What is SDR? How is SDR's value calculated?

What is SDR? How is SDR's value calculated? If you've ever wondered about these questions, you've come to the right place. SDR is an international reserve asset created by International Monetary Fund

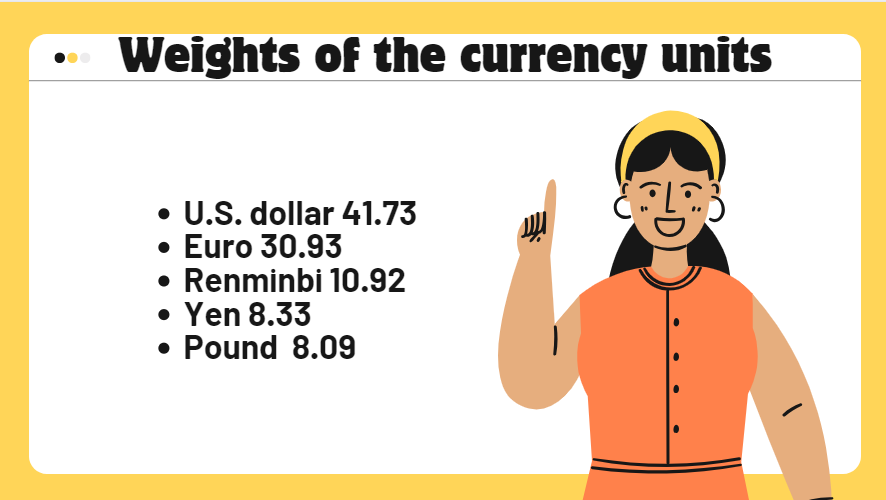

SDR, also known as Special Drawing Rights, is an important concept in the world of finance. Understanding what SDR is and how its value is calculated is essential for anyone interested in international monetary systems. In simple terms, SDR is a virtual currency created by the International Monetary Fund (IMF) that serves as a reserve asset for member countries. Its value is determined by a basket of major currencies, including the US dollar, euro, Chinese yuan, Japanese yen, and British pound. This weighted average helps provide stability and flexibility in the international monetary system. By grasping the concept of SDR and its calculation, individuals can gain deeper insights into global economic mechanisms and the role of the IMF.

This is the 15.09.2021 view of the SDR page on the IMF website.

The page does not display the weights of the currency units. The "Currency amount" column does not indicate the weights of the currency units. The question is, how can we find the weights of the currency units? You can find from this link.

What is the SDR’s formula ?

Then I pulled the exchange rates from this page for the period between July and September 2016.

Do not fetch the exchange rates from elsewhere.

Additionally, you must write the values in terms of dollars for all exchange rates.

Interestingly, on the IMF site, the reverse seems to be true for the Yuan.

I don't understand this.

For each currency pair, we find

[ (Weight/ Average of July-September 2016) * value on 30 September 2016] and then add them together.

However, when all currency pairs are calculated in USD, we assign "1" to BEX and TEX values for USD.

We find the value "Sum of (W/BEX)*TEX" in the following notation.

Here, the IMF calls the numerator of the second part of the equation "$/SDR".

But this will be "SDR/$". 🙂 This number which is used in IMF calculations change only transition periods. For example, currency unit didn’t change until transition period’s end. You can control from IMF page.

When you do the calculations one by one, you will find the "Currency Amount" values.

When you multiply these values by the current exchange rates (for Yuan and Yen, take the inverse of the exchange rate), you will reach the "U.S dollar equivalent" values.

The sum of these values will give us how much $ 1 SDR makes.

On 15 July, if one Euro is $1.18, while the curreny amount of the Euro is 0.38

1.18 $ * 0.38 = 0.45 $ (U.S dollar equivalent)

Let's do it for the yuan.

If (1 / 6.45) = $ 0.15, while the yuan's curreny amount value is 1.01

0.15$ * 1.01 = 0.15 $ (U.S. dollar equivalent)

You can download my excel file from this link.

Dont remember that the changes in the exchange rates lead to change in U.S dollar equivalent and this changes SDR/$. SDR/$ is sum of the U.S dollar equivalents.

Dont remember that SDR/$(IMF used in currency amount) is only change in transition period.

IMF published “Illustrative Currency Amounts in New Special Drawing Right (SDR) Basket”, more detailed calculation page and calculation’s excel file in this issue.

SDRs Are the Great Untapped Source of Climate Finance

https://archive.is/Olkz8

Source:

The SDR page on the IMF website, https://www.imf.org/external/np/fin/data/rms_sdrv.aspx, (08.12.2023)

What are the steps for calculating currency amounts for the new SDR basket?, https://www.imf.org/external/np/exr/faq/sdrbsktfaq.htm#one, (08.12.2023)

How and when are the currency amounts for the new SDR basket determined?, https://www.imf.org/external/np/exr/faq/sdrbsktfaq.htm#one, (08.12.2023)

IMF Exchange Rates, https://www.imf.org/external/np/fin/ert/GUI/Pages/CountryDataBase.aspx, (08.12.2023)

Illustrative Currency Amounts in New Special Drawing Right (SDR) Basket,https://www.imf.org/en/Topics/special-drawing-right/sdr-valuation-basket/Issues/2022/072222,, (08.12.2023)

Engin YILMAZ (

)