New Eurosystem’s Operational Framework (ECB New Operational Framework)(2024)

The new Eurosystem’s operational framework ECB New Operational Framework Soft floor with a narrow spread 2024 ECB New Policy

INTRODUCTION

These are the preliminary details necessary for understanding the new Eurosystem’s operational framework. If you are familiar with the 'Key ECB Interest Rates', ‘Asset purchase programmes ‘, 'Targeted Longer-Term Refinancing Operations', 'The Euro Short-Term Rate', ‘ Pandemic emergency purchase programme ‘, 'The Corridor System' and 'The Floor System', you may skip Part I and proceed directly to Part II.

Credits to Isabel Schnabel for The Eurosystem’s operational framework1 , Back to normal? Balance sheet size and interest rate control2, and The ECB and its New Operational Framework3.

PART I

Key ECB Interest Rates

The deposit facility rate (DF or DFR): The rate defines the interest banks receive for depositing money with the central bank overnight.4

Main refinancing operation rate: The main refinancing operations (MRO) rate is the interest rate banks pay when they borrow money from the ECB for one week.5

The marginal lending facility rate is the interest rate banks pay when they borrow from the ECB overnight.6

Asset Purchase Programmes

The ECB’s asset purchase programme (APP) started as part of a package of non-standard monetary policy measures that also included targeted longer-term refinancing operations, and which was initiated in mid-2014 to support the monetary policy transmission mechanism and provide the amount of policy accommodation needed to ensure price stability.7

The APP consists of the:

Targeted longer-term refinancing operations (TLTROs)

The TLTROs8 are targeted operations, as the amount that banks can borrow is linked to their loans to non-financial corporations and households. Normally, banks lend credit to customers and borrow reserves to meet the reserve requirements from the ECB. This tool provides reserves to banks at an interest rate that is more attractive before the lending process begins.

It's important to emphasize that participating banks should issue more loans to non-financial corporations and households, excluding those for household purchases.

The euro short-term rate (€STR) (Old name is EONIA)

The euro short-term rate (€STR) reflects the wholesale euro unsecured overnight borrowing costs of banks located in the euro area.9

Pandemic emergency purchase programme (PEPP)

The ECB’s pandemic emergency purchase programme (PEPP) is a non-standard monetary policy measure initiated in March 2020 to counter the serious risks to the monetary policy transmission mechanism and the outlook for the euro area posed by the coronavirus (COVID-19) outbreak. The PEPP is a temporary asset purchase programme covering private and public sector securities.10

