Understanding Interest Rate Swaps: A Guide to Calculations

Understanding Interest Rate Swaps: A Guide to Calculations What is the Interest Rate Swap ? How to calculate the Interest Rate Swap? Interest Rate Swap Calculation #CFA101 #CFA #interestrateswap

Mastering Interest Rate Swaps: Your Guide to Calculations

Unlock the secrets of these financial powerhouses! Our guide demystifies swap calculations, helping you hedge risk, speculate on rates, and access better deals. Dive in and conquer the world of interest rate swaps! #finance #investing #derivatives

Welcome to our financial journey through the intricate world of Interest Rate Swaps (IRS) – a powerful financial instrument that allows companies to manage and optimize their interest rate exposure. In this blog post, we will delve into the fundamentals of Interest Rate Swap calculations, demystify the complex terminology, and guide you through the process of implementing these calculations using the versatile programming language, Python.

Understanding Interest Rate Swaps

Interest Rate Swaps are financial agreements between two parties to exchange cash flows based on interest rates. The market in dollar, euro, and sterling interest rate swaps is very large and very liquid. These are the most important type of swaps in terms of transaction volume. They are used to manage and hedge interest rate exposure or to speculate on the direction of interest rates.

Global (net - net) interest rate swaps (2023/Q1)

Global (net - net) interest rate swaps have reached 13.1 trillion dollar in first quarter of the 2023 according to the BIS statistics.

Why Python?

Python has become the language of choice for financial professionals due to its simplicity, readability, and a vast array of libraries specifically designed for financial modeling. In this series, we will leverage Python to demystify the calculations involved in Interest Rate Swaps, making it accessible for both finance professionals and enthusiasts alike.

What to Expect

In the upcoming posts, we will cover essential concepts such as:

Introduction to Interest Rate Swaps: A deep dive into the structure of Interest Rate Swaps, understanding the different types, and exploring the motivations behind their usage.

Cash Flow Modeling: Learn how to model the cash flows associated with Interest Rate Swaps, breaking down the payments and understanding their timing.

Python Libraries for Finance: Explore powerful Python libraries such as NumPy and pandas, which streamline complex financial calculations.

Implementation of Interest Rate Swap Calculations: Step-by-step guides on implementing Interest Rate Swap calculations using Python code, making it accessible for both beginners and seasoned developers.

Introduction to Interest Rate Swaps

An interest rate swap is an agreement between two counterparties to make periodic interest payments to one another during the life of the swap. These payments take place on a predetermined set of dates and are based on a notional principal amount. The principal is notional because it is never physically exchanged—hence the off-balance-sheet status of the transaction— but serves merely as a basis for calculating the interest payments (Choudhry).

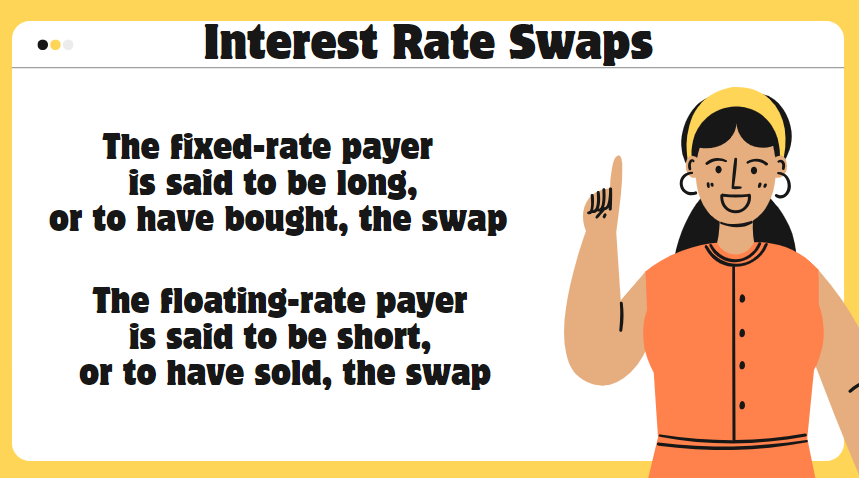

In a plain vanilla, or generic, swap, one party pays a fixed rate, agreed upon when the swap is initiated, and the other party pays a floating rate, which is tied to a specifi ed market index. The fixed-rate payer is said to be long, or to have bought, the swap. In essence, the long side of the transaction has purchased a floating-rate note and issued a fixed-coupon bond. The floating-rate payer is said to be short, or to have sold, the swap. This counterparty has, in essence, purchased a coupon bond and issued a floating rate note (Choudhry).

