Understanding the Fed's Balance Sheet: A Basic Guide ( Fed Balance Sheet 101)(No finance degree needed!)

Understanding the Fed's Balance Sheet: A Basic Guide ( Fed Balance Sheet 101) Fed's Balance Sheet 101 What Does It Tell Us About Our Financial Future? T-account approach

In this crash course, you'll learn:

What the Fed owns and owes: Explore the key parts of the balance sheet, like government bonds and bank reserves.

How it affects the economy: Discover how the Fed's actions, like buying or selling assets, affect the interest rates.

Why it matters to you: See how the Fed's decisions impact your borrowing costs, investments, and overall financial well-being.

By the end, you'll have a basic understanding of this powerful tool and its influence on your world. No finance degree needed!

T-account is a Visual Tool

A T-account is a visual tool used to represent the various components of a balance sheet, displaying the relationship between assets and liabilities. In the context of Federal Reserve (Fed) policy and balance sheet analysis, T-accounts play a crucial role in understanding the central bank's financial position and its monetary policy actions.

Firstly, T-accounts help illustrate the impact of Fed's open market operations (OMOs), which are used to implement monetary policy. A T-account helps to clearly represent these transactions and the subsequent changes in the Fed's balance sheet.

Secondly, T-accounts provide a simple and organized way to analyze the Fed's assets (such as securities holdings) and liabilities (like reserve balances and currency in circulation). T-accounts reveal the mechanics behind tools like quantitative easing/tightining and open market operations, making Fed actions more transparent.

In summary, T-accounts are important for understanding and analyzing Fed policy and balance sheets as they offer a clear, organized framework to visualize transactions, assess the impact of monetary policy actions, and evaluate the central bank's financial position.

Fed’s Balance Sheet

This is Fed’s balance sheet and it is shown the most important items in assets and liabilities. You can see more details about the items in this link1 and item’s statistics from this link2.

Securities held outright on the Fed's balance sheet refer to:

U.S. Treasury Securities (Bills, Notes, Bonds): These are government debt instruments purchased directly by the Fed.

Mortgage-backed Securities (MBS): These are financial instruments backed by pooled mortgages, purchased outright by the Fed.

Repurchase agreements: Repurchase agreements, commonly known as "repos," are short-term borrowing agreements primarily used in the money markets. When the Fed conducts a repo, it buys securities from banks with an agreement that the banks will buy them back, usually the next day, injecting liquidity into the banking system.

Loans: The "Loans" item on the Federal Reserve's balance sheet refers to the total amount of loans that the Fed has made to financial institutions. This can include various types of credit facilities.

Currency in circulation: Currency in Circulation refers to the total value of U.S. dollar bills and coins that are physically circulating in the economy outside of the Federal Reserve. This includes all the money held by the public, businesses, and the banks (not stored within the Fed itself)

Reserve Balances: These are deposits that private banks hold at the Federal Reserve. These are important because they help banks meet their reserve requirements and provide liquidity to the banking system.

Reverse repurchase agreements: RRPs are a type of financial transaction where the Federal Reserve sells securities (like Treasury bonds) to financial institutions with an agreement to buy them back at a future date, typically the next day, at a higher price

U.S. Treasury, General Account: The "U.S. Treasury, General Account" item on the Federal Reserve's balance sheet refers to the main operating account of the U.S. Department of the Treasury held at the Federal Reserve. This account is used by the Treasury to manage the government's day-to-day banking needs. It includes deposits of revenue from taxes and other sources, and from these funds, the Treasury makes payments for government obligations and expenses.

How does Fed create the reserves? (Method 1)

When the Fed buys securities from non-banking financial institutions, it creates both the reserves and deposits in the banking system. The following representation shows this situation in t-account perspective in Fed balance sheet.

When the Fed buys securities from banks, it creates reserves in the banking system. The following representation shows this situation in t- account perspective in Fed balance sheet.

From the Fed’s perspective, it doesn’t matter who is selling the securities; the size of its balance sheet increases by the same amount in either case.

