Understanding SOFR: The New Benchmark for U.S. Dollar Interest Rates

A Deep Dive into the Secured Overnight Financing Rate (SOFR) This post emphasizes the comprehensive nature of Secured Overnight Financing Rate (SOFR). LIBOR is old school, SOFR is new kid!

Understanding SOFR

Key Takeaways:

Federal Reserve established the ARRC to find a robust, transaction-based alternative to LIBOR in 2014 and ARRC chose the Secured Overnight Financing Rate (SOFR) in 2017.

The SOFR is a broad measure of the cost of borrowing cash overnight, collateralized by U.S. Treasury securities in the repurchase agreement (repo) market.

The SOFR is published on the Federal Reserve Bank of New York’s website every U.S business day at approximately 8:00 am.

The SOFR is calculated as a volume-weighted median of transaction-level tri-party repo , GFC Repo and DVP data.

The current SOFR rate is % 5.40 (12/28/2023).

The SOFR is a fully transaction-based rate reflecting roughly $2.2 trillion of daily transactions in a market with a diverse set of borrowers and lenders

History of SOFR

LIBOR is Old School

LIBOR(London Interbank Offered Rate) is a measure of the cost of borrowing between banks and a crucial benchmark for interest rates worldwide. LIBOR was calculated in five currencies: UK Pound Sterling, the Swiss Franc, the Euro, Japanese Yen and the U.S. Dollar. It's crucial to understand that LIBOR is not determined by the actual rates banks pay to borrow from one another. Rather, it is derived from the banks' reported estimates of what they believe they would have to pay.Consequently, this system allows for the possibility of banks submitting artificially lower rates, making it relatively easy to manipulate LIBOR. The LIBOR scandal arose when it was discovered in 2012 that banks were falsely inflating or deflating their rates so as to profit from trades, or to give the impression that they were more creditworthy than they were.

SOFR is New Kid

In 2014, the Federal Reserve Board and the New York Fed convened the ARRC, a group of private-market participants tasked with identifying robust alternatives to USD LIBOR and supporting a transition away from LIBOR. In June 2017, the Alternative Reference Rates Committee (ARRC), backed by a substantial portion of its Advisory Group, declared that it had chosen the Secured Overnight Financing Rate (SOFR).

As part of its evaluation process, the ARRC considered a comprehensive list of potential alternatives, including:

Term unsecured rates

Overnight unsecured rates like the Overnight Bank Funding Rate (OBFR)

Term secured rates

Overnight secured rates like the Secured Overnight Financing Rate (SOFR)

Treasury bill and bond rates

After extensive discussion, the ARRC narrowed its list to two rates that it considered the be the strongest candidates: an overnight unsecured rate (OBFR) and an overnight Treasury repurchase agreement (repo) rate (SOFR). In June 2017, the ARRC, with the support of a significant majority of its Advisory Group, announced it had selected SOFR as its preferred alternative to USD LIBOR.(SOFR Starter Kit Part I)

What is SOFR ?

SOFR is a broad measure of the cost of borrowing cash overnight, collateralized by U.S. Treasury securities in the repurchase agreement (repo) market. It is calculated daily by the Federal Reserve Bank of New York with the Office of Financial Research.

Where is SOFR Published ?

SOFR is published on the Federal Reserve Bank of New York’s website every U.S business day at approximately 8:00 am. Fed has the ability to correct and republish this rate until 2:30 pm New York City Time each day, users may wish to reference the rate after this time (e.g. 3:00pm) The SOFR rate published on any day represents the rate on repo transactions entered into on the previous business day and the date associated with each rate reflects the date of the underlying transactions rather than the date of publication.

