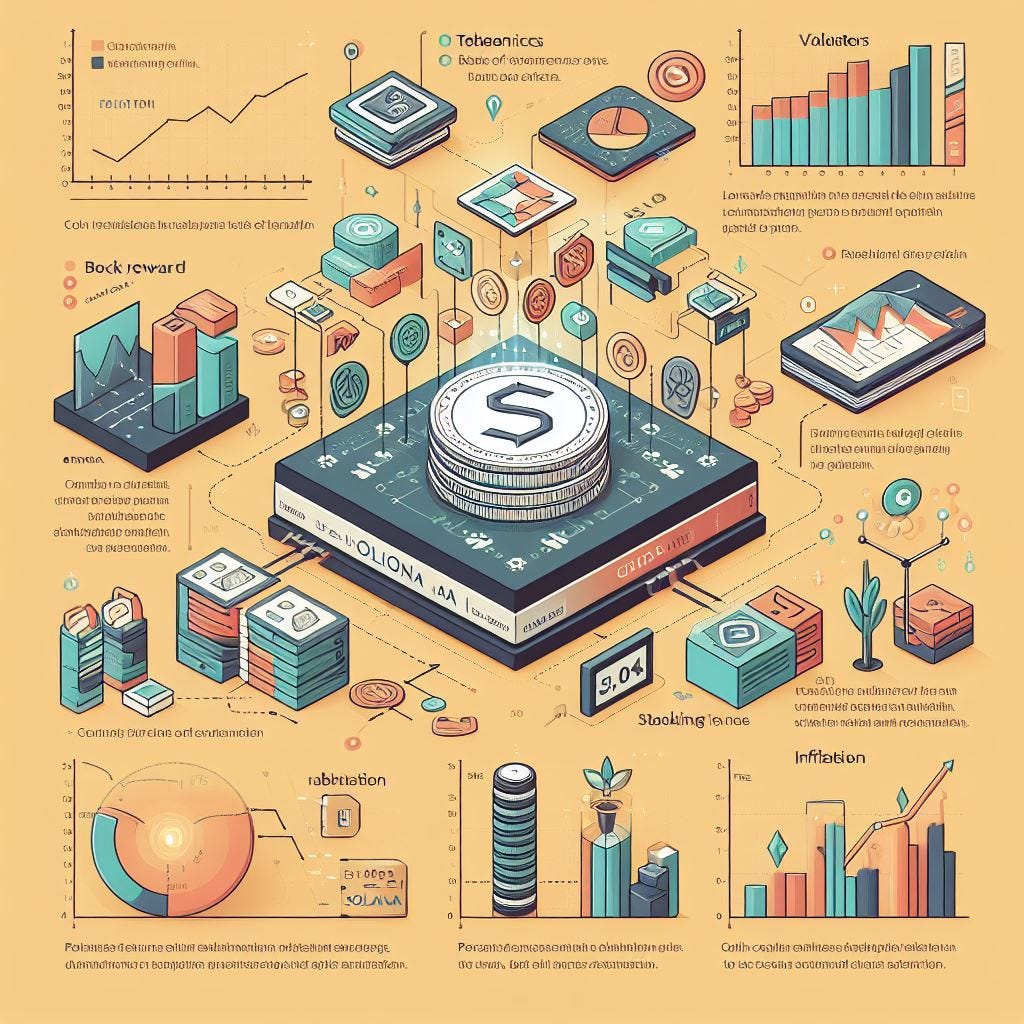

Solana: Tokenomics and Coin Creation (Solana's Tokenomics: Beyond Coin Creation)

Solana: Tokenomics and Coin Creation (Solana's Tokenomics: Beyond Coin Creation) Exploring SOL's fixed supply, model, and distribution strategies, and their influence on the Solana ecosystem

This website1 indicates that the Solana (SOL) token is the fifth largest cryptocurrency in the world's crypto market. It might surpass Binance Coin (BNB) in the coming days, as the difference in their market capitalization is only $3 billion.

What is the current supply of SOL?

The total amount of tokens is equal to difference between the issued Sol token and burned Sol token. At network launch, 500,000,000 SOL2 were instantiated in the genesis block. The total Sol token supply has been reduced by the burning of transaction fees and a planned token reduction event. These are the last numbers. Total supply is 571m sol token3. The amount of circulating Sol token is 442m and the non-circulating Sol token amount is 128m4.

The ratio of the circulating to the total Sol token amount is %77.5.

Non circulating supply takes two main forms:

SOL that is locked in a stake account. Usually staked, this SOL is generally the result of an investment in SOL or a grant by the Solana foundation.

SOL that is owned by Solana Labs or the Solana Foundation. This is also kept in stake accounts but is not locked.

The Solana protocol will automatically create new tokens on a predetermined schedule5. The Solana protocol uses the “Inflation Rate” term for the annualized growth rate of the Total Current Supply at any point in time.

Initial Inflation Rate: 8%

Disinflation Rate: -15%

Long-term Inflation Rate: 1.5%

The graph starts with an 8% the growth rate of newly issued SOL token when the schedule begins in February 2021. It indicates a disinflation rate of -15%. Disinflation refers to the rate at which the newly issued SOL token rate decreases over time. In this case, the -15% suggests that the growth rate of newly issued SOL token is reduced by 15% each year from its starting point.

The long-term inflation rate of 1.5%, indicates that after a 10 years, the newly issued SOL token rate will stabilize at this percentage. Solana team also calculated the SOL token issuance in the next 15 years using the assumptional inflation datas. I can note that this projection doesn’t include the fee burning amounts.

From these simulated Inflation Schedules, we can also project ranges for token issuance over time. It is understand that the Sol token supply will be 800m in the next 15 years.

The effective protocol-based annual staking yield (%) per epoch received by validation-clients is to be a function of:

the current global inflation rate, derived from the pre-determined disinflationary issuance schedule (see Validation-client Economics)

the fraction of staked SOLs out of the current total circulating supply,

the commission charged by the validation service,

the up-time/participation of a given validator over the previous epoch.6

The ratio of the total staked SOL tokens to the total amount of SOL is 66.2%.7

At present 50% of all fees on Solana - whether base fees8, vote fees or priority fees - are burned. The remaining 50% are sent to the leading validator who proposed the block.

Engin YILMAZ (

)

![Total Current Supply [SOL] Total Current Supply [SOL]](https://substackcdn.com/image/fetch/$s_!j1X0!,w_1456,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F2cbaec5e-0377-42db-9219-15a604f86a3a_1121x224.png)