The corridor system

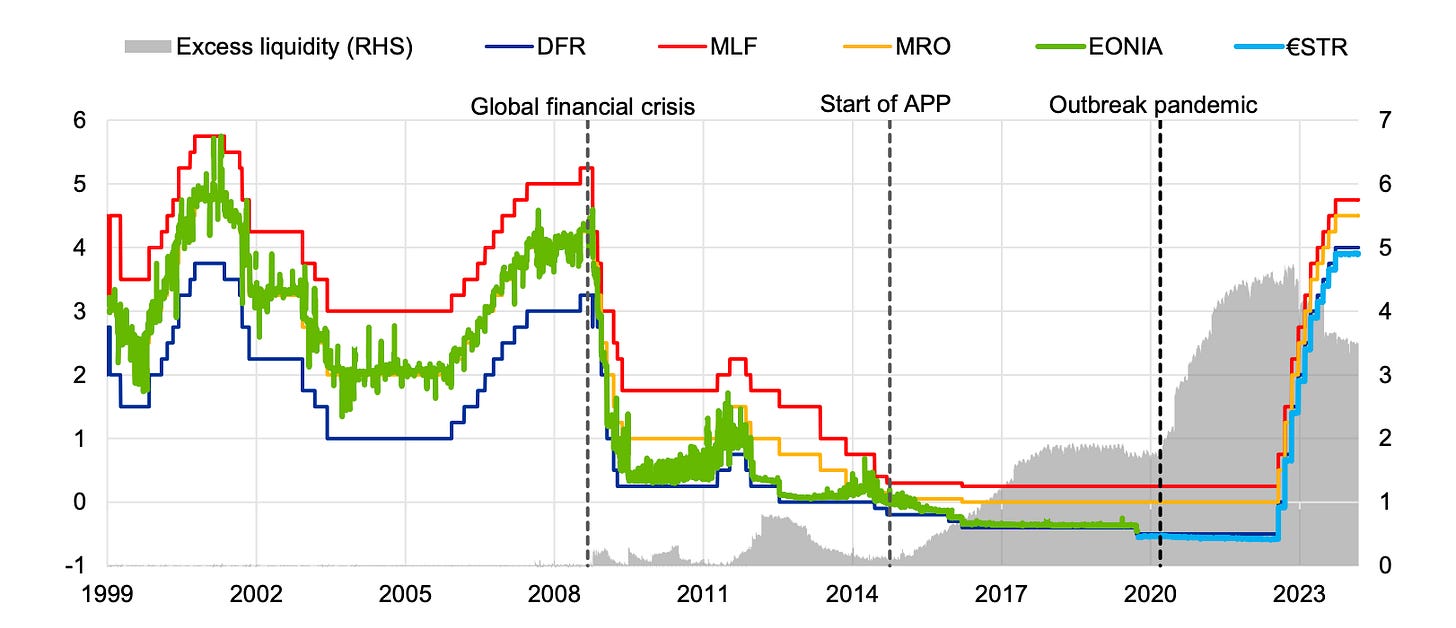

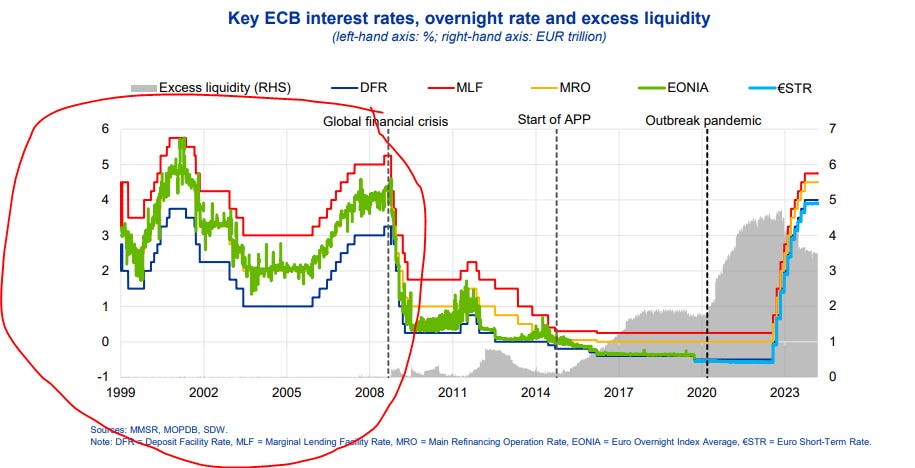

The corridor system is based on managing scarce reserves and is controlled by two interest rates in a symmetric corridor, or sometimes by one interest rate in an asymmetric corridor.11 The graph depicts the supply and demand for reserves within the Eurosystem's corridor system before the 2008 financial crisis.

This graph illustrates how the corridor system functioned before the 2008 crisis, highlighting that this system had a wide corridor. The wide corridor is indicated by the wide distance of the MLF and DF rates. This suggests that the central bank is aiming to keep market interest rates within a wide range.

The floor system

The floor system is not based on the amount of reserves and is controlled by a single interest rate.12 The graph illustrates the Eurosystem's shift to a floor system of monetary policy around 2015. In this system, the central bank provides ample reserves through asset purchases and targeted longer-term refinancing operations (TLTROs), which can be seen from the large horizontal shift to the right in the "Supply of reserves" curve. This system is characterized by the central bank controlling the interest rate directly by setting the rate it pays on reserves, rather than by actively managing the quantity of reserves to influence market rates.