By contrast, the size of the banking sector’s balance sheet depends on who sells the assets. If banks sell the assets, the size of the banking sector’s balance sheet is unchanged, although its composition is different.

However, if the assets are sold by the non-bank , the banking sector’s balance sheet will increase by the amount of assets purchased.3

QE (Quantitative Easing) involved the Federal Reserve buying securities from non banks to inject money into the economy.

How does Fed create the reserves? (Method 2)

The Federal Reserve also uses repurchase agreements to inject reserves into the banking system. You can observe the following representation: when the Fed utilizes repos, the reserves in the system increase.

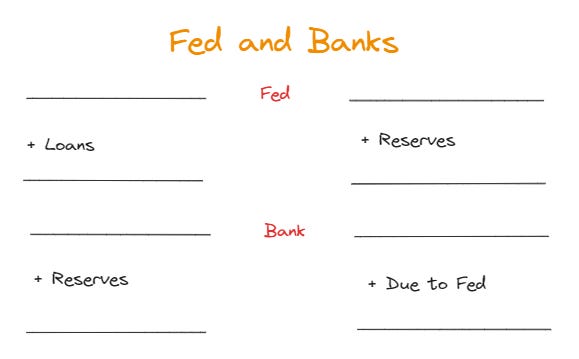

How does Fed create the reserves? (Method 3)

Fed also uses other lending facilities(loans) to inject reserves to the system. This is not only lending tool in the balance sheet.

What is the function of the reserves?

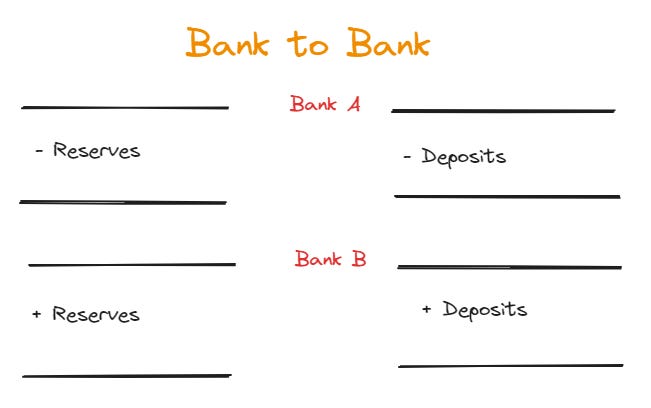

What is the function of the reserves in the modern financial sytem and Fed balance sheet ? Banks use reserves to settle payments and as a safe and liquid asset.4

When a customer from Bank A sends money to a customer at Bank B, Bank A's deposits and reserves decrease, while Bank B's deposits and reserves increase. Banks also are required to hold a reserves due to regulatory requirements.

Do you understand the reserves’ function in banking system ?

Currency in circulation refers to the physical forms of money, such as coins and paper bills, that are used for transactions and purchasing goods or services. This physical money represents only 8% of the total money supply, while deposits account for 92% of the total money supply.

How does the Federal Reserve increase the amount of physical money?

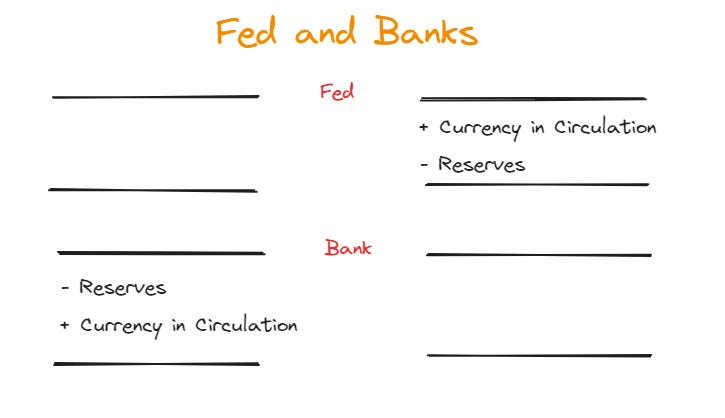

How does the Federal Reserve increase the amount of physical money on its balance sheet? When people prefer to hold physical cash, banks reduce their reserves, leading to an increase in physical money in circulation.

