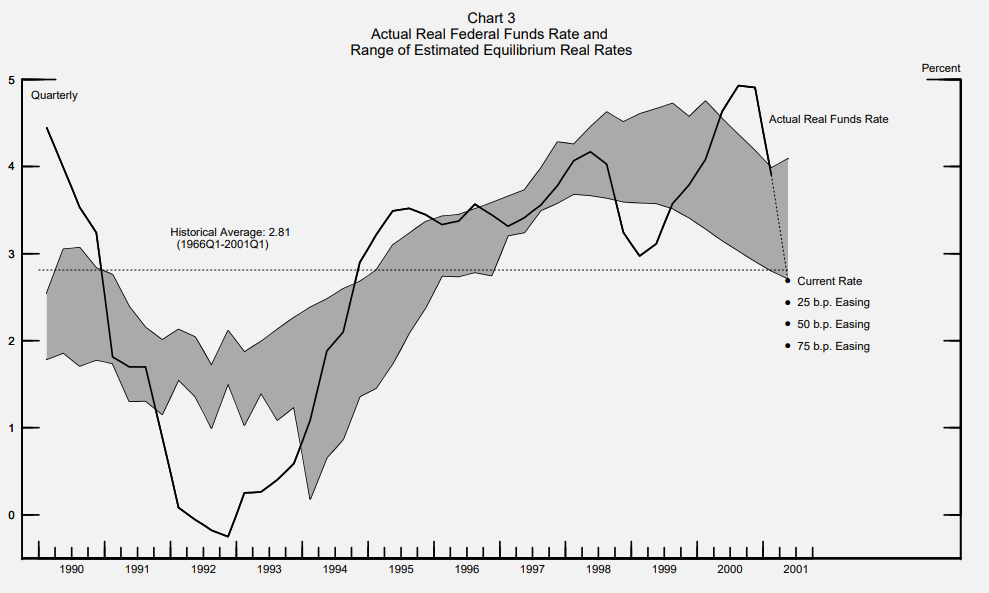

The natural real interest rate came onto the Federal Reserve's agenda 100 years later, as illustrated by the graph titled 'Actual Real Federal Funds Rate and Range of Estimated Equilibrium Real Rates' in the May 2001 Bluebook.8

Thomas Laubach and John Williams, researchers at the Fed, calculated the natural real interest rate using Kalman filters9 in the Bluebook. They published the first draft of their work in November 2001 and called the natural real interest rate as r-star.10

The New York Fed regularly publishes11 the results of the Laubach-Williams and Holston-Laubach-Williams models, which provide estimates of the natural rate of interest, or r-star, and related variables.

Conclusion

When making policy decisions, the Federal Reserve primarily looks at macro and micro data from various sectors. Powell clearly states this. To support these data, the Fed uses its own macroeconometric model, new Taylor rules and r-star.

Engin YILMAZ (

)Sources

See Knut Wicksell, Interest and Prices: A Study of the Causes Regulating the Value of Money, 1898, English translation, London: Macmillan and Company, 1936, p. 102.Link

John H. Williams. "The Monetary Doctrines of J. M. Keynes," The Quarterly Journal of Economics 45, no. 4 (August 1931): 547 – 587

John B. Taylor. "Discretion versus Policy Rules in Practice," Carnegie-Rochester Conference Series on Public Policy, Vol. 39 (December 1993), pp. 195 – 214, Link

The Use and Abuse of Taylor Rules: How Precisely Can We Estimate Them? Alina Carare and Robert Tchaidze, 2005, Link