Today in ALL ABOUT THE MONEY, we explain how the Social Security Trust Fund actually works.

The Social Security Trust Fund is not a single fund.

It is made up of two separate trust funds.

OASI – Old-Age and Survivors Insurance

This fund pays Retirement benefits and Survivor benefits.

DI – Disability Insurance

DI supports disabled workers and their dependents.

Around 184 million workers in the United States are in Social Security–covered employment — meaning they contribute payroll taxes and earn benefit eligibility.

Approximately 75 million people currently receive Social Security benefits — including retirees, disabled workers, and survivors.

The average monthly Social Security payment is approximately $737 — providing basic income support to millions of beneficiaries.

Social Security is primarily funded by payroll taxes. Workers and employers contribute through FICA, while self-employed individuals contribute through SECA. These payroll taxes make up the bulk of Trust Fund revenues. In addition to payroll taxes, Social Security also receives revenue from:

Interest earned on Treasury securities held by the Trust Fund,

Federal Income Taxes on Social Security benefits,

Reimbursements and transfers from the general fund of the U.S. Treasury.

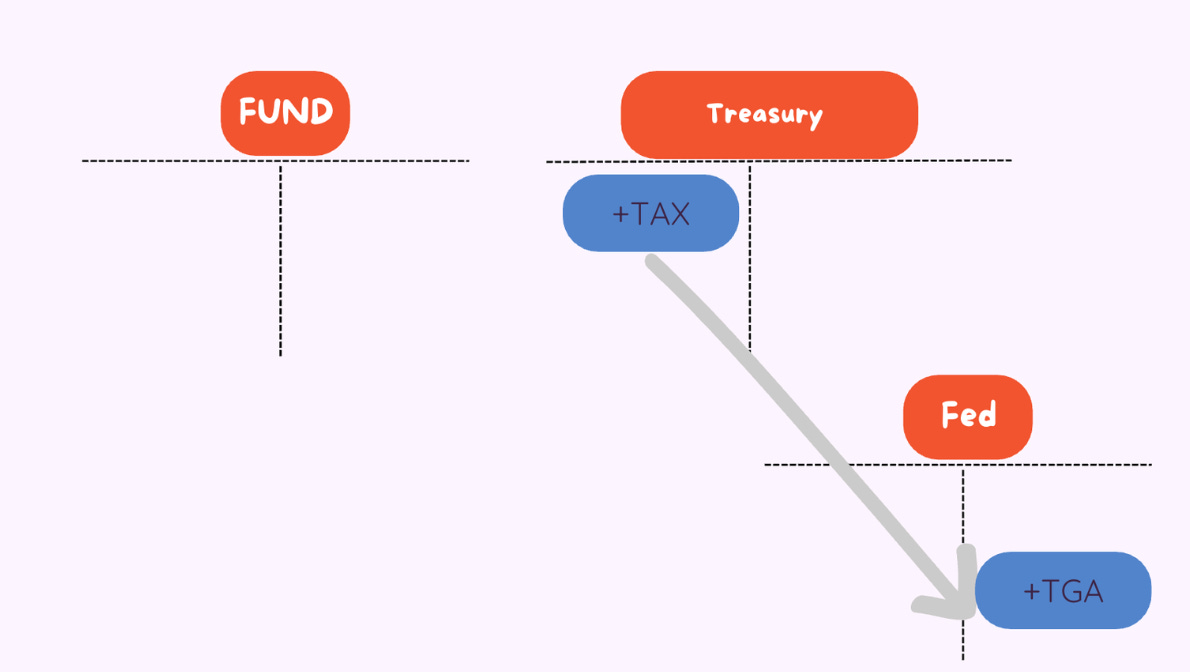

When payroll taxes are withheld from workers’ paychecks, the funds are collected by the IRS and transferred to the U.S. Treasury. The money does not go into a separate Trust Fund vault. Instead, it is deposited into the Treasury General Account at the Federal Reserve, where it becomes part of the government’s overall cash balance.

