In this post, I look at the reference rates at the core of money markets. Published by the New York Fed, these benchmarks—such as the EFFR, OBFR, and SOFR—play a vital role in both monetary policy implementation and the functioning of Treasury repo markets. They provide transparency, standardize pricing, and support liquidity across the financial system.

Money Market Reference Rates

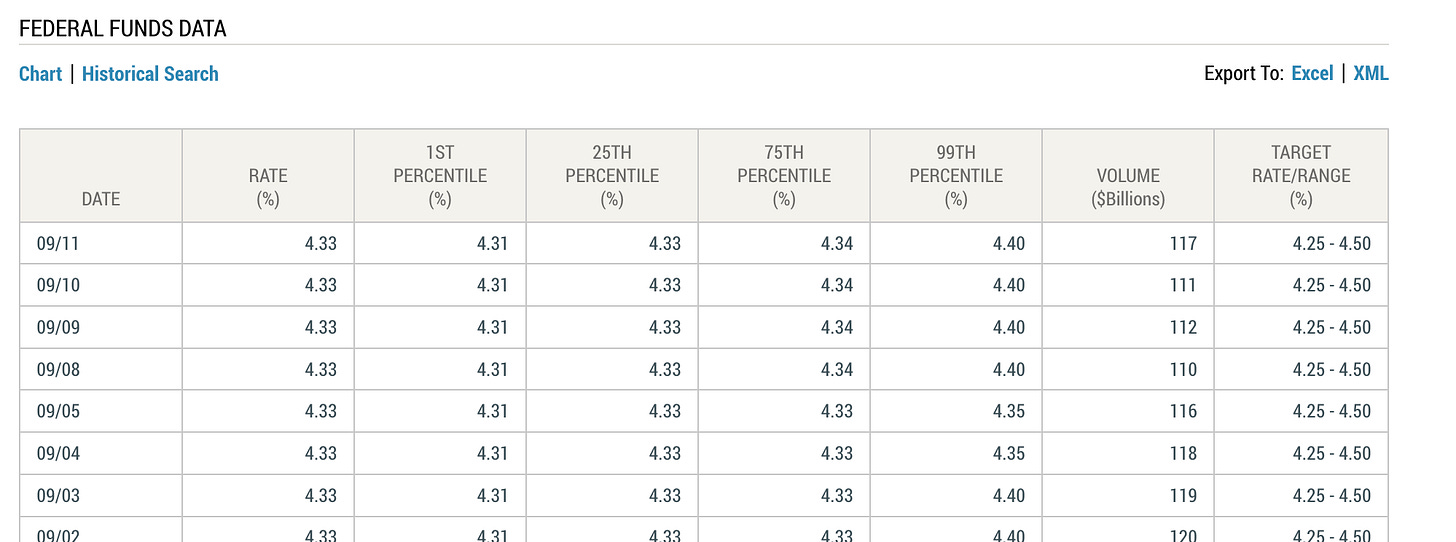

a-Effective Federal Funds Rate (EFFR)