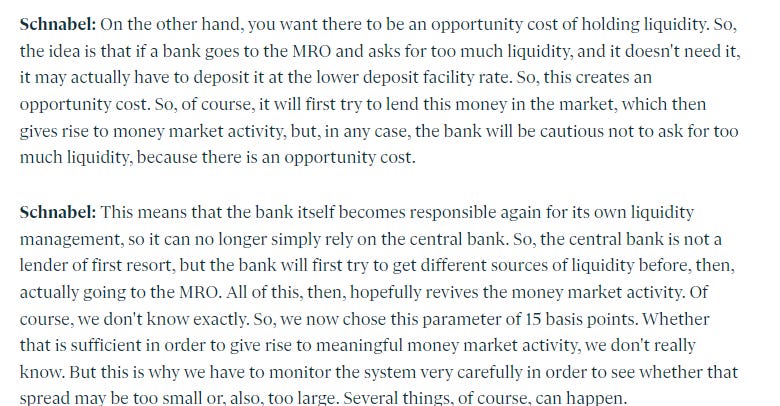

When ECB launched the APP in mid-2014 and excess liquidity started to grow rapidly, ECB effectively moved from a “corridor” towards a “floor” system. The shaded area represents excess liquidity, which has been rising since around 2015, indicative of the ECB’s implementation of non-standard monetary policy measures, such as asset purchases and TLTROs, to inject more liquidity into the banking system.

The following figure summarizes the interest rate implementation mechanisms in the corridor and the floor frameworks.13

Structural Operations

The term "structural operations" as used by the European Central Bank (ECB) refers to market operations conducted by the central bank to adjust the structural position of the Eurosystem vis-à-vis the financial sector. In simpler terms, these operations are meant to manage the liquidity situation in the market over the longer term, rather than addressing immediate, short-term fluctuations.

PART II

Pre-2008 Corridor Framework

The ability to effectively steer overnight rates in the pre-2008 corridor framework relied heavily on two features.

The first was ECB’s ability to accurately predict the reserves needed to steer the operational target towards the middle of the corridor.

The second feature was a well-functioning interbank market that distributed central bank reserves efficiently across the euro area banking system.

Isabel stated that this sytem was the corridor system with scarce liquidity. The corridor was actually quite large, so it was like +/- 100 basis points.

By providing the reserves needed to plug the liquidity deficit, the Eurosystem was able to steer the unsecured overnight interest rate to the middle of the corridor that is spanned by the ECB’s three key policy rates:

the DFR

the MROs and

the MLF.

This graph illustrates how the corridor system functioned before the 2008 crisis, highlighting that this system had a wide corridor.

The ECB accepted deviations of the overnight rate from the policy target that were, on average, larger than those of the Federal Reserve System or the Bank of Japan but smaller than those of the Bank of England or Sveriges Riksbank . This was partly a reflection of the relatively large size of the corridor.

The global financial crisis

The global financial crisis exposed vulnerabilities of the pre-2008 corridor framework.

As the global financial crisis unfolded in August 2007 and banks hoarded reserves, parts of the euro area money market froze and interbank funding costs soared.

The liquidity in the system was no longer determined by the ECB alone but also by banks, which affected the ECB’s ability to steer money market rates. Isabel identifies this system as the demand-driven system with a relatively wide corridor.

The ECB came out of the global financial crisis, but then it basically entered the sovereign debt crisis, which was quite a difficult period for the ECB.

Sovereign Debt Crisis

The ECB launched the three-year longer-term refinancing operations in 2011 and 2012 in response to the euro area sovereign debt crisis, excess liquidity rose considerably, pushing money market rates from levels close to the rate on the MROs down to the DFR.

The effective lower bound and the balance sheet is increased since mid-2014

In 2014, facing the zero lower bound, the ECB employed TLTROs and asset purchases and it is called the first wave of balance sheet expansion. The ECB started purchasing bonds under the asset purchase programme (APP). As these purchases created new central bank reserves, excess liquidity quickly rose to levels that were sufficiently large to keep money market rates closely anchored around the DFR. It offered banks a series of targeted longer-term refinancing operations (TLTROs) and conducted asset purchases to stimulate economic activity and raise inflation. These operations also led to a sharp increase in the reserves. You can see this growth from the above graph (excess liquidity indicated by the gray space).

