A Deep Dive into FX Basis Swap Spreads: Drivers, Dynamics, and Implications

What is foreign currency basis spread? What is the basis spread of a cross currency swap? How is FX swap calculated? How are FX swaps settled? FX Basis Swap Spreads

In the dynamic world of foreign exchange (FX) markets, the concept of FX basis swap spreads plays a pivotal role, influencing a range of financial transactions and strategies. This article aims to demystify this complex subject, starting with the fundamental question: What is a foreign currency basis spread? Throughout this discussion on FX Basis Swap Spreads, we aim to provide clarity and insight into these essential yet often complex financial concepts, shedding light on their significance in the global financial landscape. Whether you're a finance professional, a student, or simply someone interested in understanding the world of currency swaps and FX markets, this article is designed to guide you through the essentials of FX basis swap spreads.

Key Takeaways:

What is a Swap?

What are Interest Rate Swaps?

What are FX Swaps?

What are Cross Currency Swaps?

What is FX Swap Spread?

Why is FX Swap Spread an Important Indicator?

Introduction

What is the "FX Basis Swap Spread" that you often heard about during the 2008 and 2020 crises?

In this article, I will try to explain this topic briefly.

First of all, this concept is represented by two different names. "Basis swap" and "Basis swap spread".

What is SWAP?

Swap is the exchange of certain financial assets between two parties within a certain period of time. I got this definition from wikipedia.

Okay, let's go to a more professional source1;

In this book, on page 627, "A swap, by definition, is a legal arrangement between two parties to exchange specific payments".

A swap is a legal arrangement between two parties to exchange specific payments.

WHAT ARE INTEREST RATE SWAPS?

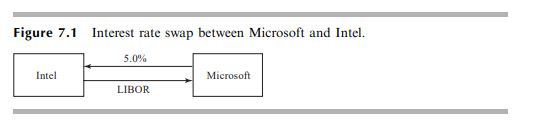

Let's start with the first swaps. The first swaps are interest swaps. In these swaps, one party carries a financial liability (debt) with fixed interest payments while the other party carries a financial liability (debt) with floating interest payments. An interest rate swap involves the exchange of interest payments. The party with fixed interest payments receives floating interest payments and the party with floating interest payments receives fixed interest payments2.

Nowadays, interest rate swaps are not simply the exchange of interest rates on liabilities, but are directly linked to the parties' own borrowing strategies (cash flows, etc.).

As in the example below3, one party promises the other party a fixed payment of 5% per annum (payable every 6 months), while the other party pays the other party Libor. Here, the party making the Libor payment is the party making the floating interest payment.

WHAT ARE FX SWAPS?

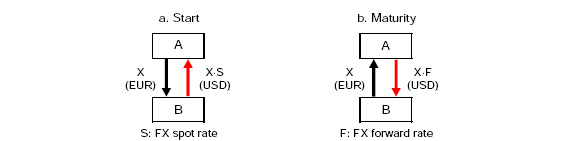

FX swaps4 involve the direct exchange of currencies instead of the exchange of interest payments.

In the above example; Party A gives euros to the counterparty at the current Euro/dollar rate (S: FX Spot Rate) on the day of the contract. Party B, in turn, gives the counterparty the dollar equivalent to the euro received.

At the end of the contract, the money received is returned at the agreed rate (F: FX Forward rate). There is interest in this transaction as the agreed future rate is calculated based on the interest of both parties.

A good source5

WHAT ARE CROSS CURRENCY SWAPS?

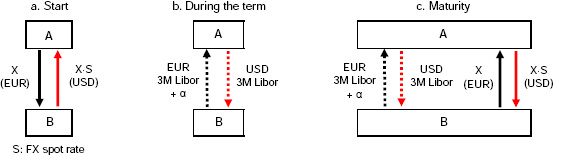

Cross currency swaps are based on periodic interest payments between two parties in different currencies (provided that the current exchange rate between them is fixed). Although it is a bit complicated, we can explain it in a graphical way below.

Initially bank A gives bank B 100 euros and bank B gives bank A 150 dollars. The euro-dollar exchange rate is fixed at 1 euro = 1.5 dollars until the end of the term. Every 3 months, bank A pays bank B a quarterly dollar interest and bank B pays bank A a quarterly euro interest. At the end of the term, bank A gives back 150 dollars and bank B gives back 100 euros. Economic literature suggests that the purpose of this transaction is to exploit comparative advantages, hedging and speculation. Here, interest payments can vary widely. In our example, the two parties pay Libor, variable interest.

LIBOR is history. Let's not forget that! Examples will change.

In general, cross currency swaps work as follows6.

The firm on the euro side (firm A) receives the 3-month euro interest rate plus the spread from the firm on the dollar side.

What is FX Swap Spread?