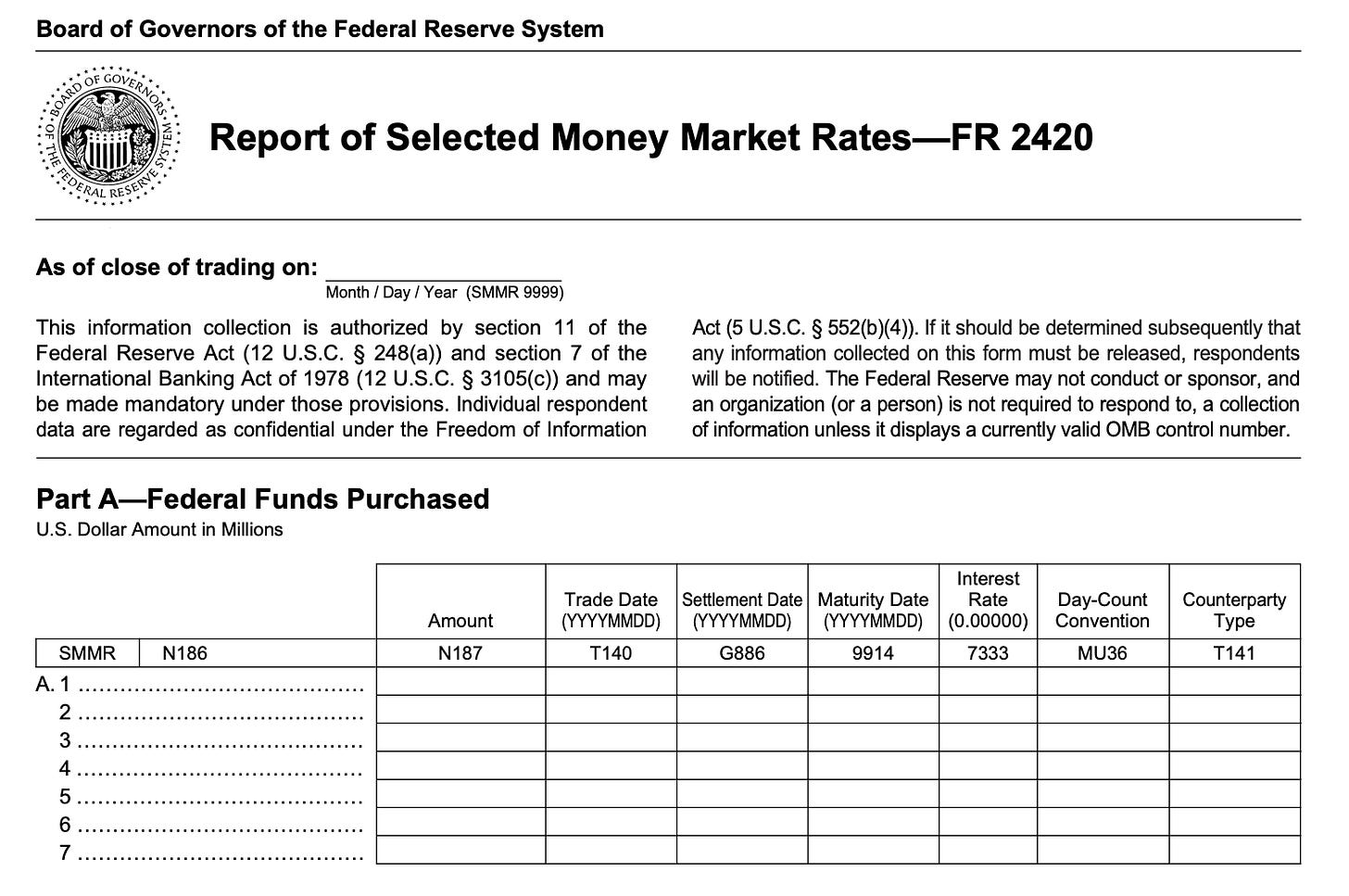

Effective Federal Funds Rate (EFFR) is calculated using data on overnight federal funds transactions provided by domestic banks and U.S. branches and agencies of foreign banks, as reported in the FR 2420.

The federal funds market consists of domestic unsecured borrowings in U.S. dollars by depository institutions from other depository institutions and certain other entities(U.S. branches and agencies of foreign banks), primarily government-sponsored enterprises (Federal Home Loan Banks ).

When a depository institution or certain other entities has surplus balances in its reserve account, it lends to other banks in need of larger balances. In simpler terms, a bank with excess cash, which is often referred to as liquidity, will lend to another bank that needs to quickly raise liquidity. (Time Series)