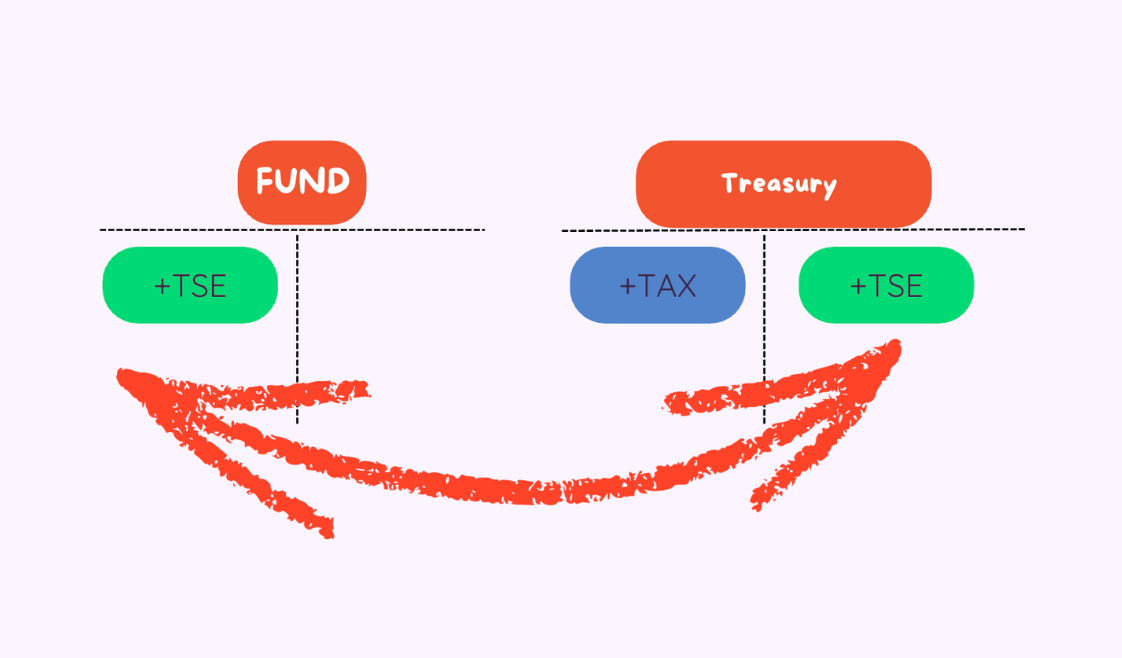

When payroll taxes are collected, they go to the U.S. Treasury. In exchange, the Treasury issues special-issue Treasury securities to the Social Security Trust Fund. The Trust Fund holds these securities — not cash.