How does physical money ends up in a citizen's wallet?

Do you want to learn how physical money ends up in a citizen's wallet? It's a very simple process and involves basic accounting. The customer reduces their deposits, and the bank provides cash to the customer.

Fed’s Balance Sheet

Could you see the assets of Fed’s balance sheet ? These are three important items : Securities, repo and loans.

Could you see the liabilities of Fed’s balance sheet ? These are four important items : Currency in circulation (Federal reserve notes), reserves ( other deposits held by depository institutions), reverse repurchase agreements (reverse repo) and U.S. Treasury General Account.

This arrangement is essentially the opposite of a repurchase agreement (repo), hence the term "reverse" repurchase agreement. The Federal Reserve employs reverse repurchase agreements to withdraw reserves from the banking system. This mechanism can be described as follows: when the Fed engages in reverse repos, the reserves within the system decrease.

How does Fed withdraw the reserves from the banking system?

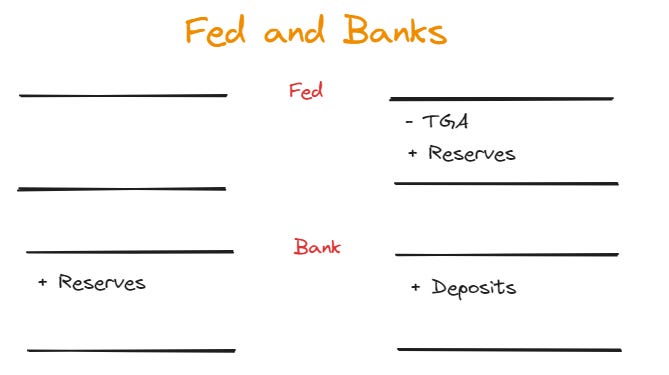

How to work TGA'?

The TGA, or Treasury General Account, is an account held by the United States Department of the Treasury at the Federal Reserve. It functions similarly to a checking account for the U.S. government, where the Treasury deposits its receipts (collecting taxes and issuing debt) and from which it disburses payments for government expenses (like salaries, social security benefits, and interest on the national debt).

When the Treasury collects taxes and issuing debts and those funds are deposited into the TGA, it can reduce the reserves banks hold at the Fed because money that was previously in bank accounts (and counted as reserves and deposits decrease) is transferred to the TGA.

Conversely, when the Treasury spends from the TGA, these funds flow back into the banking system, increasing reserves and deposits.

Engin YILMAZ (

)

Really interesting. Great to see the Fed’s balance sheet. Interesting to see that almost all Fed assets are securities (treasuries and MBS) and liabilities are either currency (Fed notes are mostly $100 bills as well as smaller ones) or deposits from banks. Reverse repo and the treasury’s account are about 15% of total. Best to think of those as just non-bank deposits.

Couple of questions/comments: I’d de-emphasize “reserves” since banks no longer have reserve requirements and earn interest on all of their Fed balances. It’s probably best to just think of those as deposits that banks hold at the Fed. Most importantly, understanding the Fed B/S means you need to understand their bank depositors too.

Most banks hold about 20% of their assets in cash and securities, so when their deposits at the Fed go up (what you call “reserves”) it is most likely that those funds either come from 1) selling securities or 2) increases in deposits from customers. If #1, the Fed’s QE is little more than treasuries and MBS migrating from bank portfolios to the Fed portfolio. For example, $1T in QE means banks in aggregate sell $1T in MBS and put that $1T in their Fed account; meanwhile, the Fed uses that new $1T deposit from banks to buy $1T in MBS. It’s reasonable to wonder whether that trade is all that meaningful.

If #2, bank customers shift investments from term fixed income (like MBS funds) to bank deposits. Those bank deposits (a liability of the banks) must be invested somewhere, and many banks would use them to increase their balances in their Fed account. That is, both liabilities and assets of the banks would rise. As with #1, the Fed uses those deposits from banks to buy securities. In aggregate, these will be the same securities the bank customers sold in order to have extra funds to deposit.