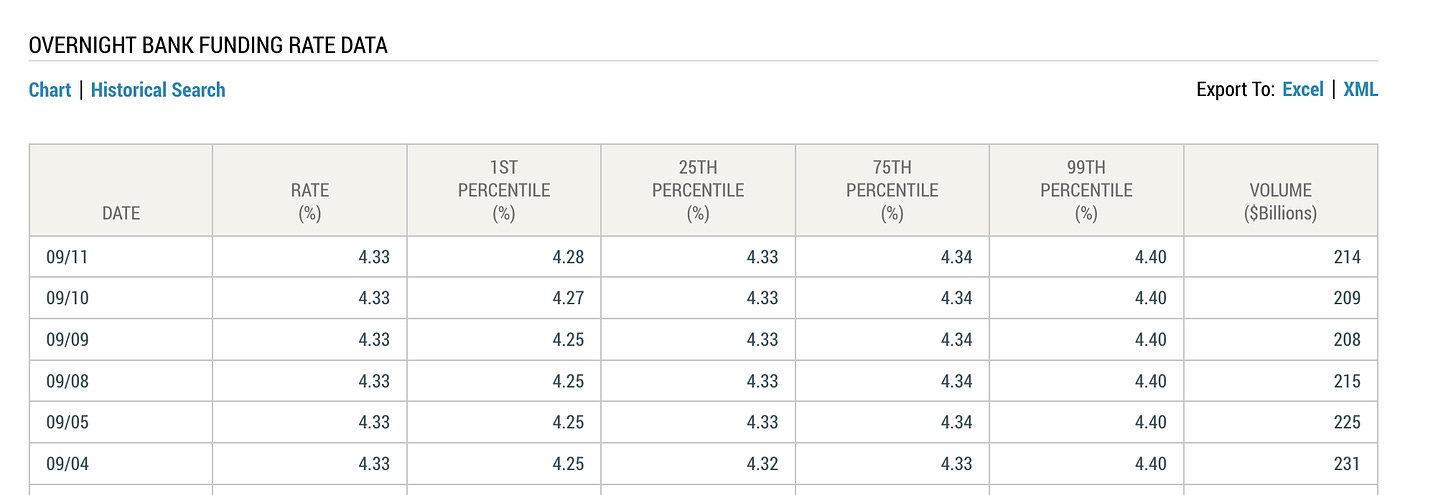

b-Overnight Bank Funding Rate (OBFR)