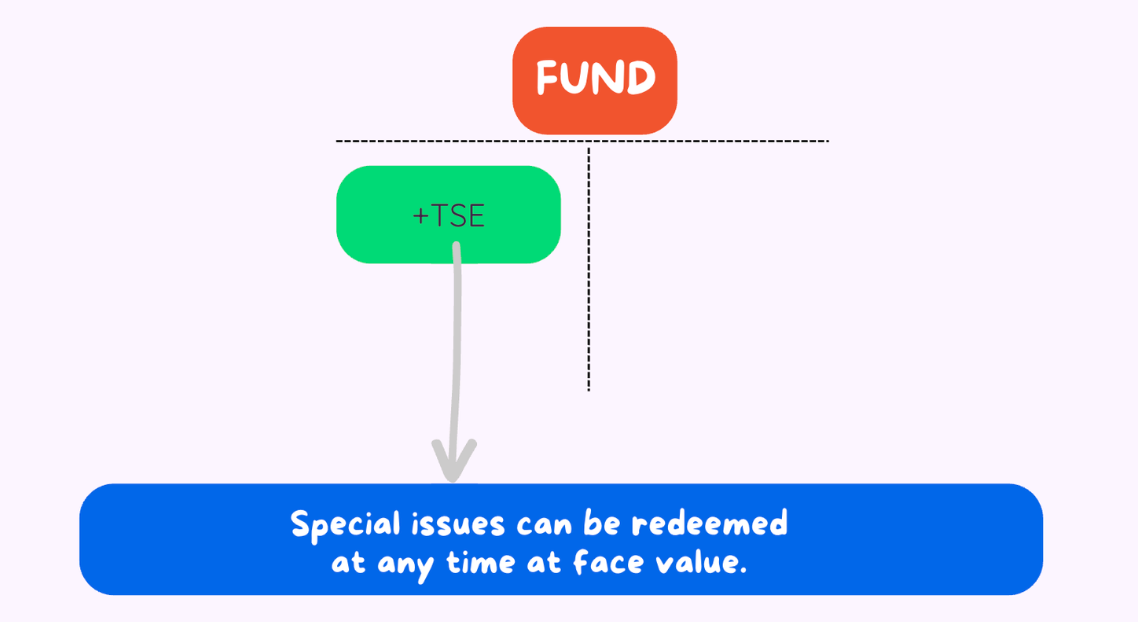

The Social Security Trust Fund holds special-issue Treasury securities (TSEs).

These securities are not traded in financial markets. They can be redeemed at any time at face value. When the Trust Fund needs cash to pay benefits, it redeems these securities. The Treasury then provides the necessary funds.

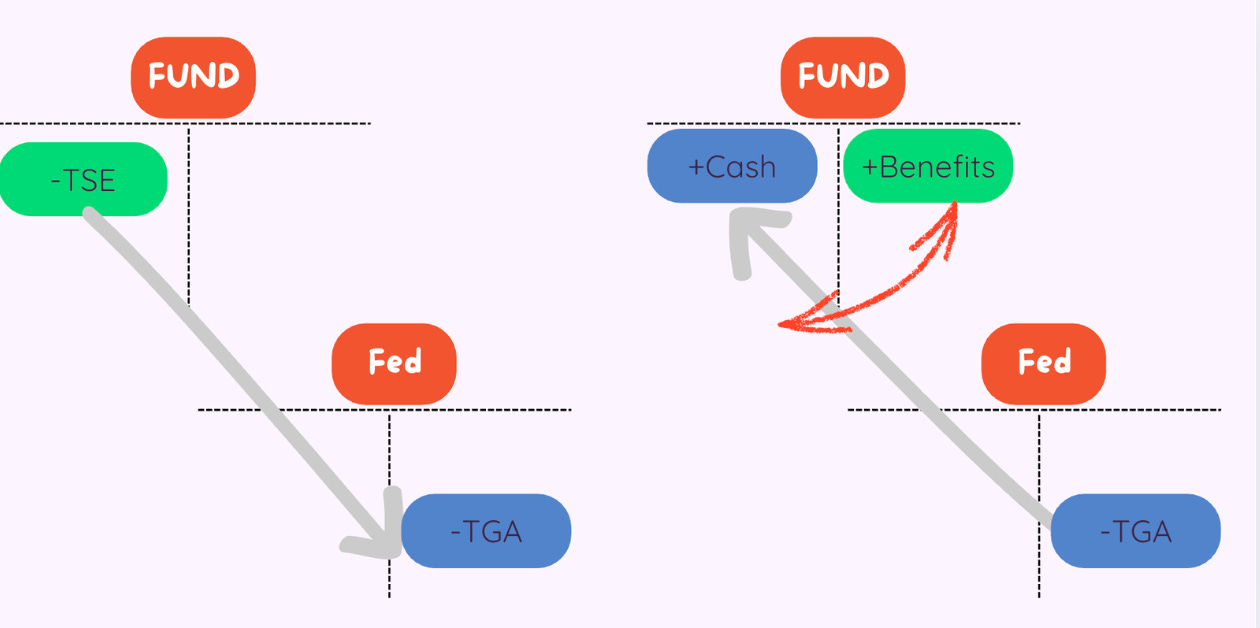

What Happens When the Trust Fund Redeems Securities?

On the left side:

The Trust Fund reduces its holdings of special-issue Treasury securities.

That’s why you see minus TSE.

This means the Fund is redeeming its securities.

The Treasury must provide the cash.

Where does the cash come from?

From the Treasury General Account (TGA) at the Federal Reserve.

