Understanding Government Balance Sheets: A Guide to Spending, Taxes, and Borrowing (With Python Codes)

Dive into the world of balance sheets! See how spending, taxes, & borrowing impact the treasury balance sheet and economy. Is it a ticking time bomb? We break down the numbers. Read & be informed!

In this article, where we evaluate spending, taxation and borrowing, you will directly see the reflections of these concepts on the state balance sheet. We will process real data using Python and see how this data looks in the real government balance sheet.

Key Takeaways:

Treasury Closing Balance = Treasury Opening Balance + Deposits - Withdrawals

Deposits = Taxation + Borrowing

Withdrawals= Spending

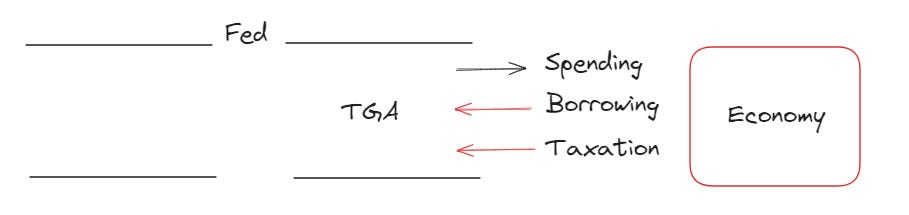

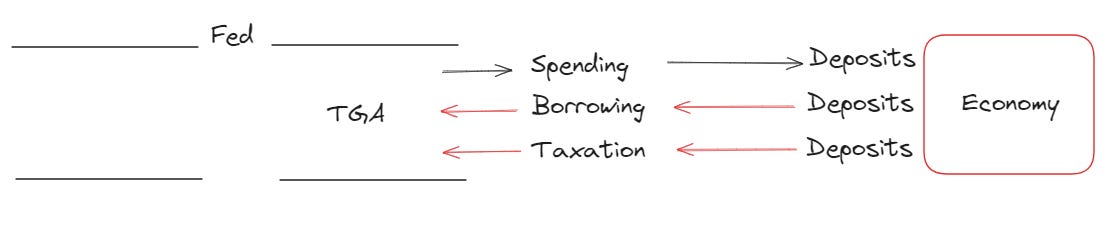

By law, the US government must tax and borrow in order to spend.

Through taxation and borrowing, deposits will be withdrawn from the market (reducing the money supply) and deposits will be increased again through spending (increasing the money supply).

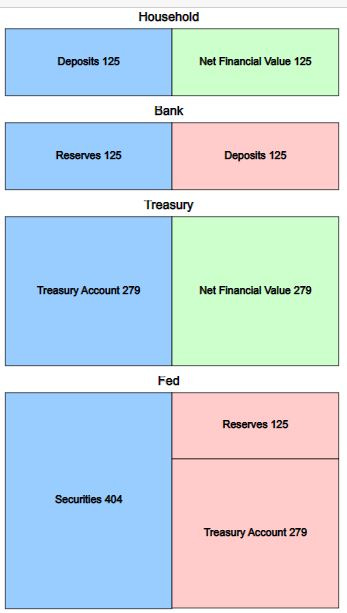

PUBLIC BALANCE ON MAY 11 (2023)

We go back to May 11th and analyze the US public balance. On the evening of May 11, after all the calculations are done, the treasury's account at the Fed (liability item) has $143 billion left. This will be the opening value for May 12. Remember this value.

From which sources does money enter this account during the day and why does money leave it? As you might expect, money in this account increases through tax collection and borrowing, and money in this account decreases through spending. The money in the economy increases with spending and decreases through tax collection and borrowing.

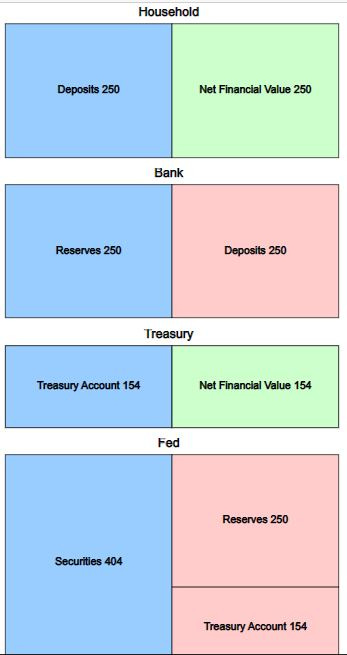

On the morning of May 11, the treasury had $154 billion(Opening Balance) in its account, but during the day the money in this account increased by $125 billion (Deposits) through taxes and borrowing and decreased by $136 billion (Withdrawals) due to expenditures.