FX Swap spread: The cost of borrowing dollars in the FX market minus the cost of borrowing directly in dollars.

Let's consider the EURUSD exchange rate.

One person, in what we call a synthetic way;

First, he can borrow Euros and buy dollars by entering into an FX Swap transaction with these Euros.

Or one can go the direct route and pay direct dollar interest and borrow dollars.

The FX swap spread gives us the difference between borrowing dollars synthetically and borrowing dollars directly.

Why is FX Swap Spread Important?

In times of crisis, the cost of borrowing dollars synthetically increases, especially in the EURUSD parity. This7 shows that the financial structures of countries outside the US suffer from a serious dollar shortage.

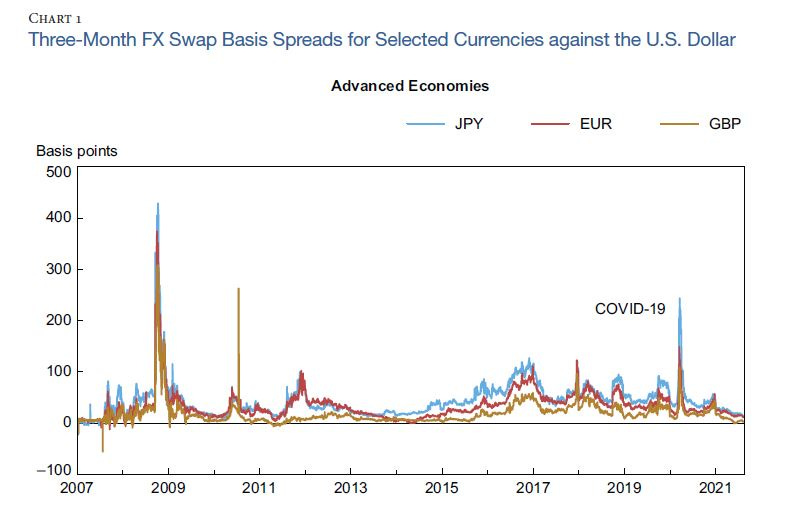

As can be seen, there were significant spread differences in the EURUSD parity during the 2008 and 2020 crises.

The cost of the dollar increased in non-US countries that could access the dollar synthetically.

If you look at this in cross currency swaps (remember the examples above), given that the dollar interest rate is fixed, the interest paid for the euro has increased significantly at negative levels, causing those on the euro side of the swap to receive less euro interest.

Note: The pricing of cross currency swaps is determined directly by the interest rates specified in the contract.

It is not clear when typed. Let's post a picture8.

I am also taking the example statement directly from the website where I got the picture.

Today, if US Libor is 1.6% and Euribor -0.4%, the theoretical cost of a EUR/USD currency swap to a European company is 2%

(i.e. it pays 1.6% on the dollar rate, but 0.4% on the euro rate since Euribor is negative today).

If, due to dollar scarcity, the counterparty offers a "spread" of -50 basis points, the cost of this swap to the European company would rise to 2.5%.

(1.6% Dollar rate + 0.4% Euro rate + 0.5% currency basis).

When the cross-currency basis is negative, it is cheaper to borrow U.S. dollars directly than to borrow U.S. dollars through the FX swap market. When the cross-currency basis becomes more negative, investments in U.S. securities become less attractive to foreigners without direct access to U.S. dollar funding because for given interest received in U.S. dollars, the actual return to the foreign investor shrinks amid higher funding costs.

New source9.

Engin YILMAZ (

)Sources

http://docs.finance.free.fr/DOCS/Bloomberg%20Press,.Fixed%20Income%20Securities%20and%20Derivatives.pdf

Hull, J. (2018),Options, Futures and Other Derivatives. Pearson Publishing.,s:174

Hull, J. (2018),Options, Futures and Other Derivatives. Pearson Publishing.,s:175

BIS (2008), ‘The basic mechanics of FX swaps and cross-currency basis swaps’, BIS Quarterly Review, March 2008.

https://www.ingwb.com/binaries/content/assets/solutions-and-products/hedging-solutions/foreign-exchange/ing_financial_markets-product_description-fx_swap_be-en.pdf

BIS (2008), ‘The basic mechanics of FX swaps and cross-currency basis swaps’, BIS Quarterly Review, March 2008

The Fed’s Central Bank Swap Lines and FIMA Repo Facility, (2022), https://www.newyorkfed.org/medialibrary/media/research/epr/2022/epr_2022_fima-repo_choi.pdf

https://bondvigilantes.com/blog/2017/12/cross-currency-basis-implications/

https://archive.is/https://www.bloomberg.com/news/articles/2017-12-15/why-cross-currency-basis-swaps-are-year-end-focus-quicktake-q-a#xj4y7vzkg

Very informative article. https://www.qu.edu.sa/