A Historical Look at the Early Fed's Lending Mechanisms and Tools

A Historical Look at the Early Fed's Lending Mechanisms and Tools

Let's explore the history of the lending mechanisms and tools in the Federal Reserve Act. We'll examine why these mechanisms and tools had been used and how they functioned.

Introduction

The Federal Reserve Act of 1913 introduced various lending mechanisms and tools that evolved over the years, addressing the financial needs and economic conditions of the time. These mechanisms included rediscounting commercial paper, advances to member banks, and open market operations. Understanding the history and function of these tools provides insight into the Federal Reserve's role in shaping the U.S. monetary policy.

An Act

To provide for the establishment of Federal reserve banks, to furnish an elastic currency, to afford means of rediscounting commercial paper, to establish a more effective supervision of banking in the United States, and for other purposes1.

The meaning and usage of some words in this paragraph have shifted significantly over the past century. Let's clarify them.

The Commercial Paper

The term “commercial paper” referred to short-term bank loans to businesses, not the modern usage of short-term borrowing by businesses in the marketplace.2

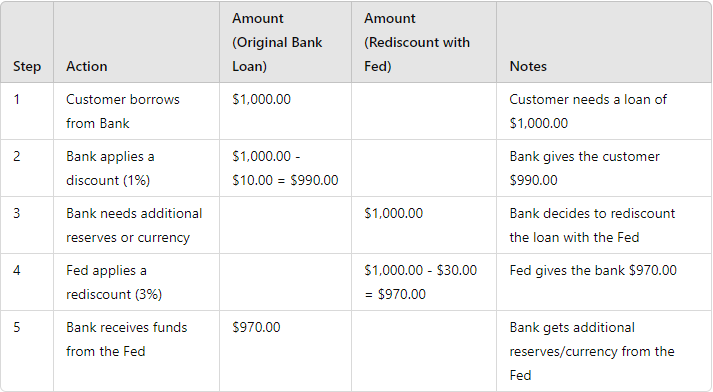

The Rediscounting

In those days, most short-term bank loans were made on a discount basis (the discount being the difference between the amount borrowed and the amount repaid on a loan). When a member bank desired to acquire additional reserves or currency, it would “rediscount” some of those loans with its Federal Reserve Bank. The transaction was called a rediscount because the Reserve Bank would pay out a smaller amount (the discount) of currency or reserves to the member bank than would ultimately be repaid to the Fed when the loan matured. When the rediscounted loans approached maturity, the Reserve Bank would return them to the member bank for collection. Upon maturity the bank’s reserve account with the Fed would be charged for the full amount of the original loan.3

The Real Bills Doctrine

The real bills doctrine (commercial loan theory of banking) dominated the Federal Reserve's lending practices during its first years. As W. Randolph Burgess noted in reviewing this period, it was felt that “. . . the central bank of a country should take into its portfolio only the highest grade ‘self-liquidating’ paper of short term. This paper should be so directly related to the turnover of business that the funds to pay off any loan would be provided automatically by the completion of the business transaction represented by the paper. In this way it was believed the funds of the central bank would only be put into use at times when they were required by business, and they would flow back into the central bank as soon as the need had passed.4 Mr. Phelan conceded that banks were "very much averse" to discounting their paper with other banks and that such rediscounting had been regarded as "a sign of weakness"; but he believed that with the enactment of the Federal Reserve Act, rediscounting would be regarded, "as it should be, as an ordinary and proper part of a bank's business."5

The philosophy 6 of embodied in the Federal Reserve Act contemplated that Reserve Bank credit should be extended for a short term only, and confined to financing production and the distribution of goods from producer to consumer. It should not be used to finance investments or speculative activity of any kind — securities, commodities, or real estate. Confining bank credit to productive purposes, it was believed, would result in an automatic response of supply to the expanding and contracting needs of commerce, industry, and agriculture.