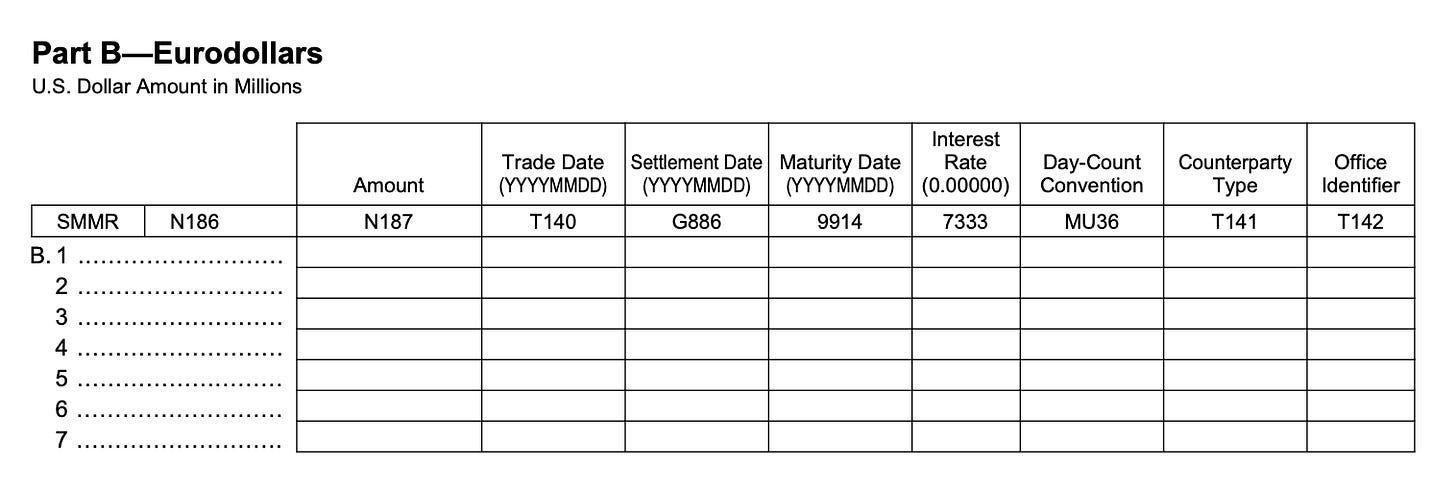

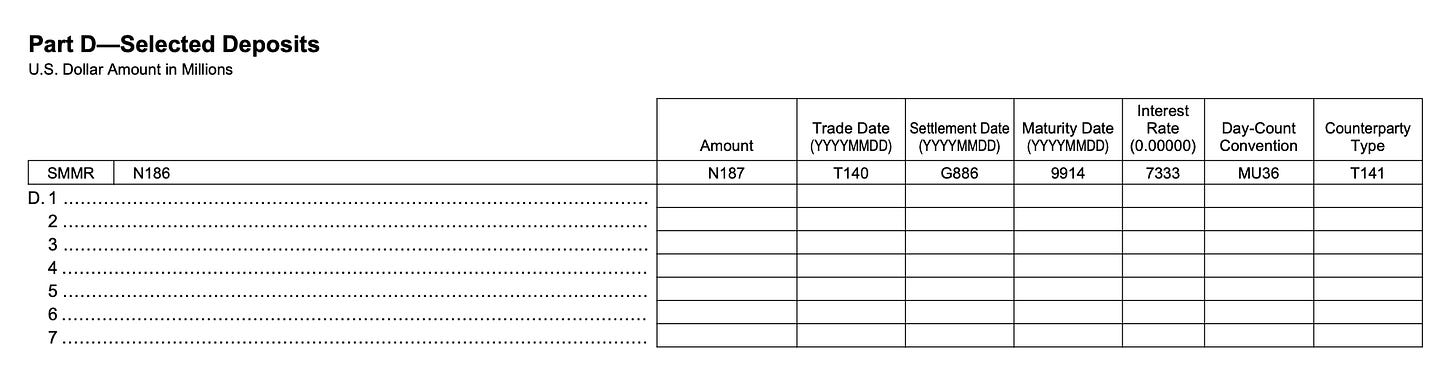

Overnight Bank Funding Rate (OBFR) is calculated using the same federal funds transaction data that is included in the EFFR, as well as certain overnight Eurodollar transaction data (Part B) and, as reported in Part D of the FR 2420, certain overnight “selected deposit” transactions that are placed at domestic bank branches. (The included Eurodollar transactions are unsecured borrowings of U.S. dollars booked at international banking facilities and at offshore branches that are managed or controlled by a U.S. banking office.) (Time Series)

