Corridor vs. Floor Systems: A Complete Guide for Central Bankers

Navigating the Labyrinth: Demystifying Corridor and Floor Systems in Monetary Policy What is the corridor system? What is the floor system? What are the differences between two system? #Fed #Corridor

Key Takeaways:

The corridor system is based on the management of scarce reserves and is controlled by two interest rates in a symmetric corridor, or sometimes by one interest rate in an asymmetric corridor.

The floor system is not based on the level of reserves and is driven by a single interest rate.

The corridor system wasn't part of the Federal Reserve's policy approach until the early 2000s.

After the 2008 global financial crisis, with the Federal Reserve's quantitative easing operations, the Fed changed its system from a corridor to a floor.

Overnight reverse repurchase agreements were increased in 2013, creating an alternative floor below the federal funds rate.

43.8% of central banks use a corridor system and 21.9% use a floor system.

Introduction.

The Federal Reserve implements monetary policy by choosing a target for the federal funds rate. The Federal Reserve (Fed) defines this rate as "The federal funds rate is the interest rate at which depository institutions trade federal funds (balances held at Federal Reserve Banks) with each other overnight". ]

The Federal Reserve influenced the federal funds rate through open market operations (OMO). These operations, which involve the buying and selling of securities in the open market by a central bank, are an important tool of the Federal Reserve's monetary policy. It has used OMOs to adjust the supply of reserve balances so as to keep the federal funds rate around the target set by the FOMC.

The total supply of Federal Reserve balances available to depository institutions has been determined primarily through open market operations. Through these operations, the Federal Reserve had considerable influence over conditions in the federal funds market.

The Corridor System

The corridor system of monetary policy refers to a framework established by two key interest rates: the discount rate and the interest rate on reserves. The discount rate (primary credit rate) is the rate at which the Federal Reserve is willing to lend funds to banks in good standing against collateral. This rate tends to create a upper bound or ceiling. The interest rate on reserves is what banks earn on the funds they hold in their accounts at the Federal Reserve. This rate tends to create a lower bound or floor.

The corridor system wasn't part of the Federal Reserve's policy approach until the early 2000s. Before that, from 1955 to 2000, the federal funds rate (the rate at which banks lend to each other overnight) was often higher than the discount rate (the rate at which banks could borrow from the Federal Reserve). This pattern suggests that the Fed's discount rate didn't effectively set a limit on market interest rates during this period.

The Fed used the upper bound precisely in 2003.

The Board of Governors approved Reserve Bank requests to set the primary credit rate at 100 basis points above the FOMC's federal funds target rate and the secondary credit rate at 50 basis points above the primary credit rate, effective 9 January 2003.

.

The Federal Reserve's monetary policy framework had no formal lower bound until 2008, leading some authors to describe it as a asymmetric corridor.

Borio defines the corridor system as a scarce reserve system Borio's explanation is as follows: in many cases the lending facility at the top was never binding because the management of the reserves was such that they didn't really need to go and borrow. The system as a whole was never short so that they didn't have to borrow or go to the central bank. So I think the key word here is short."

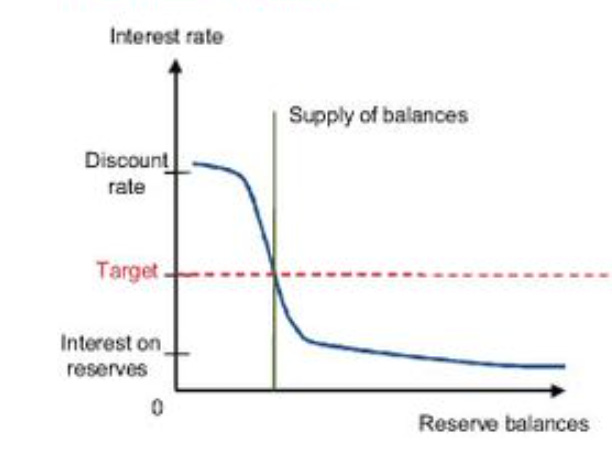

To illustrate how the supply of reserves affects money market rates, the figure shows a stylised depiction of the relationship between the overnight interest rate and banks' demand for reserves. Prior to the global financial crisis (GFC), the Federal Reserve operated a system in which just enough reserves were supplied (the red vertical line in the figure) to meet banks' reserve requirements and payment needs.

.

The pre-crisis framework is also depicted as follows. There is a discussion of the elastic and inelastic interest rate range.

The floor system

The Fed's new post-crisis monetary policy is based on the floor system. To understand the floor system, we need to go back to the days of the crisis. In the early days of the crisis, the large amount of liquidity injected into the market by the Fed caused the federal funds rate to fall rapidly. This significant deviation showed that in the absence of a floor rate, the federal funds rate could move towards 0. In response to the current situation, the Fed decided in October 2008 to pay interest on required and excess reserves.