At the end of the day, 154 +125-136 =$143 billion dollars (Closing Balance) remained.

$143 billion(Closing Balance) = $154 billion(Opening Balance) + $125 billion (Deposits) -$136 billion (Withdrawals)

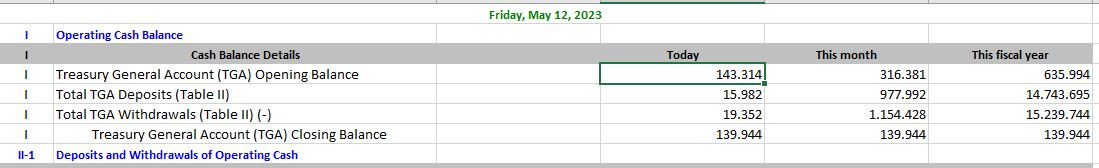

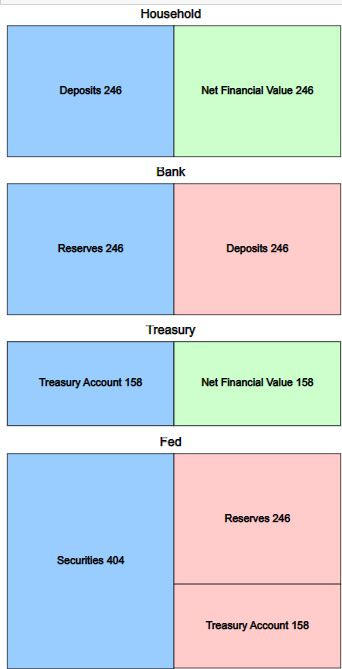

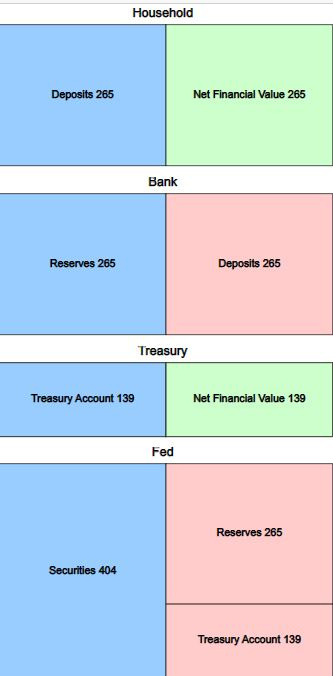

PUBLIC BALANCE ON MAY 12 (2023)

We go back to May 11th and analyze the US public balance. On the evening of May 11, after all the calculations were done, the Treasury's account at the Fed (the liability item) had $143 billion (Opening Balance) left, and this was the opening value on May 12.

During the day, 15 billion came in through taxes and borrowing (Deposits) and 19 billion (Withdrawals) was spent by the government. 139 billion (Closing Balance) remained at the end of the day (Closing Balance).

First of all, by law, the US government must tax and borrow in order to spend. Without taxation and borrowing, the treasury account at the Fed would be zero (0). Through taxation and borrowing, deposits will be withdrawn from the market (reducing the money supply) and deposits will be increased again through spending (increasing the money supply).

It is assumed that primary dealers are the borrowers. If there are banks, deposits will not decrease, reserves will decrease. In the next article, I will show that the current structure can also be established through transfers between the Fed and the Treasury. I will convey MMT's view in a way.

In total, deposits in the banking system increased by USD 4 billion at the end of the day (for May 12).

$143 billion (Opening Balance) - $139 billion (Closing Balance) = $4 billion deposit

Python Codes

PUBLIC BALANCE ON MAY 11 (Opening)

ON MAY 11 (Taxation and Borrowing)

ON MAY 11 (Spending)

ON MAY 12 (Taxation and Borrowing)

ON MAY 12 (Spending)

This is my github repository.

Engin YILMAZ (

)Source:

Daily Treasury Statement, (2023.05.11), Link

Daily Treasury Statement, (2023.05.12), Link

Also we discuss in reddit.

https://www.reddit.com/r/MMT/comments/18uhnww/mmt_modern_monetary_theory_explained_5_articles/