So:

The TGA balance falls

That’s why you see minus TGA

On the right side:

The Fund receives cash (plus Cash)

Then pays benefits (plus Benefits)

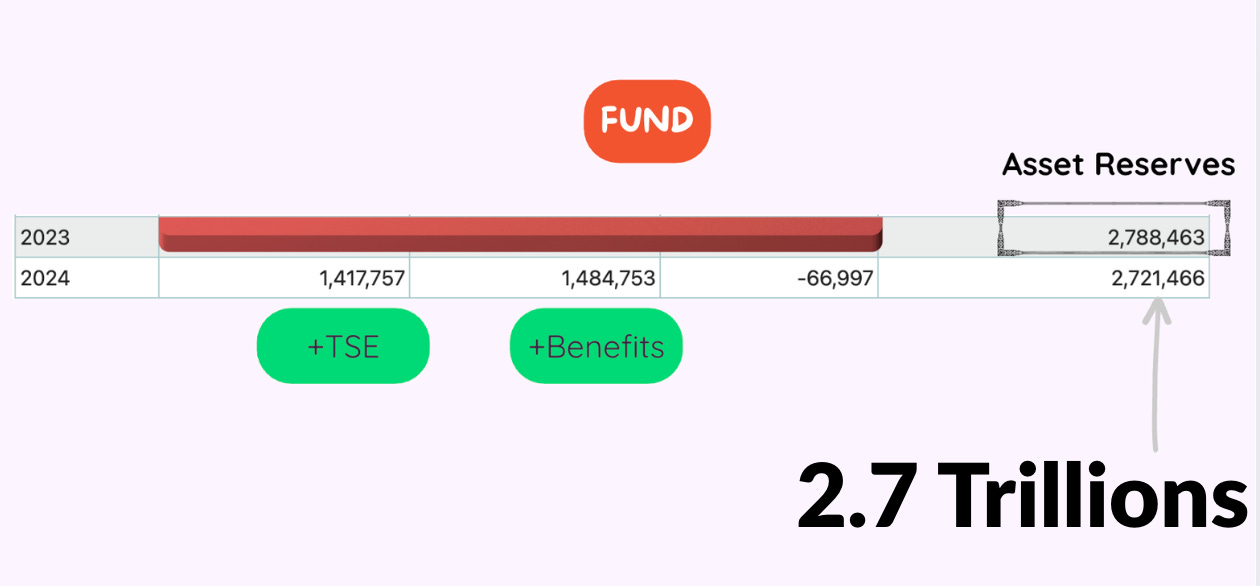

Social Security benefits are primarily paid from current revenues. When revenues are not enough to cover total costs, the Trust Fund redeems its asset reserves. As a result, reserves rise in surplus years and decline in deficit years.

In 2024, revenues were $1.417 trillion, while benefit costs were $1.484 trillion, creating a deficit of $66 billion. The Trust Fund covered this shortfall by redeeming Treasury securities, which reduced total asset reserves from $2.788 trillion to $2.721 trillion.