Treasury Repo Reference Rates

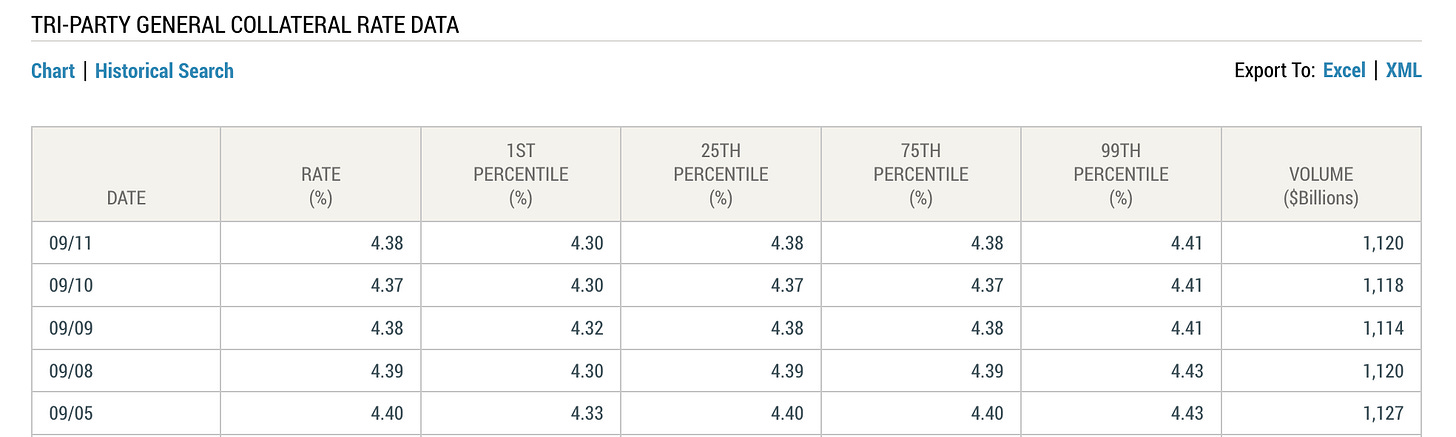

a-The Tri-Party General Collateral Rate (TGCR)

