Understanding the Bank Term Funding Program (Funding Me Softly !) #BTFP

Understanding the Bank Term Funding Program (#BTFP) The Bank Term Funding Program (#BTFP) Explained Ensures bank liquidity during crises

Key Takeaways:

The 2023 bank failures, with Silicon Valley Bank, Signature Bank, and First Republic Bank, collectively involved $532 billion in assets, eclipsing the 2008 crisis figures.

How much in reserves is being provided to banks through the BTFP? 167 billion $

Fed also used two other different instruments to provide the reserves to banks. How much in reserves is being provided to banks through these credit extensions? The Federal Reserve's credit extensions totaled significant amounts, with $152 billion through the discount window and $228 billion through other credit extensions.

Introduction

Everything started with the bankruptcy of Silicon Valley Bank (SVB) on March 10, 2023, followed by Signature Bank and First Republic Bank. Do you remember those days? Large and sudden withdrawals by its depositors. This illustration is from New York Times 1 and it is created by Karl Russell2.

Washington Mutual Bank in 2008 had $432 billion in assets and this makes it the largest bank failure in the United States3. The total assets involved in the bank failures of 2023, which include Silicon Valley Bank at $209 billion, Signature Bank at $110 billion, and First Republic Bank at $213 billion, amount to an unprecedented sum of $532 billion. This aggregate figure not only surpasses the individual asset volume of any bank failure in prior years but also exceeds the combined assets of all bank failures recorded in the dataset for any given year, including the historically significant 2008. That year saw the collapse of Washington Mutual with $432 billion in assets, in addition to $94 billion from 24 other bank failures, totaling $526 billion. Hence, the bank failures in 2023 represent a new high-water mark in terms of the total asset volume impacted.

The FDIC acted more quickly than the Fed in managing this crisis.

This was the introduction sentence from FDIC’s statement on March 10, 2023 .

You can read the FDIC's statement on Silicon Valley Bank.4 The FDIC also has provided affirmative responses to all inquiries from SVB’s customers.

IS MY MONEY SAFE? Yes!

DO I HAVE ACCESS TO MY MONEY? Yes!

WILL MY AUTOPAYMENTS/BILL PAY/ONLINE BANKING STILL WORK? Yes!

WILL I RECEIVE INTEREST ON MY CERTIFICATES OF DEPOSIT (CDs)? Yes!

The Fed began to intervene in SVB's situation on March 12, 2023, with a brief statement.

The Federal Reserve Board declared this Sunday that it would offer additional funding to banks. The Fed aimed to ensure that banks could satisfy their depositors' demands. The additional funding was made available through the creation of a new Bank Term Funding Program (BTFP), which offers loans of up to one year to eligible depository institutions. These institutions may pledge U.S. Treasuries, agency debt, mortgage-backed securities, and other qualifying assets as collateral. The establishment of this program was facilitated by the Federal Reserve through its use of the extraordinary powers granted under section 13(3) of the Federal Reserve Act, codified at 12 U.S.C. § 343. Nathan wrote about the section 13(3) of the Federal Reserve Act.5

What is the BTFP’s recipe ?

Banks are allowed to pledge their securities at par (face) value instead of market value. Banks benefit from the ability to pledge their securities at their face value rather than the market value, particularly when the market price is less due to higher interest rates. This approach provides a favorable position for banks to leverage assets that have lost market value since their initial purchase at lower interest rates. The Federal Reserve has communicated6 to Congress its expectation of no losses from the program, highlighting that the loans are issued against collateral and include a recourse clause, which obligates borrowers to repay the loans in full, even if the collateral does not cover the loan amount.

I would like to state that Fed also used the discount window (primary credit) tool and other credit extensions(FDIC guarantee) in managing this turmoil.

How does the BTFP function within the Fed's balance sheet?

This illustration shows that Fed gives the reserves to the banks with the BTFP. We can see this accounting reality in the following balance sheet.

How much in reserves is being provided to banks through the BTFP?