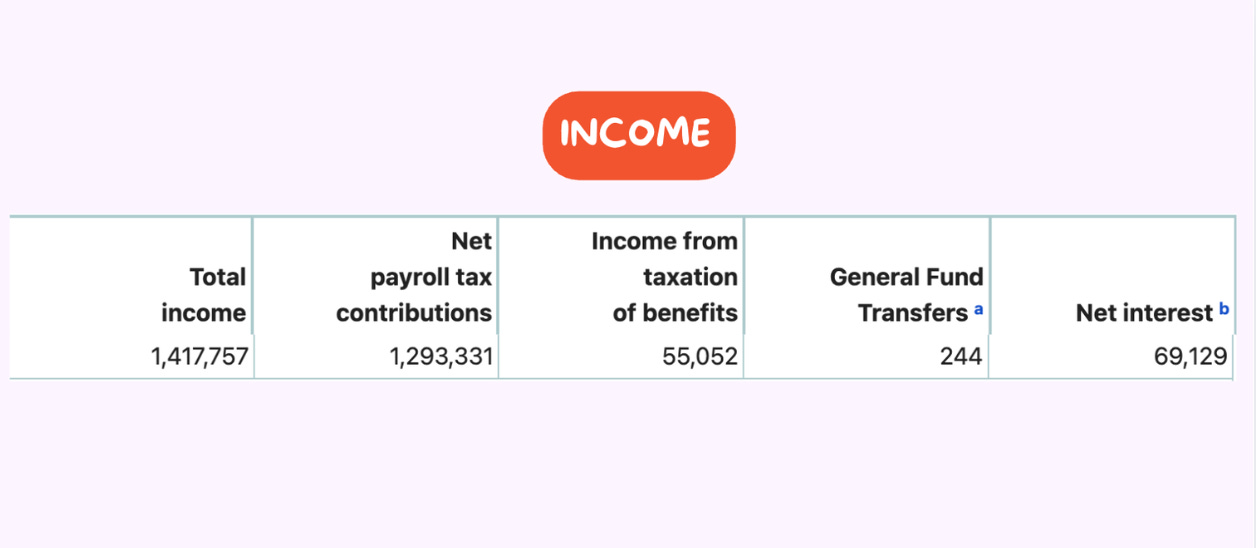

In 2024, the Social Security Trust Fund recorded total income of $1,417,757 million. The largest portion came from net payroll tax contributions, amounting to $1,293,331 million. Income from the taxation of benefits contributed $55,052 million, while general fund transfers added $244 million. In addition, the Trust Fund earned $69,129 million in net interest.

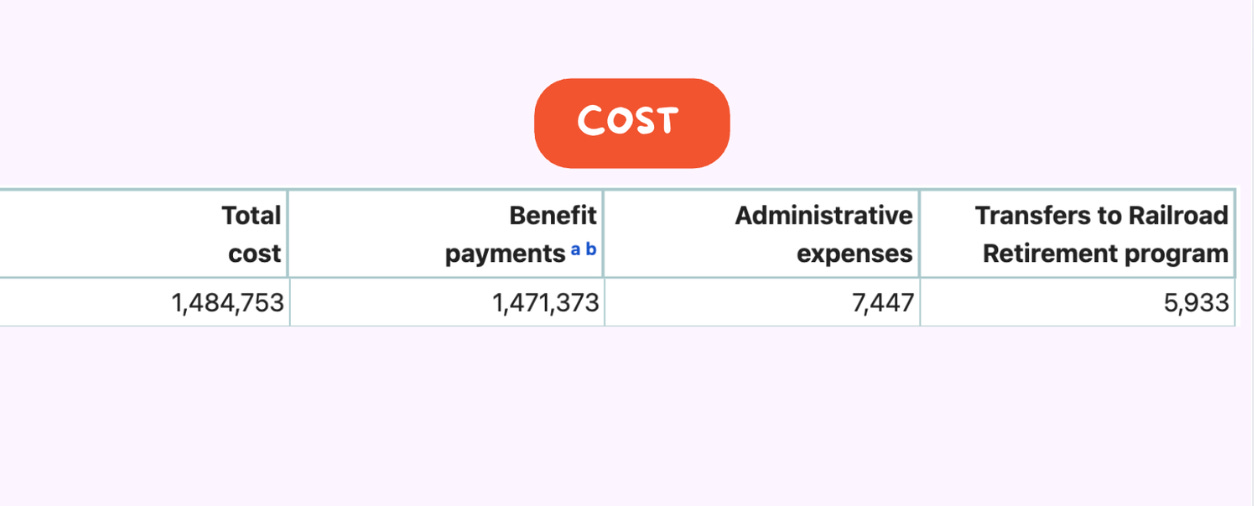

In 2024, total costs amounted to $1,484,753 million. The vast majority of this spending consisted of benefit payments, which totaled $1,471,373 million. Administrative expenses were $7,447 million, and transfers to the Railroad Retirement program accounted for $5,933 million.

Thank you very much for watching and for your time.

If you found this video helpful, I would truly appreciate your support.

📘 Modern Monetary System in Theory and Practice: Who Creates Money?

A balance-sheet–grounded framework for understanding how money actually works in the modern economy.

Special Issue1 , Investment2, Income3, Contributions4, Report5, Data6, CFR Report7

References