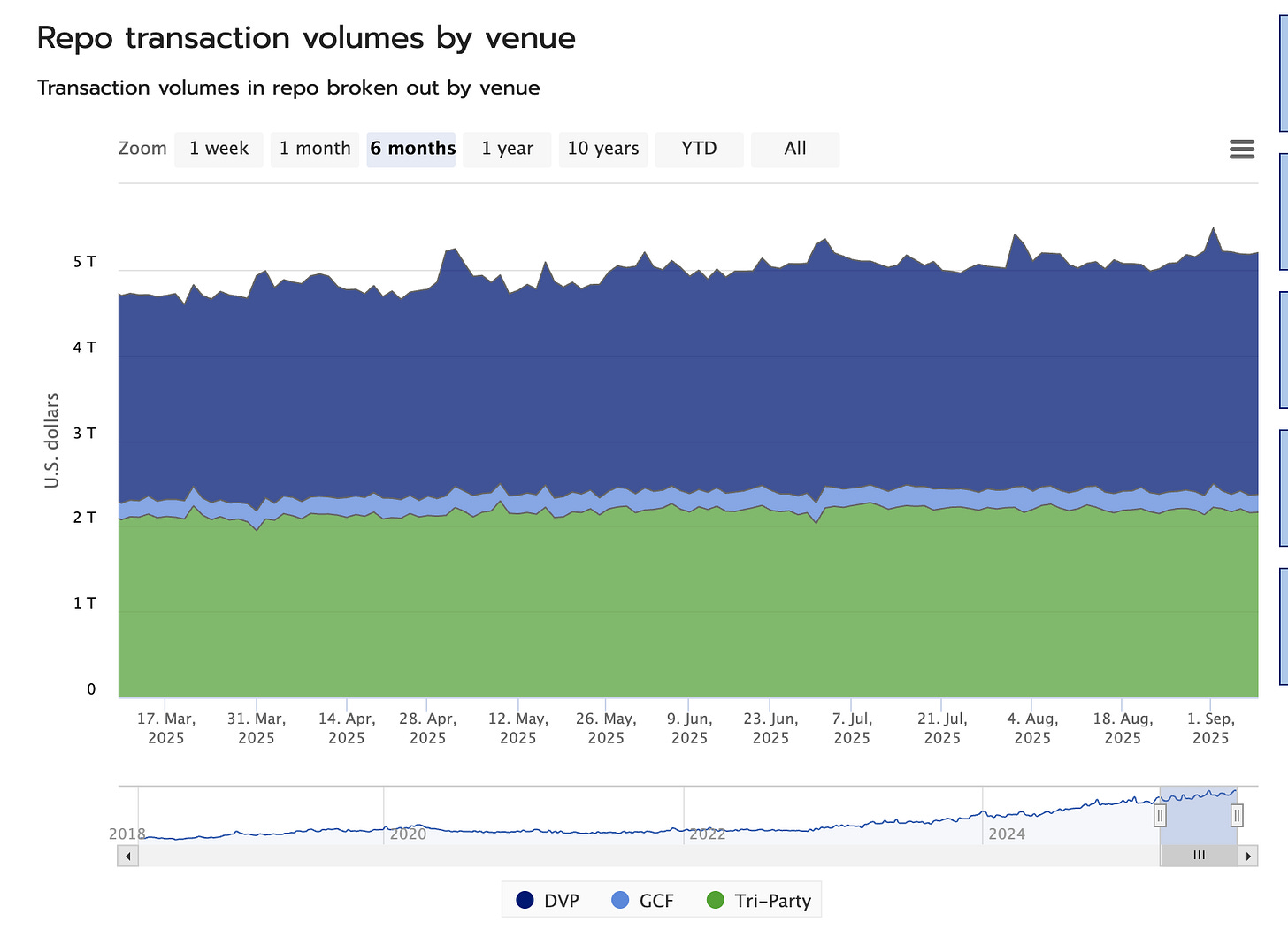

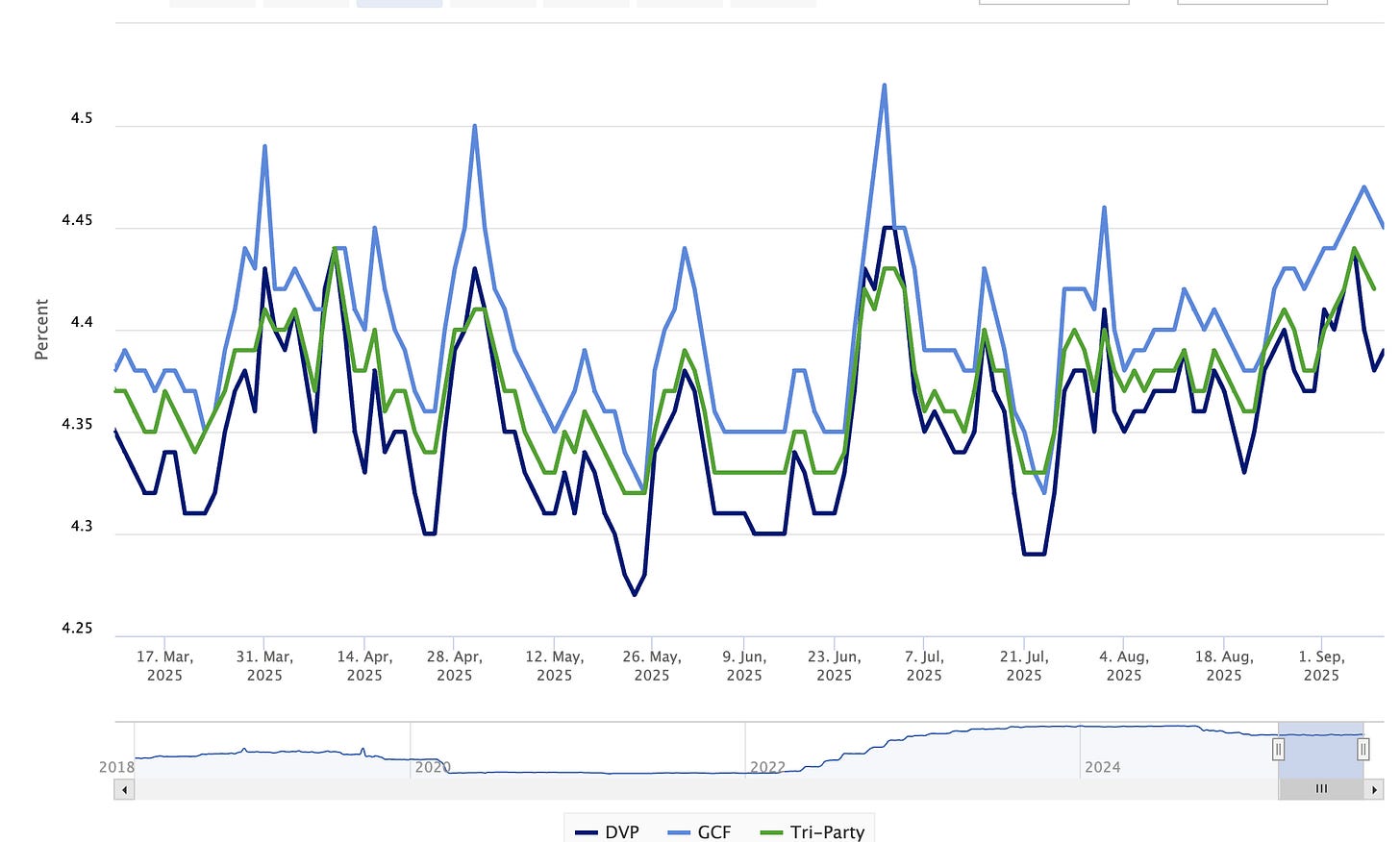

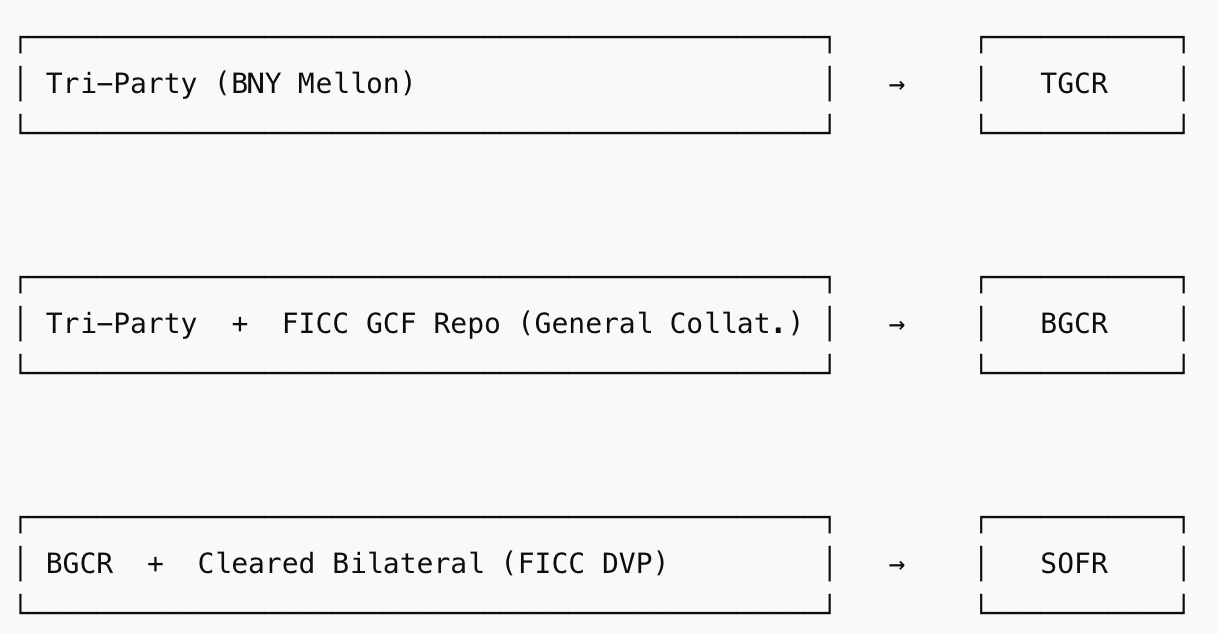

The Tri-Party General Collateral Rate (TGCR) is a measure of rates on overnight, specific-counterparty tri-party general collateral repo transactions secured by Treasury securities. The rate excludes GCF Repo transactions and transactions to which the Federal Reserve is a counterparty.

The Broad General Collateral Rate (BGCR) is a measure of rates on overnight Treasury general collateral repo transactions. The BGCR includes all trades used in the TGCR plus GCF Repo trades.