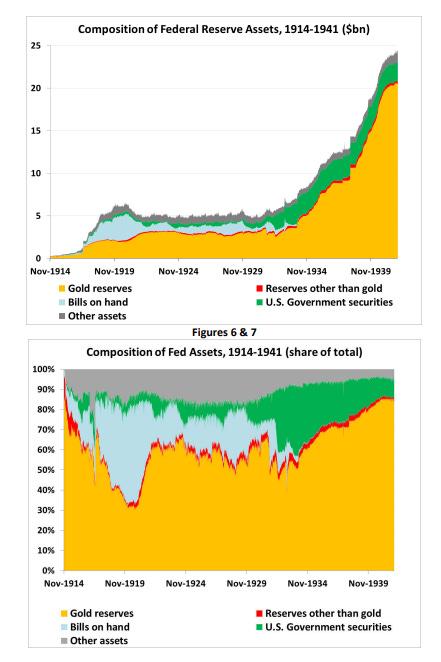

The Historical Statistics on Rediscounting

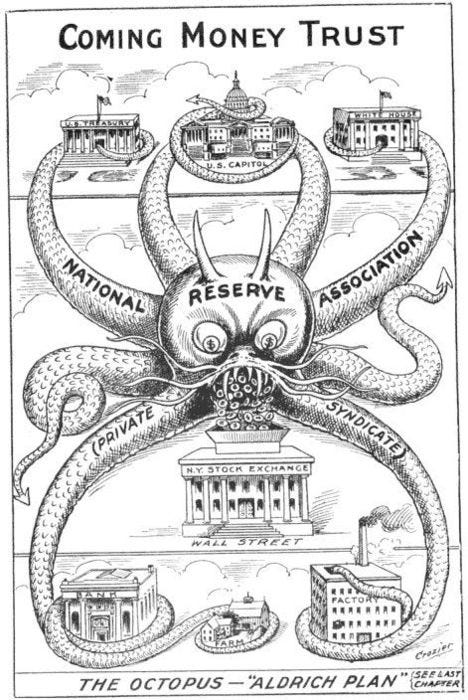

This is the composition of the Fed’s assets7 in the balance sheet between 1914-1941. Total gold reserves made up almost 84 percent of assets when the Fed opened in November 1914, declining to less than 40 percent in 1918 as the Fed’s total bills on hand increased and it shrank to nearly nothing in the end of the 1934.

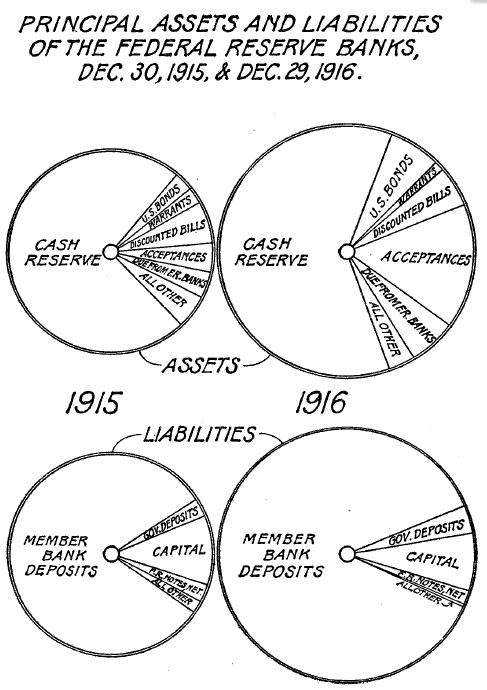

The Fed’s Balance Sheet and Rediscounting

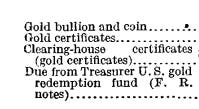

This is the Federal Reserve's first balance sheet, published8 on December 31, 1914. In the following table, I have combined the asset and liability items.

Given the international gold standard in place at that time, it's unsurprising that gold coin holdings were a significant component of the assets listed.

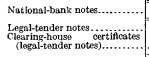

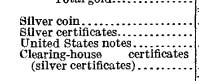

In the early years of the Federal Reserve, its assets (the resources) in balance sheet primarily consisted of the gold, silver and various certificates. These are called as “Cash Reserves”.

Legal-tender notes: Prior to the Fed's establishment, legal-tender notes, which were physical paper currency, circulated as money.

Silver and Silver Certificates: Prior to the Fed's establishment, the silver coins and certificates representing a specific amount of silver were legal tender.

First Annual Report of the Federal Reserve Board 1914, Page:202, Link Gold and Gold Certificates: Prior to the Fed's establishment, the gold coins and certificates representing a specific amount of gold.