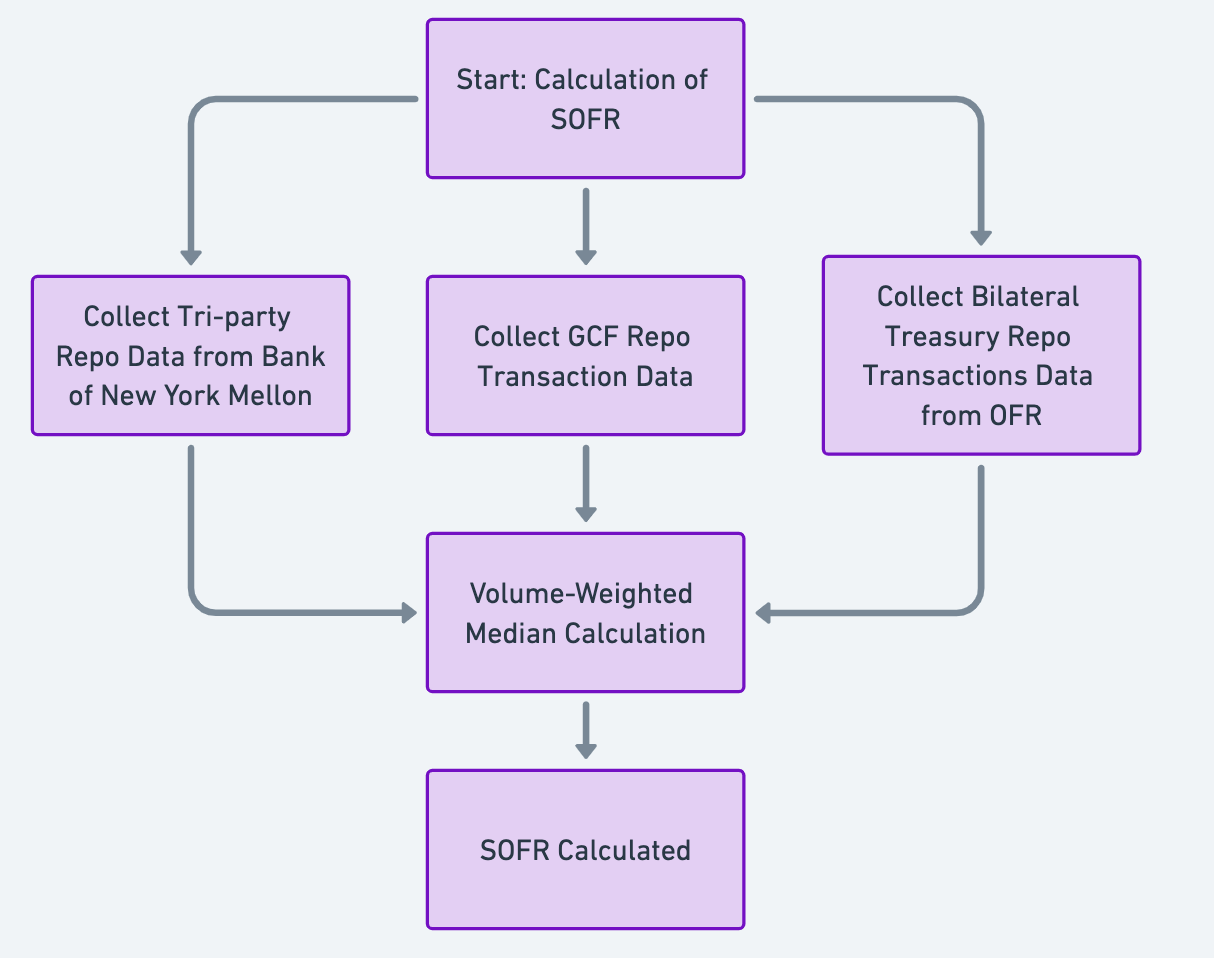

How is SOFR Calculated ?

The SOFR is calculated as a volume-weighted median of transaction-level tri-party repo data collected from the Bank of New York Mellon as well as GCF Repo transaction data and data on bilateral Treasury repo transactions cleared through FICC's DVP service, which are obtained from the U.S. Department of the Treasury’s Office of Financial Research (OFR). SOFR is generally a few basis points higher than rates based only on tri-party transactions (such as the Bank of New York Mellon’s Treasury Tri-Party Repo Index or the tri-party general collateral rate produced by FRBNY) but is generally lower and less volatile than DTCC’s Treasury GCF Repo Index.(An Updated User’s Guide to SOFR)

What is current SOFR rate?

The current SOFR rate is % 5.40 (12/28/2023). The Secured Overnight Financing Rate (SOFR), a measure of the cost of borrowing cash overnight collateralized by Treasury securities, hit 5.4% on Thursday - the highest since April 2018, when the New York Fed began publication of the rate.

What makes SOFR a robust rate?

SOFR is a fully transaction-based rate reflecting roughly $2.2 trillion of daily transactions in a market with a diverse set of borrowers and lenders. This is much larger than the transaction volumes in any other U.S. money market. These factors make SOFR a reliable representation of conditions in the overnight Treasury repo market – reflecting lending and borrowing activity by a wide array of market participants, including asset managers, banks, broker-dealers, insurance companies, money market funds, pension funds, and securities lenders.(SOFR Starter Kit Part II)

Where can I find the historical data of SOFR rate?

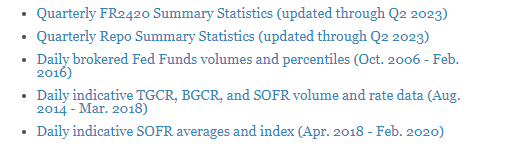

FRBNY, in cooperation with the Office of Financial Research, began publishing SOFR on April 1, 2018.

Prior to the start of official publication, FRBNY released data from August 2014 to March 2018 representing modeled, pre-production estimates of SOFR that are based on the same basic underlying transaction data and methodology that now underlie the official publication.

FRBNY has also separately released a much longer historical data series based on primary dealers' overnight Treasury repo borrowing activity.

SOFR is reliable as it's based on actual transactions and includes a broad range of data from different sources, making it a key indicator of U.S. financial markets.

Sources:

LIBOR Scandal, 2012, Link, Link 2, Link 3, Link 4

ARRC, 2023, Alternative Reference Rates Committee, Link

IOSCO, 2023, Link

An Updated User’s Guide to SOFR, 2021, The Alternative Reference Rates Committee February 2021, Link

Pre-Production Estimates of SOFR, 2017, Link

Statement Regarding the Publication of Historical Repo Rate Data, 2018, Link

Overnight Bank Funding Rate, 2023, Link

Latest SOFR Data, 2023, Link

SOFR Starter Kit Part I, 2023, Link

SOFR Starter Kit Part II, 2023, Link

US overnight funding rate hits record high amid year-end volatility, 2023, Link

Engin YILMAZ (

)