How does the Fed determine the market interest rate?

How does the Fed determine the market interest rate? #Fed #RRP #IORB #Bankingreserves #limitedreserves #amplereserves ##discountrate

The Federal Reserve, also known as the Fed, plays a crucial role in determining the market interest rate. By adjusting the federal funds rate, the interest rate at which banks lend each other money overnight, the Fed influences borrowing costs throughout the economy. This, in turn, affects borrowing rates for businesses and individuals, impacting lending, investing, and spending decisions. Through a combination of monetary policy tools, the Fed seeks to maintain price stability and promote maximum employment. Understanding how the Fed determines the market interest rate is essential for investors, borrowers, and anyone interested in the overall health of the economy. In this article, we will explore the factors that influence the Fed's decision-making process and its implications for the financial markets.

What is the Federal Funds Rate?

The Federal Reserve (Fed) defines this concept as “The federal funds rate is the interest rate at which depository institutions trade federal funds (balances held at Federal Reserve Banks) with each other overnight”. [1]

Federal funds are depository institutions’ reserve balances with Federal Reserve Banks. You can check this data from Fed balance sheet.[2]

The reason why the interest rate is defined as the "federal funds rate" here is due to the fact that the funds (reserves) in question are kept within the Fed.

How is the federal funds rate calculated?

At this point, the question "how is the federal funds rate calculated?" comes to mind. The Federal Reserve (Fed) defines this concept as “The effective federal funds rate (EFFR) is calculated as a volume-weighted median of overnight federal funds transactions reported in the FR 2420 Report of Selected Money Market Rates”.[3] The federal funds rate is determined by ranking all financial institutions that have an account at the Fed, taking the volume of funds exchanged during the day as a criterion, and selecting the interest rate available in the median of these transactions. It is called as Effective Federal Funds Rate.

What is the Federal Funds Target Rate?

The Federal Reserve announced a target for the federal funds rate. Before 2008 (link), a target was set at each meeting.

After 2008, a range rather than a target was set.[4] [5]

What is the Discount Rate ?

Discount Rate is also called as Primary Credit Facility. The Federal Reserve (Fed) defines this concept as Primary credit is available to generally sound depository institutions at a rate set relative to the Federal Open Market Committee's (FOMC) target range for the federal funds rate.[6]

What is the Interest Rate on Reserve Balances?

The interest rate on reserve balances (IORB rate) is the rate of interest that the Federal Reserve pays on balances maintained by or on behalf of eligible institutions in master accounts at Federal Reserve Banks. Starting July 29, 2021, the interest rate on excess reserves (IOER) and the interest rate on required reserves (IORR) were replaced with a single rate, the interest rate on reserve balances (IORB). [7]

What is the Overnight Reverse Repurchase Agreements’ Rate ?

The Federal Reserve (Fed) defines this concept as A reverse repurchase agreement (known as reverse repo or RRP) is a transaction in which the New York Fed under the authorization and direction of the Federal Open Market Committee sells a security to an eligible counterparty with an agreement to repurchase that same security at a specified price at a specific time in the future.[8]

How was the federal funds rate determined before the 2008 crisis?

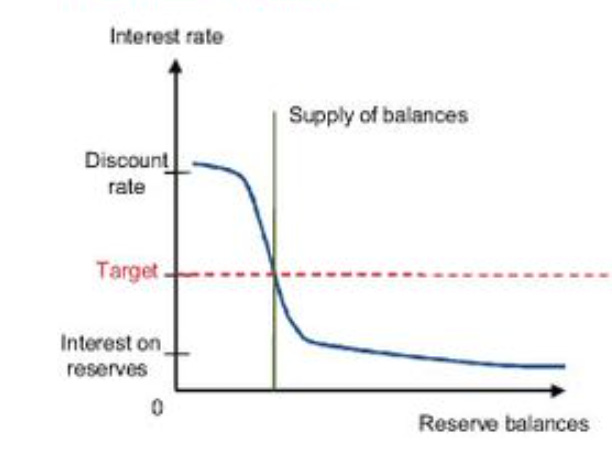

The monetary policy conducted by the Fed before the crisis is based on the 'corridor system.' You can ask the logical question. Where is the corridor ? A corridor-style system(asymetric) is depicted in the figure above: The discount rate is set above the target interest rate(FFR) and the zero interest rate is set below it. This is asymetric corridor system.

A corridor-style system(symetric) is depicted in the figure above: The discount rate is set above the target interest rate(FFR) and the interest on reserves is set below it. This is asymetric corridor system.[11][12]

Many central banks use what is known as a symmetric channel (or corridor) system for monetary policy implementation. Such systems are used, for example, by the European Central Bank (ECB) and by the central banks of Australia, Canada, England, and (until spring 2006) New Zealand.[13]

The intersection of the supply curve and the demand curve occurs on the downward-sloping segment of the demand curve. This positioning suggests that the Federal Reserve provides a "limited"(scarce) quantity of reserves to the banking system. In other words, it aims for a specific supply of reserves to ensure that the market Federal Funds Rate (FFR) aligns with the Federal Open Market Committee's (FOMC) target. Because even slight shifts of the supply curve to the right or left result in higher or lower FFR rates, respectively, the Fed must vigilantly monitor the level of reserves.

How was the federal funds rate determined after the 2008 crisis?

The new monetary policy conducted by the Fed after the crisis is based on the 'floor system.' To understand the floor system, we have to go back to the days of the crisis. In the early days of the crisis, the large amount of liquidity injected into the market by the Fed caused the federal funds rate to fall rapidly. This significant deviation showed that, in the absence of a floor rate, the federal funds rate could move towards "0". In response to the current situation, the Fed decided to pay interest on required and excess reserves in October 2008.