The ECB's response to the pandemic(2020) triggered the second wave of balance sheet expansion, notably through the initiation of the pandemic emergency purchase programme (PEPP) and modifications to the third series of TLTROs, which substantially increased the reserves.

When ECB launched the APP in mid- 2014 and excess liquidity started to grow rapidly, ECB effectively moved from a “corridor” towards a “floor” system. The supply curve shifted further and further to the right, crossing the demand curve at its flat, highly elastic part, where discrete changes in liquidity have very little effect on the level of short-term interest rates.

The aggregate level of reserves has been largely determined by the quantity of asset purchases rather than by banks’ liquidity choices in the floor system.

These are the problems in the floor system

- Decline in Unsecured Interbank Market Reserve Transactions

Following the global financial crisis, the substantial increase in excess reserves and the significant fragmentation have led to a marked decrease in the amount of reserves being exchanged through the unsecured interbank market.

- Hold a higher level of excess reserves

There are two main reasons as to why banks may today wish to hold a higher level of excess reserves.

Regulatory changes: The introduction of Basel III has resulted in a measurable increase in the demand for high-quality liquid assets (HQLA) that banks need to hold to comply with the liquidity coverage ratio (LCR). Many euro area banks currently use excess reserves to meet regulatory requirements, especially in those countries with high excess liquidity. For the euro area as a whole, excess reserves currently account for 60% of HQLA holdings.

Banks’ precautionary behaviour: Banks’ precautionary behaviour in guarding against liquidity risks, as the turbulent events in the past few weeks forcefully underline. Overnight deposits at euro area banks have shown an upward trend in relation to banks’ total deposits until about mid-2022. The banks often decided to hold on to about %20 of excess reserves which they placed in the deposit facility that pays a lower rate of remuneration, so that the short-term rate remained stuck to the floor of the corridor.