In November 2008, the target federal funds rate, the interest paid on required reserves, and the interest paid on excess reserves were equalised at 1%. This marked the transition to the floor system. In the floor system, the target interest rate is directly equal to the federal funds rate (the central bank's lending rate). Then the Fed could provide so much liquidity to the financial system.

The Fed researchers called this system "Divorcing Money from Monetary Policy". The key feature of this system is immediately apparent from the chart: the equilibrium interest rate no longer depends on the exact quantity of reserve balances supplied. Any quantity large enough to fall on the flat portion of the demand curve will implement the target rate. In this way, a floor system "decouples" the quantity of money from the interest rate target and hence from monetary policy.

Despite the floor system, which aligns the target rate with the floor rate, market interest rates have not necessarily converged to this point. In practice, the federal funds rate has generally remained below the IORB. The effective funds rate was below the IORB rate because the typical fed funds transaction then (as now) consisted of the GSEs lending to a bank. The excess of reserve balances had made interbank transactions uncommon. The GSEs earned nothing on deposits at the Fed, so they lent the funds to banks that earned the IORB rate, and the two parties essentially split the difference, resulting in a fed funds rate that was well below the IORB rate. As a solution to this problem, the volume of overnight reverse repurchase agreements was increased in 2013, creating an alternative floor below the floor rate. Williamson defined this as the floor-with-subfloor system.

Interest on excess reserves (IOER) (new IORB) serves as the upper bound, while reverse repurchase agreements (RRP) represent the lower bound for the effective federal funds rate (EFFR).

In this regime, the supply curve intersects the demand curve at the flat portion of the demand curve. In this regime, the Fed has chosen to offer a substantial level of reserves to the banking system, and since small shifts in the supply curve have little or no effect on the FFR rate, the level does not need to be monitored as closely.

The Fed no longer relies on OMOs as the primary policy tool for targeting the federal funds rate in its day-to-day, normal operations because small shifts in the supply of reserves have no effect on the FFR by design. Instead, the Fed would lower its IOER rate and RRP rate, shifting the bottom of the demand curve downward, causing market rates, including the FFR, to move in the same direction and by a similar amount. To be clear, lowering the IOER rate and the RRP rate puts downward pressure on the federal funds rate and other market rates by reducing the incentive to hold reserves at the Fed. This system is called an abundant reserves regime because the Fed has created significantly more reserves. You can see how reserves grow over this period in the following chart

.

Monetary Policy Benchmarks 2023 shows that 43.8% of central banks operate with a corridor system and 21.9% with a floor system.

.

Thank you for listening!

Want to watch the short version?

Veridelisi loves you!

Engin YILMAZ (@veridelisi)

Note:

1- Fed statement:

Prior to the crisis, this regime maintained good monetary control, albeit with a high degree of operational complexity. The Federal Reserve's Long-Term Operating Regime Page 4

2- Staff statements:

"With a floor system, there is generally little need for detailed information about the demand curve for reserves, and the regime is robust to shifts in demand and shifts in supply...."

If you had a corridor system, the reserves added by QE and special liquidity programmes would have to be drained in order to maintain monetary control, and we saw in 2008 that this can be difficult to do".

Sources:

FED Effective Federal Funds Rate, (2024), https://fred.stlouisfed.org/series/FEDFUNDS (01.10.2024).

The Federal Reserve Bank of New York publishes a detailed explanation of OMOs each year in its Annual Report.

Todd Keister, (2012), Corridors and Floors in Monetary Policy, Link.

Annual Report on Open Market Operations, (2002), Link.

Claudio Borio, (2024), Link

Lorie K. Logan, (2020),Return to Operating with Abundant Reserves, Link.

Engin YILMAZ , (2023), How does the Fed determine the market interest rate?, Link.

Todd Keister, Antoine Martin and James McAndrews, (2008), Divorcing Money from Monetary Policy, Link.

Bill Nelson (2021), The Overnight Reverse Repurchase Agreement Facility,Link

Stephen Williamson, (2015), On the Road to Normal, Link

Revising teaching materials to reflect how the Federal Reserve implements monetary policy, (2020), Link.

Gara Afonso, (2023), Scarce, Abundant, or Ample? A time-varying model of the reserve demand curve, Link.

Central bank monetary policy benchmarks, (2023), Link

I enjoyed your post. Please keep generating more content! I have a question about the RRP rate. What's the mechanism that prevents the funds rate from declining below the RRP rate? How exactly does it serve as the lower limit for the funds rate? I understand that a bank wouldn't lend reserves at a rate that's below IORB, which creates the upper limit, but don't understand completely how the RRP rate creates the lower limit.