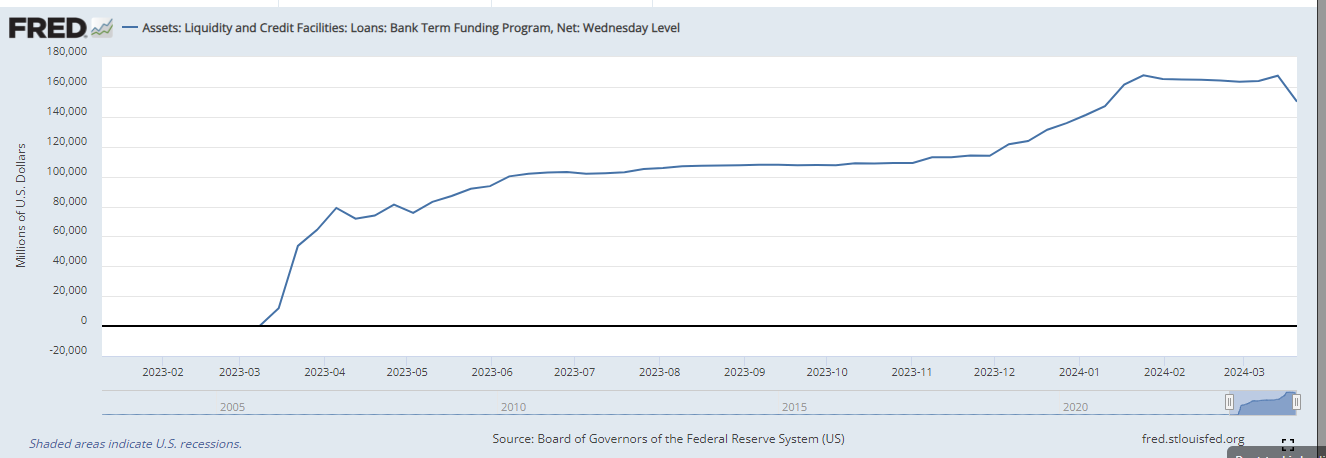

How much in reserves is being provided to banks through the BTFP? This is a good question. We can learn the answer of this question from FRED database7.

167 billion $

It illustrates an increasing trend in the amount of funding provided through the BTFP, reaching a peak(167 billion $) before a slight decrease is observed in the latest data point. The latest data point is actually the final one because the Fed announced it will stop extending new loans under the BTFP as of March 11, 20248.

Remember that the Fed also used two other different instruments to provide reserves to banks. We are investigating these instruments.

Primary Credit (Discount Window)

Federal Reserve extended loans under its ordinary discount window lending authority (section 10B of the Federal Reserve Act9). The primary credit reached $152 billion in the first week, and then the banks began to pay it back.10

152 billion $

When the BTFP was created, the Fed adjusted margin requirements for the discount window so that banks can borrow up to 100% of the collateral value for these securities from each. However, valuing collateral at par through the BTFP currently increases borrowing potential for many securities compared to the discount window. In addition, banks can borrow for longer from the BTFP and the BTFP’s interest rate is currently lower than the discount window’s.11 In the program’s first few days, lending through the discount window significantly outpaced BTFP lending. However, this trend reversed by the end of the program.

Other Credit Extensions

The loans to the depository institutions were extended under section 10B discount window authority against collateral posted by the depository institutions, and supported by an FDIC guarantee of repayment. The other credit reached $228 billion in the second month, and then the banks began to pay it back.12

228 billion $

The value of lending through other credit extensions became the largest among the Federal Reserve's tools.

Steven Kelly asked : Where does the FDIC get its money?

The FDIC has13 $200 billion of credit lines with the Treasury: technically, $100 billion with Treasury and $100 billion with the Treasury’s Federal Financing Bank. It can14 also borrow from the FHLBs and from banks themselves.15

Conclusion

The sequence of bank failures in 2023, beginning with Silicon Valley Bank and including Signature Bank and First Republic Bank, has been unprecedented both in speed and scale, involving a total of $532 billion in assets. In response, the Federal Reserve and the FDIC have deployed an array of financial tools with considerable agility.

Engin YILMAZ ( Veridelisi )

EVERY COMPLEX BANKING ISSUE ALL AT ONCE: THE FAILURE OF SILICON VALLEY BANK IN ONE BRIEF SUMMARY AND FIVE QUICK IMPLICATIONS, Link

Report to Congress Pursuant to Section 13(3) of the Federal Reserve Act: Bank Term Funding Program, Link

Federal Reserve Board announces the Bank Term Funding Program (BTFP) will cease making new loans as scheduled on March 11, Link

Engin - another good post! A related topic that I'd be interested in reading about is interest from regulators on expanding and potentially mandating discount window usage by the banks. Also interested in reading about expansion of the standing repo facility.