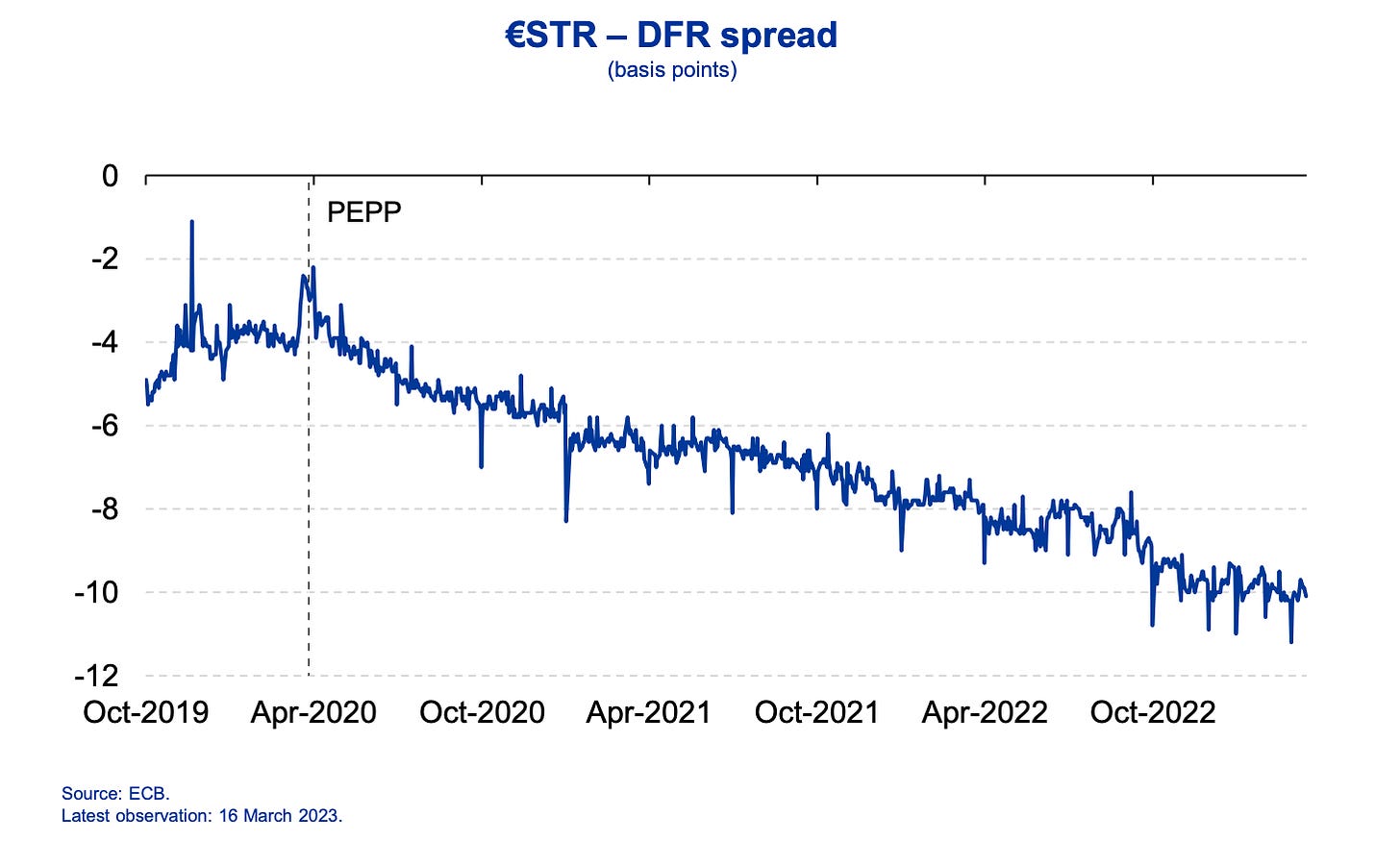

- €STR, increasingly decoupling from the DFR

The large increase in reserves is result from PEPP and TLTROs has made the floor in the euro area more and more leaky, with the euro area’s benchmark interest rate, €STR, increasingly decoupling from the DFR.

The euro area’s benchmark interest rate, €STR, increasingly decoupling from the DFR is explained from the following perspectives by Isabel.

- Increase the borrowing from non-banks

The ECB controls the widening of this interest rate gap by broadening access to the deposit facility. This system disintermediates the unsecured money market, so that the computation of €STR heavily relies on banks’ trading with market participants who have no access to the Eurosystem’s balance sheet. The ECB calculates that borrowing from non-banks accounted for nearly 90% of all unsecured money market transactions.

- The banks used the TLTROs to reduce their borrowing in the market

The provision of ample reserves discouraged banks from seeking market-based funding solutions. For example, many banks used the TLTROs to reduce their borrowing in the market, causing a decline in the issuance of commercial paper, secured or unsecured bank bonds and other liabilities.

- Increase the Eurosystem’s footprint in financial markets

The abundant liquidity increased Eurosystem’s footprint in financial markets considerably over the past decade. As providing reserves through asset purchases reduces the free float of safe assets, liquidity may dry up in some segments of the financial market and collateral may become scarce.

Isabel stated that the ECB is concerned about liquidity issues related to collateral in the Euro area.

-25 banks alone currently hold over 40% of excess liquidity

In the euro area, for example, 25 banks alone currently hold over 40% of excess liquidity, with little changes over time. The liquidity that comes from asset purchases often ends up primarily with a few large financial institutions, which are mostly situated in a limited number of member countries.

