Primary Dealers' Power in Repo Market

What do Primary Dealers in Repo Market ? What are Primary Dealers ? Primary Dealers role in U.S economy ? All about the Primary Dealers #primarydealers

New, Hot and Fresh:

The daily repo transaction’s amount of primary dealers is nearly 3.1 trillion $.

U.S Treasury Securities and U.S Treasury Inflation-Protected Securities are nearly 2.2 trillion $. This amount is equal to the %70 of the repo transactions.

Watch This Article

What are the Primary Dealers?

This question is typically asking for an explanation of the concept or role of primary dealers. It seeks a definition of what primary dealers are and what they do in the context of finance and government securities. A primary dealer is an entity that purchases government securities directly from the government, aiming to resell them to other parties and thus serving as a market maker for these securities.

You would like to read more complicated text about the primary dealers. This is Treasury department’s statement about the primary dealers.

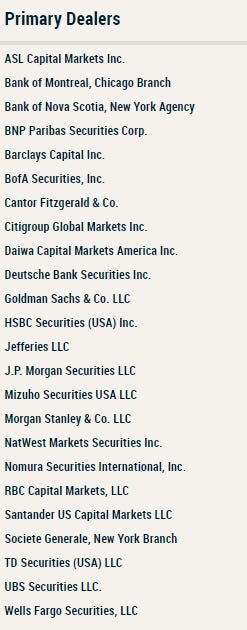

Who are the primary dealers in U.S?

There are 24 primary dealers (December 2023) in U.S financial system and these dealers are shown in N.Y Fed web site.

You are curious about historical list of the primary dealers, you can reach from this Historical Primary Dealer Lists . If you are extremely interested in the earlier historical background of these companies, you can read more about them here.

What are the functions of primary dealers?

(a) to participate consistently as a counterparty to the New York Fed in its execution of open market operations as directed by the Federal Open Market Committee (FOMC)

(b) to provide the New York Fed's trading desk with market information and analysis helpful in the formulation and implementation of monetary policy. (Fed, 2023)

What is the real function of primary dealers?

Primary dealers ensure the orderly functioning of the US financial system by acting as intermediaries in the repo market, where trillions of dollars and Treasury securities are circulated.

Primary Dealers’ Transaction Volume in Repo Market

OFR Short-term Funding Monitor web site gives us some clues about the transaction volume of the primary dealers. We find the detailed statistics on primary dealers from N.Y Fed web site. Fed gives us Market Data API and we can use this data to reach the repo transactions’ amount.

In my experience, this API is quite difficult to use. I will solve this with my python experience.

Python Code of Primary Dealers’ Transaction Volume

You can use my code to access the transaction amounts of the Primary Dealers in the repo market. Basically, you open my code and run in colab.

These are first result for every securities. (6 December 2023)

The repo market requires that borrowers pledge securities as collateral against the possibility they may default on a loan. Types of collateral vary and can influence the rate of return charged for short-term funding and the willingness of lenders to extend such funding. The two securities used (as collateral ) in the largest amount in repo transactions are U.S Treasury Securities and U.S Treasury Inflation-Protected Securities . The amount of these securities is nearly 2.2 trillion $. This amount is equal to the %70 of the repo transactions. The daily repo transaction’s amount of primary dealers is nearly 3.1 trillion $.

Repo Market Segments

Ok. We talk about this issue in next post.

Engin YILMAZ (

)Repo Market Visualized, How does it work?

In the U.S. financial market, the repurchase agreement (repo) market plays a crucial role in maintaining liquidity and supporting short-term borrowing needs. But how does this market actually work? In this article, we'll delve into the mechanics of the repo market, exploring the key players involved and the unique process of buying and selling repurchas…

Source:

Fed (2023). Primary Dealer Relationships: Frequently Asked Questions.https://www.newyorkfed.org/markets/pridealers_faq_100111.html

OFR U.S. Repo Markets Data Release . (2023). https://www.financialresearch.gov/short-term-funding-monitor/datasets/repo/ and https://www.financialresearch.gov/short-term-funding-monitor/market-digests/volume/chart-26/