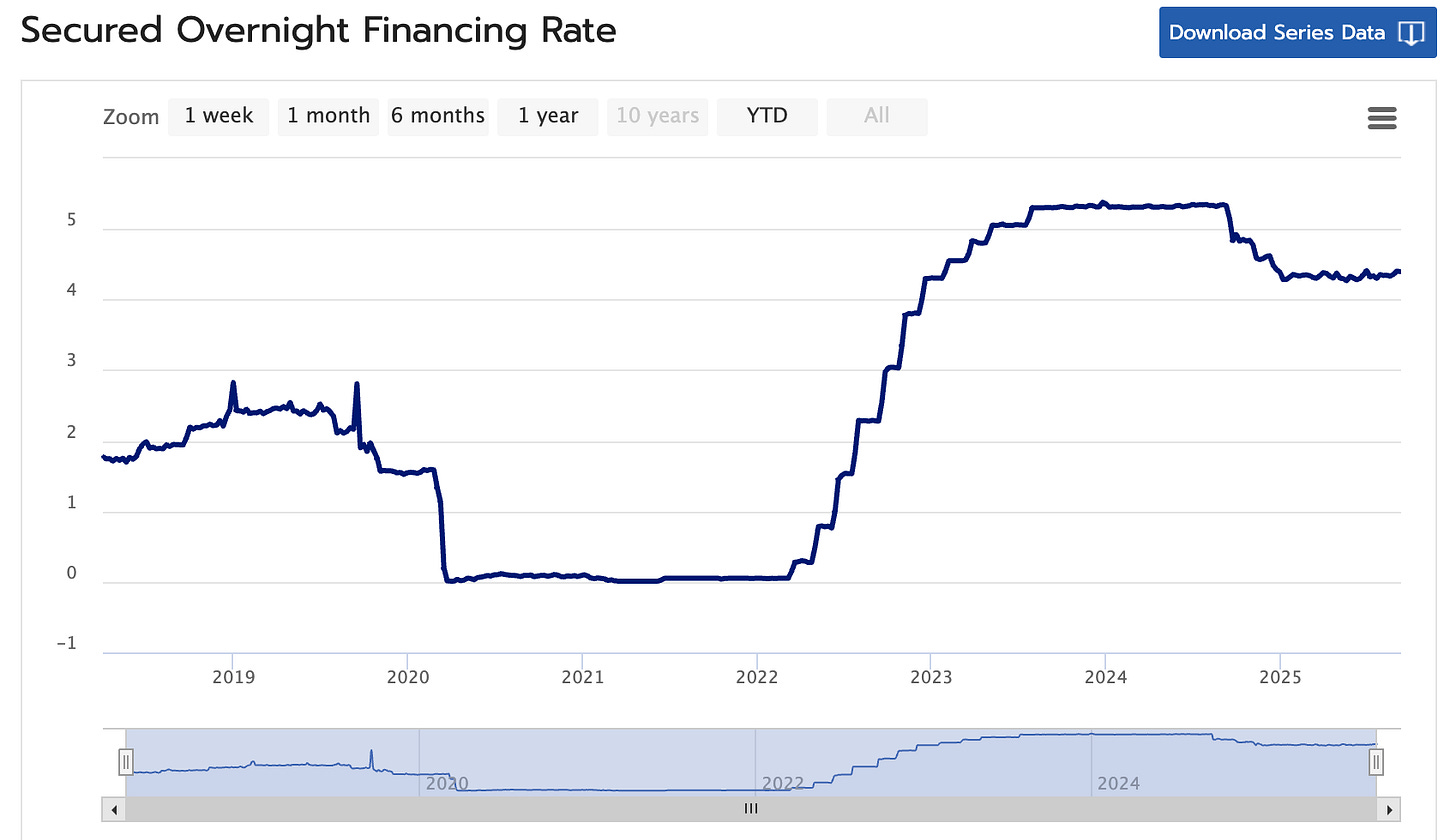

The Secured Overnight Financing Rate (SOFR) provides a broad measure of the general cost of financing Treasury securities overnight. The SOFR includes all trades used in the BGCR plus data on transactions cleared through the Fixed Income Clearing Corporation's Delivery-versus-Payment (DVP) repo service.

Source:

https://www.newyorkfed.org/markets/reference-rates/additional-information-about-reference-rates#effr_obfr_primary_data_inputs

https://www.financialresearch.gov/