The balance sheet declined since March 2023

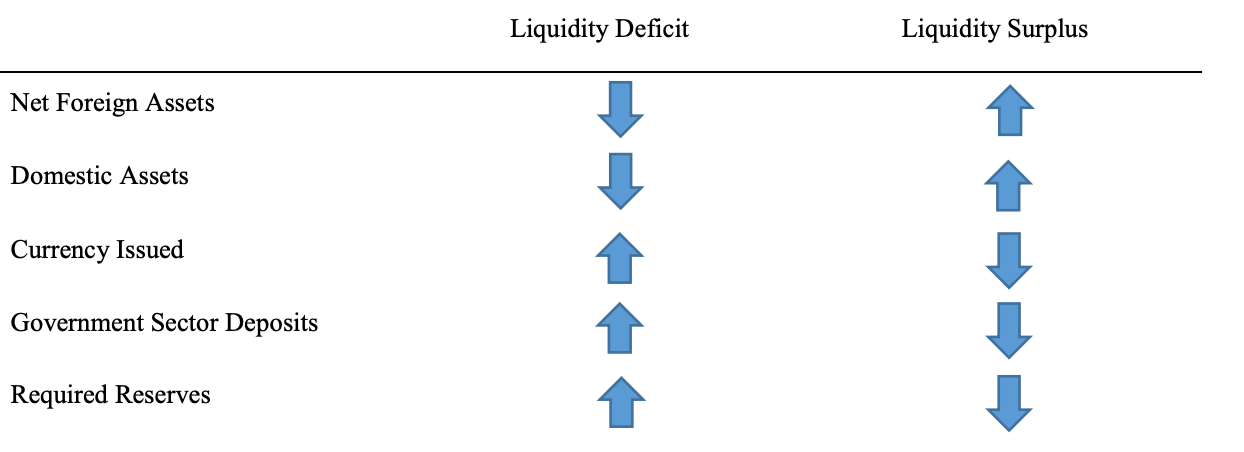

It is known that the ECB is going to review the New Operational Framework already in two years time. The balance sheet has declined further since the beginning of March 2023, when ECB stopped fully reinvesting maturing securities bought under the asset purchase programme. However, the size of ECB’s balance sheet will not return to the levels seen before the global financial crisis. Over the long run, the ECB’s balance sheet size is driven by growth in reserve requirements and by what are known as autonomous factors , which are beyond the control of the Eurosystem.

This illustration14 is from my article and you can learn more about the autonomous factors.

ECB estimates that excess liquidity will be fully absorbed by 2029. At that point, the Eurosystem’s balance sheet would still be about three times the size it was in 2007. The ECB knows that declining supply of reserves creates the new problems in banking sector. The reserve scarcity puts upward pressure on interest rates even at high levels of aggregate excess reserves.

The reserves has started to decline because of the sharp reversal in the course of monetary policy that was necessary to fight the post-pandemic surge in inflation. The TLTRO loans’ repaying , and as some of the bonds held by the Eurosystem have matured without being reinvested, excess liquidity has fallen by about €1.2 trillion from a peak of nearly €4.7 trillion in mid-202215. By the end of 2025, it is expected to decline by another €1.4 trillion to around €2.1 trillion.

Isabel Schnabel explained that initially, there were repayments of the TLTROs—Targeted Longer-Term Refinancing Operations—and a gradual commencement of Quantitative Tightening (QT). This led to a reduction in excess liquidity. They are cautious not to reduce reserves too quickly because, similar to the crisis in the USA in 2019, rapid reductions can lead to unexpected financial disturbances.

Changes to the operational framework for implementing monetary policy (13 March 2024)

The ECB Governing Council16 has evaluated options that would safeguard the smooth implementation of monetary policy as reserves become less ample.

The Governing Council will continue to steer the monetary policy stance through the DFR. Short-term money market interest rates are expected to evolve in the vicinity of the DFR with tolerance for some volatility as long as it does not blur the signal about the intended monetary policy stance.

The Eurosystem will provide liquidity through a broad mix of instruments, including short-term credit operations (i.e. MROs) and three-month longer-term refinancing operations (LTROs) as well as – at a later stage – structural longer-term credit operations and a structural portfolio of securities.

The rate on the MROs will be adjusted such that the spread between the rate on the MROs and the DFR will be reduced to 15 basis points from the current spread of 50 basis points. The rate on the marginal lending facility (MLF) will also be adjusted such that the spread between the rate on the MLF and the rate on the MROs will remain unchanged at 25 basis points.

The asset purchase programme (APP) and the pandemic emergency purchase programme (PEPP) to continue to be run off.

Banks’ minimum reserve requirements remains unchanged at 1%. The remuneration of minimum reserves remains unchanged at 0%.

Based on these principles, the framework is designed as a hybrid system that provides reserves elastically and through a mix of instruments, including both short-term lending operations and structural operations. The ECB’s operational framework has three key characteristics.