In November 2008, the target interest rate, the interest paid to required reserves and the interest paid to excess reserves were equalised at 1%. In this way, a transition to the floor system was achieved. In the floor system, the target interest rate is directly equal to the base rate (the central bank borrowing rate). With a final amendment made in December, the system that will continue until today was established. With this change, there was a transition from the targeted interest rate to the targeted interest rate range.

Despite the floor system equalizing the targeted interest rate with the floor rate, the market interest rate has not necessarily converged to this point. In practice, the federal funds rate has generally remained below the IOER. As a solution to this issue, the volume of overnight reverse repurchase agreements was increased in 2013, creating an alternative floor below the floor rate. In this way, the federal funds rate could be maintained within a certain range.

Interest on Excess Reserves (IOER)(new IORB) serves as the upper limit, while Reverse Repurchase Agreements (RRP) represent the lower limit for the Effective Federal Funds Rate (EFFR).

This approach is a modified version of the channel system described above and has been advocated in various forms by Woodford (2000), Goodfriend (2002), Lacker (2006), and Whitesell (2006b). A particular type of floor system has recently been adopted by the Reserve Bank of New Zealand.[13]

In this regime , the supply curve intersects the demand curve on the flat portion of the demand curve. In this region, the Fed has chosen to offer a sizable level of reserves to the banking system and, since small shifts of the supply curve have little or no effect on the FFR rate, the level does not need to be monitored as closely. Fed no longer relies on OMOs as the principal policy tool to target the policy rate in its day-to-day, normal operations because small shifts in the supply of reserves have no impact on the FFR, by design. Instead, the Fed would lower its administered rates, shifting the bottom of the demand curve down, which induces market rates, including the FFR, to move in the same direction and by a similar amount. To be clear, the lowering of the administered rates puts downward pressure on the federal funds rate and other market rates by lowering the incentive to hold reserves at the Fed.[9]

The amount of reserves supplied in this way will not affect the targeted interest rate, regardless of how much it is increased. In this case, the Fed can determine the reserve amount entirely independently of the targeted interest rate. On the graph, no matter how much the Excess Reserves (ER) increase, the targeted interest rate remains unchanged. Theoretically, in the floor system, the role of reserves in determining interest rates is completely eliminated. This is the clearest indication that distinguishes the floor system from the corridor system. In the corridor system—even if a narrow corridor is applied—a well-managed reserve supply by the central bank is required. In the corridor system, miscalculations of the central bank's reserve demand, banks' demands exceeding expectations, and potential liquidity squeezes can cause the market interest rate to deviate from the targeted rate.[10]

I think the idea of the floor regime is originated from 2007 turmoil in USA. The following paper was published (September 2008) when Lehman Brother collapsed 15 September 2008. Despite what this article says, a large amount of reserves were injected into the market, which pushed interest rates down to 0. Finally, the floor system was introduced in November 2008.

This is the last chart. You can click the chart and you can easily investigate these interest rates.

07.12.2023 last datas:

%5.5 Federal Funds Target Range - Upper Limit

%5.4 The Interest Rate on Reserve Balances

%5.32 The effective federal funds rate

%5.3 RRP

%5.25 Federal Funds Target Range - Lower Limit

Engin YILMAZ (

)Sources:

[1] FED Effective Federal Funds Rate, (2023), https://fred.stlouisfed.org/series/FEDFUNDS (07.12.2023).

[2] Depository institutions’ reserve balances with Federal Reserve Banks, (2023), https://www.federalreserve.gov/releases/h41/20231130/ (07.12.2023).

[3] The effective federal funds rate , (2023), https://fred.stlouisfed.org/series/EFFR (07.12.2023).

[4] Federal Funds Target Range - Upper Limit , (2023), https://fred.stlouisfed.org/series/DFEDTARU (07.12.2023).

[5] Federal Funds Target Range - Lower Limit , (2023), https://fred.stlouisfed.org/series/DFEDTARL (07.12.2023).

[6] Discount Rate Primary Credit Facility , (2023), https://fred.stlouisfed.org/series/DPCREDIT (07.12.2023).

[7] The Interest Rate on Reserve Balances , (2023), https://fred.stlouisfed.org/series/IORB (07.12.2023).

[8] Reverse repurchase agreement rate , (2023), https://fred.stlouisfed.org/series/RRPONTSYAWARD (07.12.2023).

[9] Revising teaching materials to reflect how the Federal Reserve implements monetary policy,(2020), https://www.federalreserve.gov/econres/feds/files/2020092pap.pdf (07.12.2023).

[10] How Does Federal Reserve Board Affect Interest Rate? (Before and After 2008),(2019), https://www.researchgate.net/publication/336949819_Amerikan_Merkez_Bankasi_Piyasa_Faiz_Oranini_Nasil_Etkiliyor_2008_oncesi_ve_sonrasi_How_Does_Federal_Reserve_Board_Affect_Interest_Rate_Before_and_After_2008(07.12.2023).

[11] Corridors and Floors in Monetary Policy,(2012), https://libertystreeteconomics.newyorkfed.org/2012/04/corridors-and-floors-in-monetary-policy/

[12] Monetary Policy under a Corridor Operating Framework,(2010), https://www.kansascityfed.org/Economic%20Review/documents/944/2010-Monetary%20Policy%20under%20a%20Corridor%20Operating%20Framework.pdf

[13] Divorcing Money from Monetary Policy,(2008), https://www.newyorkfed.org/medialibrary/media/research/EPR/08v14n2/0809keis.pdf

[14] Understanding Monetary Policy Implementation,(2008), https://www.richmondfed.org/-/media/RichmondFedOrg/publications/research/economic_quarterly/2008/summer/pdf/ennis.pdf