Cash Flow Modeling

Consider a plain vanilla interest rate swap with the following terms:(Choundry:136)

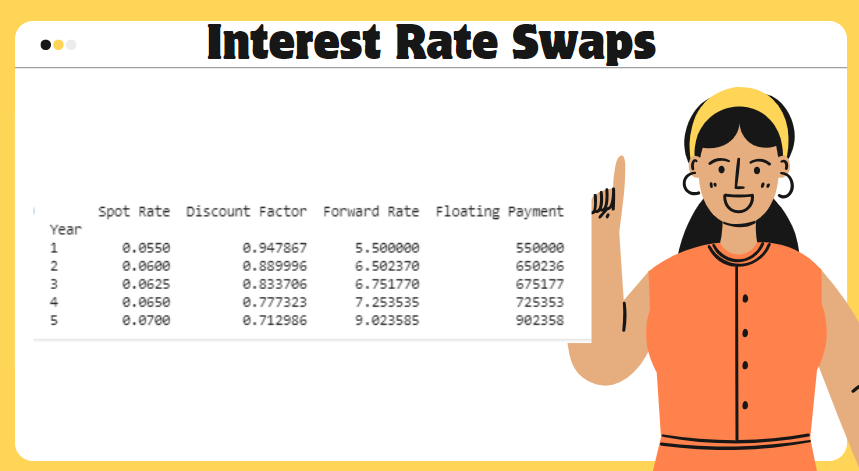

We need the zero coupon rates for 5 years.

Calculating Discount Factors

It is often helpful to use discount factors when pricing products such as interest rate swaps. A discount factor is the present value of 1 at the zero-coupon or spot rate to the receipt of that cash flow.

The following code calculates the discount factors from our spot rates (zero coupon rates).

# Calculate discount factors using this formula

discount_factors = [(1 / (1 + spot_rates[i]) ** i) for i in range(1, 6)]The long code version is in my github page.

The one-year spot rate is 5,50% .

The one-year discount factor at this rate is calculated as follows:

1/ (1+spot rate)^year

1/ (1+0.0550)^1 = 0.947867

The second-year spot rate is 6% .

The second-year discount factor at this rate is calculated as follows:

1/ (1+spot rate)^year

1/ (1+0.0600)^2 = 0.889996

One advantage of using discount factors is that the present value of a future cash flow can immediately be established by multiplying that cash flow by the discount factor for that time period.

Calculating Forward Rates

Normally we calculate forward rates as follows.

Now we calculate forward rates from discount factors.

# Calculate forward rates using this formula

forward_rates = [(discount_factors[i] / discount_factors[i + 1]) - 1 for i in range(4)]

forward_rates = [rate * 100 for rate in forward_rates] # Convert to percentageThe long code version is in my github page.

The one-year discount factor is 0.947867.

The one-year forward rate is calculated as follows:

([1/ (first year discount factor) ]-1)*100

([1/ (0.947867)] -1) *100 =5.50

The second-year discount factor is 0.889996

The second-year forward rate is calculated as follows:

([(first year discount factor) / (second year discount factor ]-1)*100

([0.947867 / 0.889996 )] -1) *100 =6.50

The third-year discount factor is 0.833706

The third-year forward rate is calculated as follows:

([(second year discount factor) / (third year discount factor ]-1)*100

([0.889996 / 0.833706 )] -1) *100 =6.75

Floating Payments

These forward rates are used to predict what the floating-rate payments will be

at each interest period.

Notional amount* floating rates

# Calculate floating payments for each year and round down

result_table['Floating Payment'] = [int(notional_principal * (forward_rate / 100)) for forward_rate in result_table['Forward Rate']]The long code version is in my github page.

The one-year floating payment is 550.000

The one-year floating payments is calculated as follows:

Notional amount* floating rates of first year

10.000.000* %5.50 =550.000

Fixed Payments

The fixed rate for the swap is calculated as follows,

FixedSwapRate= (1- last discount factor) / (the sum of discount factors)

# Calculate the fixed rate for the swap

FixedSwapRate = [(1 - discount_factors[-1]) / sum(discount_factors)]The magic number is 0.0689 [ %6.89]

Fixed Payments are calculated as follows

# Calculate fixed payments for each year

result_table['Fixed Payment'] = [int(notional_principal * FixedSwapRate[0]) for _ in result_table.index]PV Fixed Payments

For each year, calculate the present value (PV) of the fixed payment by dividing the spot rate for that year.

result_table['PV Fixed Payment'] = [int(fixed_payment / (1 + spot_rate) ** year) for yearPV Floating Payments

To calculate the present value (PV) of floating payments, we use the same logic as we did for fixed payments. For each year, calculate the present value (PV) of the floating payment by dividing the spot rate for that year.

# Calculate present value of floating payments for each year and round down

result_table['PV Floating Payment'] = [int(floating_payment / (1 + spot_rate) ** year) for yearThe present value of both PV's of the 5-year swap to be $2,870,137.

Engin YILMAZ (@veridelisi)

Source:

Choudhry, Moorad, (2005), Fixed-Income Securities and Derivatives Handbook: Analysis and Valuation

Why is the second picture AI?