Demand-driven nature: ECB will continue to provide as much liquidity as banks demand at a fixed rate in the MROs and in the three-month longer-term refinancing operations against broad collateral. The central bank reserves become less ample. The ECB currently sees no need to grant non-banks access to the Eurosystem balance sheet. The ECB believes that focusing its refinancing operations on liquidity provision ensures that this liquidity is distributed throughout the entire euro area. In contrast, liquidity that comes from asset purchases often ends up primarily with a few large financial institutions, which are mostly situated in a limited number of member countries. The ECB’s lending operations tend to lead to a more even distribution of reserves across banks and countries.

The central bank reserves become less ample. The ECB currently sees no need to grant non-banks access to the Eurosystem balance sheet. The ECB focuses its liquidity provision operations instead of the asset purchases. A demand-driven system will reduce both the Eurosystem’s footprint in financial markets and the financial risks it faces.

Isabel also referenced the Acharya paper17 and said that “ these papers by Viral Acharya and Raghuram Rajan who said that with QE, you have this ratcheting up of the balance sheet. So, whenever there's a shock, you go up, but you never really get it down again, and that's a bit of the problem that I also see. And I personally believe that the demand-driven system is better able to deal with that”.

The mix of instruments: The ECB will complement short-term lending operations with new longer-term lending operations and a new structural bond portfolio. Both of these will provide a more stable source of liquidity. But as the run-down of the APP and the PEPP portfolios proceeds, banks will increasingly need to borrow reserves from the Eurosystem, which will show up in a rise in the liquidity demanded at our regular operations. Once the Eurosystem balance sheet begins to grow durably again, ECB will start supplying reserves through new longer-term refinancing operations and through the new structural bond portfolio, taking into account legacy bond holdings.

The ECB will complement the short-term lending operations with new longer-term lending operations and a new structural bond portfolio.

The “soft” floor with a narrow spread: Current large excess liquidity levels imply that short-term interest rates can be expected to continue to trade in a narrow range around the DFR for some time. As reserves become less ample, however, money market rates could rise relative to the DFR and potentially become more volatile. The relatively narrow spread of 15 basis points between the rate on the MROs and the DFR will limit the potential upward pressure on money market rates and set incentives for banks to borrow liquidity in ECB operations as ECB balance sheet normalises. It implies that short-term money market rates are likely to evolve in the vicinity of the DFR. .

The ECB wants the spread to be small enough so that it can limit volatility, in particular, in this difficult transition phase, to a system with less excess liquidity. As reserves become less ample. The relatively narrow spread of 15 basis points between the rate on the MROs and the DFR will limit the potential upward pressure on money market rates and set incentives for banks to borrow liquidity in ECB operations as ECB balance sheet normalises. A “soft” floor means that the Governing Council will tolerate deviations from the DFR, provided such movements do not blur the signal about the intended monetary policy stance. In other words, orderly deviations in both directions are accepted. However, excessive volatility that would interfere with the monetary policy stance, or a persistent drift of money market rates away from the DFR, could require the framework parameters to be reviewed.

Isabel stated that the central bank is not a lender of first resort.

Conclusion

In conclusion, the ECB's new operational framework marks a significant shift towards a more adaptive and responsive monetary policy strategy. This change is designed to accommodate the dynamic needs of the Euro area banking sector while managing the systemic risks that have emerged in recent years. By transitioning from a "corridor" to a "floor" system and now towards a hybrid soft floor model, the ECB aims to provide liquidity through a diversified mix of instruments, including both short-term and longer-term refinancing operations as well as a structural bond portfolio.

The focus on a demand-driven system, where liquidity is provided based on the actual needs of banks, represents a strategic pivot. This approach not only aims to ensure a more efficient distribution of reserves across the euro area but also reduces the ECB's footprint in financial markets, mitigating financial risks. The introduction of a narrower spread between key operational rates seeks to stabilize money market rates, minimizing volatility during this transition to lesser excess liquidity.

Engin YILMAZ (

)ECB (2024), ECB announces changes to the operational framework for implementing monetary policy, 13 March. Link