Understanding SPVs: A Beginner's Guide to This Essential Financial Tool (Anatomy of Securitization)

Understanding SPVs: A Beginner's Guide to This Essential Financial Tool (Anatomy of Securitization)

What is the SPV?

I'm trying to provide a concise definition for this term. There are many lengthy explanations that can be overwhelming1.

A Special Purpose Vehicle (SPV) is a legal entity created for a specific purpose, often to isolate assets from a parent company. In this context, the SPV is being used to securitize a portfolio of assets, which means transferring ownership of the assets to the SPV and then financing the SPV by issuing debt securities.

Would you like to shorten this definition?

A Special Purpose Vehicle (SPV) is a separate legal entity created to isolate assets from a parent company. In securitization, the SPV acquires assets and finances them by issuing debt securities.

Bank’s Balance Sheet

The bank wants to securitise its loans and get them off its balance sheet. This bank creates the SPV and the loans are transferred from the bank's balance sheet to the SPV's balance sheet.

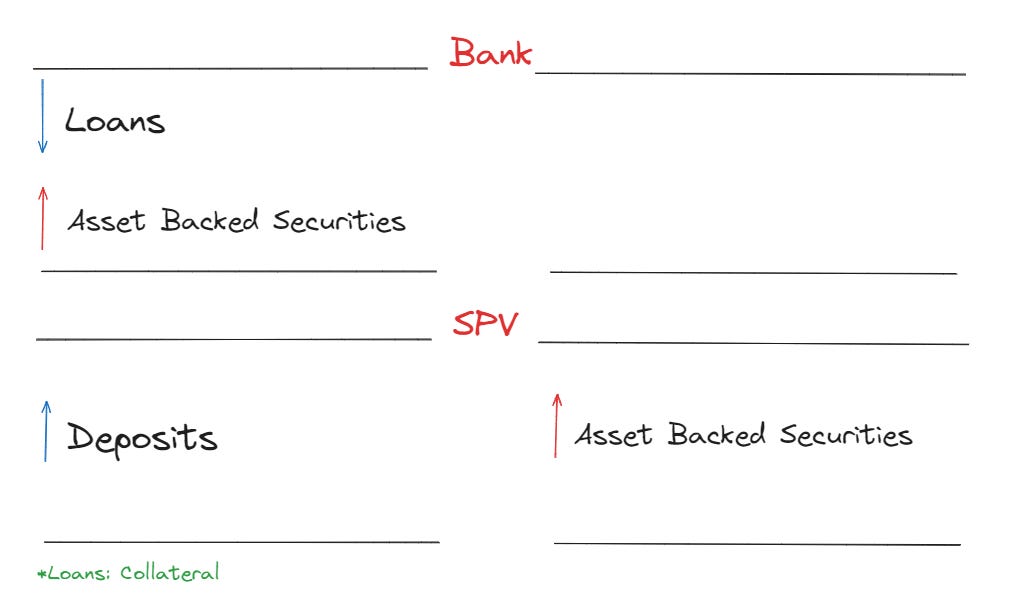

SPV’s Balance Sheet

The SPV is able to issue debt securities based on these loans. These loans will be collateral and SPV will receive the deposits.

We now refer to these debt securities as ABS or asset-backed securities.

The term ABS is the generic term. It can now vary depending on the type of assets purchased or the debt security issued. For example, if the vehicle or SPV buys mortgage loans from banks, the ABS will be transformed into MBS or Mortgage Backed Securities, whether they are Residential Mortgage Backed Securities (RMBS) or Commercial Mortgage Backed Securities (CMBS). We also have the whole series of CDOs or Collateralized Debt Obligations in which we find the purchase by the SPV of consumer loans (CLO or Collateralized Loan Obligation) or bond portfolios (CBO or Collateralized Bond Obligation) for example.2

Mortgage-Backed Securities (MBS): Debt securities backed by a pool of mortgages, where investors receive payments from mortgage borrowers' interest and principal.

Residential Mortgage-Backed Securities (RMBS): A type of MBS backed specifically by residential home mortgages.

Commercial Mortgage-Backed Securities (CMBS): MBS backed by commercial real estate mortgages, such as office buildings or shopping malls.

Collateralized Loan Obligation (CLO): A security backed by a pool of loans, typically corporate loans.

Collateralized Bond Obligation (CBO): A structured financial product backed by a pool of bonds.

Bank’s Balance Sheet

This is a bank's balance sheet, with asset-backed securities added and loans subtracted.

I make this accounting for the bank on the basis of the following release of the Dutch Central Bank.3

Big Picture

In summary, the bank transfers its loans to the SPV, which finances them by issuing asset-backed securities to investors. The loans serve as collateral for the ABS. This structure allows the bank to manage its balance sheet, reduce risk and obtain liquidity.

The loans that were originally held on the Bank's balance sheet have been transferred to the SPV. This reduces the bank's direct exposure to these loans, as they are no longer its assets. The bank receives cash(as a fee) from the SPV (financed by the ABS issuance), improving its liquidity position without needing to hold the loans on its balance sheet.

2008 Crisis

The mortgages lost their value during the financial crisis, which in the end resulted in financial distress and bankruptcy of several banks that were ‘the creators’ of those SPVs .4

ABS is based on a commitment that the loans will be paid. When the loans arent paid, this system will collapse.

Engin YILMAZ

Source

https://www.nber.org/papers/w11190

https://wholesale.banking.societegenerale.com/en/news-insights/glossary/abs-asset-backed-securities/

https://pywb.nationaalarchief.nl/nl/all/20110801200000/https://www.dnb.nl/en/news/news-and-archive/statistisch-nieuws-2011/dnb255391.jsp

Acharya, V. R. (2009). Restoring Financial Stability: How to Repair a Failed System. Hoboken, NJ: John Wiley & Sons.

https://www.bankofengland.co.uk/-/media/boe/files/statistics/data-collection/spv/spv_worked.pdf

https://www.pwc.com/gx/en/banking-capital-markets/publications/assets/pdf/next-chapter-creating-understanding-of-spvs.pdf

https://www.occ.gov/static/ots/exam-handbook/ots-exam-handbook-221.pdf

https://financialservices.house.gov/media/pdf/110503cc.pdf

https://www2.deloitte.com/content/dam/Deloitte/us/Documents/risk/us-risk-securitization-accounting.pdf

https://www.vbsoexpertise.com.br/wp-content/uploads/2020/08/Frank_J._Fabozzi_Vinod_Kothari_Introduction_to_Securitization.pdf