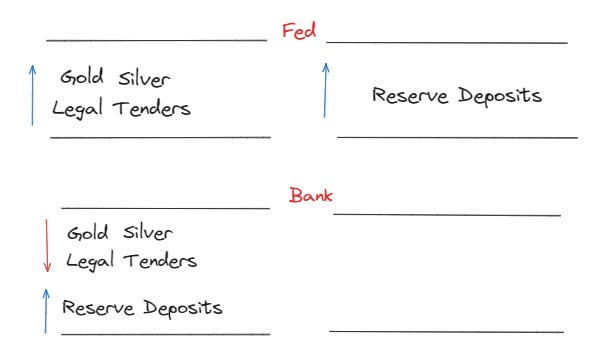

The Federal Reserve initially created reserves by holding these assets in the balance sheet. The following illustration shows how this mechanism worked in the Fed’s balance sheet.

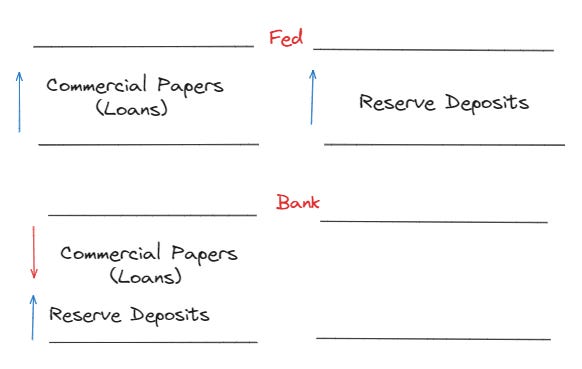

Subsequently, the Fed began creating reserves through a discount mechanism. The following illustration shows how this mechanism worked in the Fed’s balance sheet.

The Second Annual Report of the Federal Reserve Board9 likely specifies the total bills discounted in the balance sheet. These include commodity paper, trade acceptances, commercial paper, and banker's acceptances.

Why did it used ?

The mechanism for transforming illiquid bank loans quickly into cash and thus providing the nation’s money supply with the desired “elasticity.”10

The special credit assistance to farmers;

The establishment of a market for commercial paper,

It was used to encourage foreign trade by establishing a market for bankers' acceptances.

In its report on the original Federal Reserve Act, the Owen section of the Senate Banking and Currency Committee— after observing that, according to European banking practices, paper based on commercial transactions of short maturities was regarded as "self-liquidating" and "almost the exact equivalent of cash"—proposed that the Reserve Banks be permitted to discount "commercial bills and acceptances of the qualified liquid class.11"

The Advences

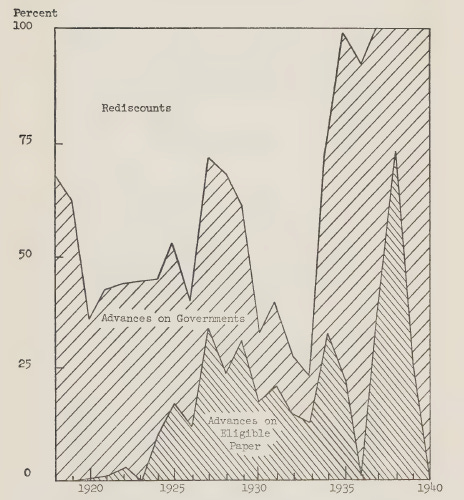

One of the most interesting chapters in the history of the lending functions of the Federal Reserve Banks is that relating to advances to member banks. Both discounts and advances are sometimes loosely referred to as discount operations, but the legal and procedural distinctions between the two are clear. (Heckley : 83) Until September 1916, member banks could borrow from the Federal Reserve banks only by rediscounting customers’ eligible paper. At that time provisions of the Federal Reserve Act were changed to permit advances (not to exceed fifteenday maturities) secured by eligible paper and by Governments. (McKinney :56) The Act was revised in 1916 to permit what was in fact a radical departure from the commercial loan theory—the use of United States Government securities as collateral to borrowings.(McKinney :12) In 1918, over 60% of all loans nationwide were short-term advances. In the following three years (1920, 1921, and 1923), the amount of outstanding loans that were refinanced through banks (rediscounts) reached similar levels to advances. However, since the mid-1930s, rediscounts have been practically unused.

How did the advances work?

