How does the Swap Facility of the People’s Bank of China work? (Swap 101)

How does the Swap Facility of the People’s Bank of China work? (Swap 101)

Two news channels announced that the PBOC has begun offering a new swap facility to companies. [Bloomberg] Beijing’s liquidity support for the stock market will come in the form of a 500 billion yuan swap facility, central bank governor Pan Gongsheng said Tuesday at a briefing in Beijing.1 [Yahoo] The People's Bank of China (PBOC) plans to set up a swap facility that would give non-bank financial institutions access to at least 500 billion yuan (US$71 billion) in funding to buy shares, in a surprise move aimed at stabilising the stock market.2

Aim:

The People’s Bank of China provides liquidity to companies to support the stock market. Could you explain how the central bank would carry out this operation? I am trying to describe this operation using the T-balance sheet approach.

Actors:

We have 3 actors in this operation:

CB: Central Bank

Bank

Company

Actions:

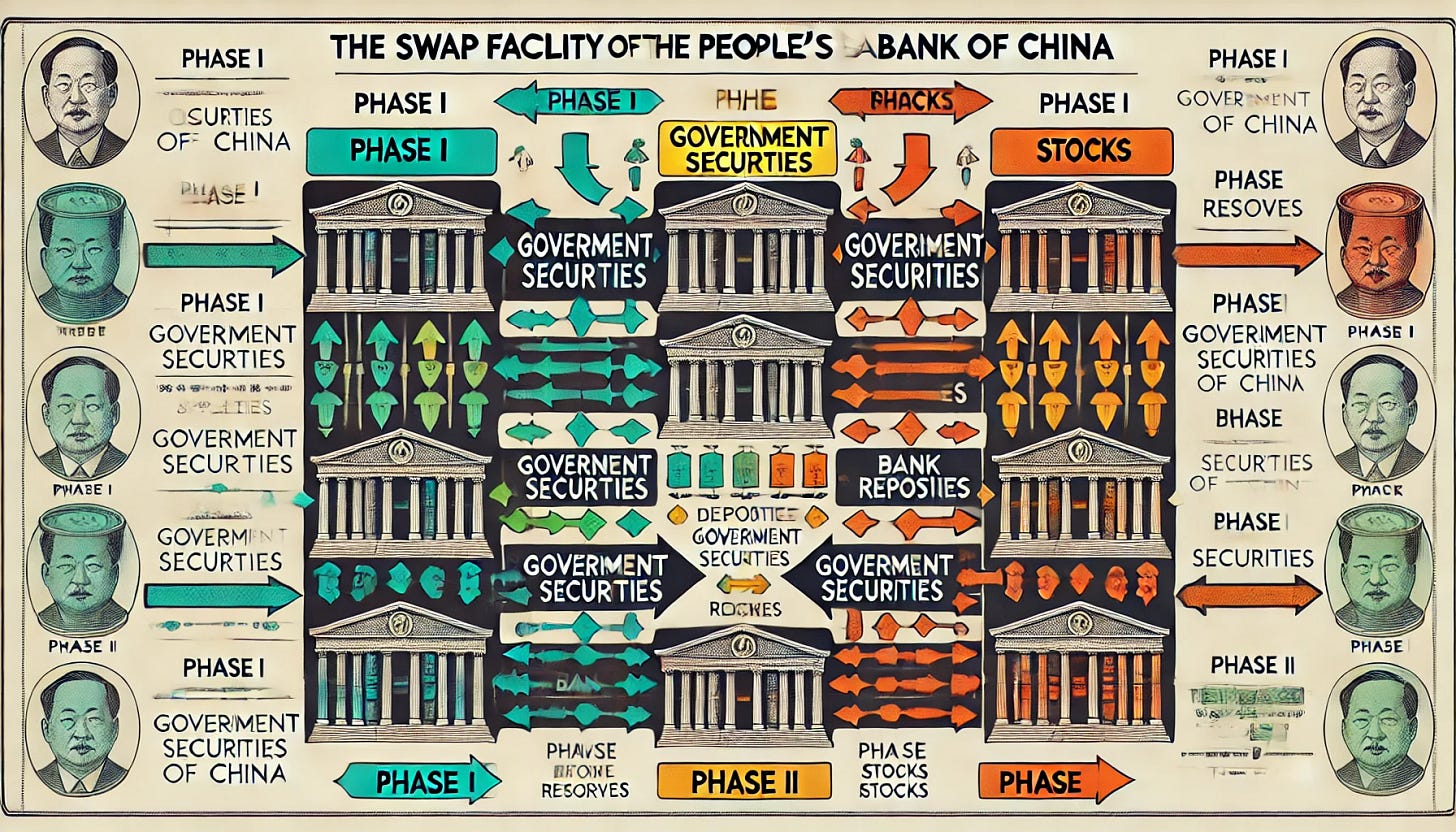

First Phase:

The first phase involves swapping eligible assets from the private sector with the central bank’s holdings. The central bank’s holdings include government securities and central bank bills.

Eligible securities firms, funds and insurance companies will be allowed to use their holdings of bonds, stock ETFs, CSI 300 constituent stocks and other assets as collateral to obtain high-liquid assets such as government bonds and central bank bills from the PBOC.

Second Phase:

The second phase companies used these government securities as the collateral for borrowing liquidity from Central Bank. The bank intermediates this transaction creating the deposits in company’s account.

The swap for more liquid assets “will significantly increase institutions’ ability to acquire funds and buy stocks.

Third Phase:

Company can invest in the stock market with its deposits.

Third Phase Balance Sheet’s Appearance:

The company swapped its stocks for government securities, received liquidity in the second phase, and then used this liquidity to buy stocks in the third phase.

☕ Company gives its stocks

💌 Company takes the government securities

❤️ Company gives the government securities

💬 Company takes the liquidity

📜 Company gives the liquidity

🕵️ Company takes new stocks

Conclusion:

The People’s Bank of China swaps private companies' stocks with its own holdings and accepts these holdings as collateral for lending liquidity to the companies. The companies then use the liquidity to buy stocks from the market. As a result, the central bank creates liquidity to increase the transaction volume of the stock market.

Engin YILMAZ ( VeriDelisi )

Sources

https://www.bloomberg.com/news/articles/2024-09-24/china-to-allow-funds-brokers-to-tap-pboc-funding-to-buy-stocks-m1frm2al

https://sg.finance.yahoo.com/news/pboc-set-us-71-billion-093000332.html

Quality post 👌