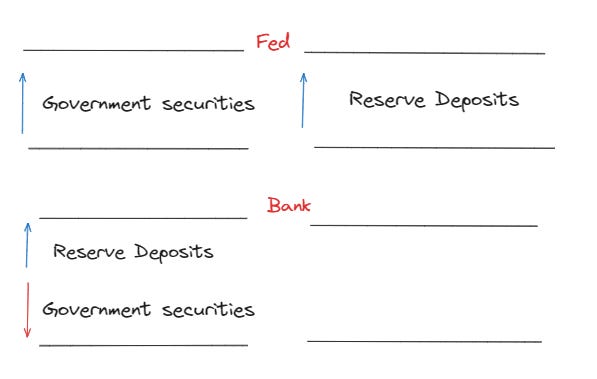

The visual summary below combines the changes from both the Federal Reserve Bank and the Member Bank. This combined table helps illustrate how the advance is represented in the balance sheets of both the Federal Reserve Bank and the Member Bank.

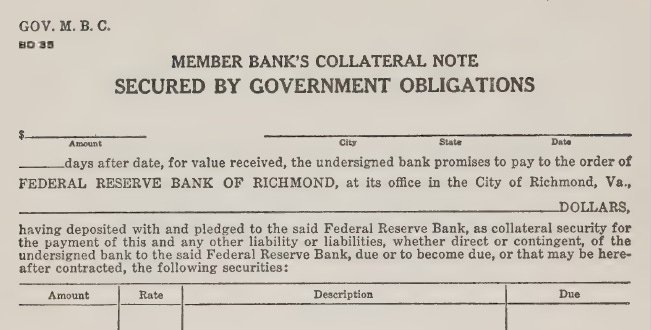

The mechanics of borrowing on Governments is simple. The borrowing bank merely sends in an executed note and application form to Federal Reserve Bank.

Open Market Purchases

The historical record shows that prior to the U.S.’s entry into World War I, the Federal Reserve’s preferred media for open market operations were private bills of exchange, trade acceptances, and bankers’ acceptances, rather than public debt. The Federal Reserve’s choice was influenced by the prevailing theory of monetary policy, known as the real bills doctrine, which held that the central bank should only provide liquidity in exchange for securities that directly finance commerce. In addition, the Federal Reserve’s use of private acceptances in open market operations was in part an effort to encourage the development of an active secondary market in private paper. The supply of Treasuries expanded rapidly during World War I due to the financing needs of the war. Concomitantly, the secondary market in Treasuries grew rapidly. 12

The New York Fed made the first open market purchase (of $5 million in New York City tax anticipation bonds) on December 31, 1914.13

The Fed officials had discovered that these operations influenced market interest rates and credit conditions. In 1923 the Open Market Investment Committee was established. The Fed then began to use open-market operations proactively to achieve broad economic objectives.

How did the operations work?

The diagram illustrates the transaction between the Federal Reserve and a Member Bank when the bank sells the government securities to Fed.

The Fed pays for these securities by increasing the member bank’s reserve deposits. This appears as an increase in both the assets and liabilities for the Fed.

During 1922 and 1923 the Reserve banks discovered, quite by accident, the possibilities of open market dealings in Government securities as an instrument of credit-control.

The Fed classifies discounts and advancements together, while accommodations fall into a separate category.

Two broadly distinguishable classes of credit operations, that is to say, ways of making "discounts, advancements and accommodations" are recognized and authorized by the Federal Reserve Act. There are, first, the so-called rediscount operations, and, second, the so-called open-market operations, these being the terms used by the Federal reserve act to distinguish the two major classes of Federal reserve bank operations.14

It was shown that purchases and sales of Government obligations by the Reserve banks directly influenced the reserve position of the members banks. Secondly, they were convinced that open market operations constituted a potent instrument of credit control only when administered jointly by all the Reserve banks.15

Conclusion

The lending mechanisms and tools established under the Federal Reserve Act of 1913 played a pivotal role in shaping the U.S. monetary policy. Rediscounting commercial paper, advances to member banks, and open market operations provided the Federal Reserve with the means to ensure liquidity, support economic activity, and manage credit conditions.

Engin YILMAZ ( VeriDelisi )

Sources

Bill Nelson (2024), The Middle Course: What Fed History Teaches Us About Liquidity Requirements, Link

George W. McKinney (1960), The Federal Reserve Discount Window.

Howard Heckley (1973) Lending Functions Of The Federal Reserve Banks.

David Marshall, Origins of the use of Treasury debt in open market operations: Lessons for the present, Link

H. Parker Willis , John M. Chapman, The Banking Situation: American Post-War Problems and Developments.