Debt Deflation

What is Debt Deflation What is a Debt Deflation Spiral What are theCauses of Deflation What is The Debt-Deflation Theory What Is Debt Deflation and How Does It Affect the Economy? #deflation

This post aims to facilitate an understanding of what debt deflation is and how it operates, particularly from the perspective of Fisher (1933).

I intend to examine the issue of debt deflation as proposed by Fisher (1933), a relatively underexplored and underinvestigated topic in economics since the 1950s. Remarkably, it has not garnered significant attention in the economics literature over the last 70 years.

Firstly, I will explain other economic concepts that are often confused with deflation.

What is the recession?

Recession: A recession is a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales.(NBER)

The National Bureau of Economic Research (NBER) follows the inflation, unemployment and other economic indicators and creates the recession chart and publishes in it's web site. The National Bureau of Economic Research (NBER) identifies the recessions of 2008 (Global Financial Crisis) and 2020 (Covid-19 pandemic).

What is the depression?

Depression: The term depression is often used to refer to a particularly severe period of economic weakness. Some economists use it to refer only to the portion of these periods when economic activity is declining. The more common use, however, also encompasses the time until economic activity has returned to normal levels. The most recent episode in the United States that is generally regarded as a depression occurred in the 1930s. The NBER determined that a peak in economic activity occurred in August 1929, and that a trough occurred in March 1933.(NBER)

This is really big number. The numerical difference between March 1933 and August 1929 reflects a contraction period spanning 43 months. At least five banking crises were observed during this recessionary period.

In his popular intermediate macroeconomics textbook, Gregory Mankiw distinguishes between the two:

There are repeated periods during which real GDP falls, the most dramatic instance being the early 1930s. Such periods are called recessions if they are mild and depressions if they are more severe.

Simply put, a depression is characterized by a longer duration than a recession.

When you lose your job, it's a recession. When all your relatives lose their jobs, that's a depression!

What is the deflation?

Deflation: The term "deflation" in economics refers to a sustained and general decrease in the overall price level of goods and services in an economy. It is characterized by a persistent decline in prices in the economy.

What is the debt-deflation theory?

Debt-deflation theory was first stated in Fisher's lectures at Yale in 1931and first stated publicly before the American Association for the Advancement of Science, on January 1,1932. Fisher (1933) outlined his views in 49 points in the article titled "The Debt-Deflation Theory of Great Depressions". This article was published in Econometrica. Irving Fisher (1933) introduced the "debt-deflation" term, describing the reciprocal destabilizing interaction between debt and deflation.

The great booms and depressions, each of the above-named factors has played a subordinate role as compared with two dominant factors, namely over-indebtedness to start with and deflation following soon after. These two economic maladies, the debt disease and the price-level disease (or dollar disease), are, in the great booms and depressions, more important causes than all others put together (Fisher:341).

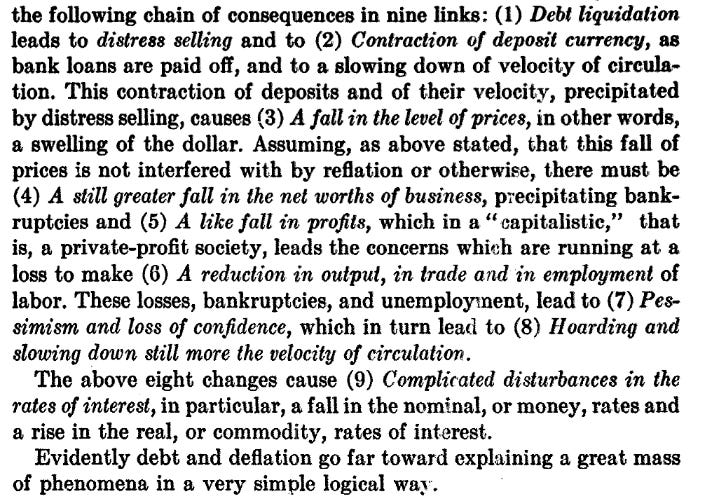

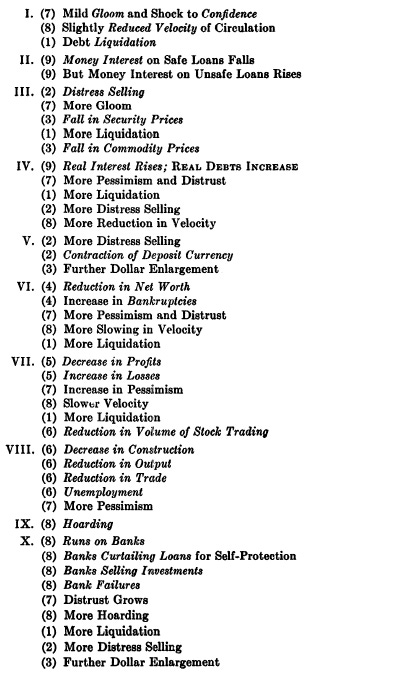

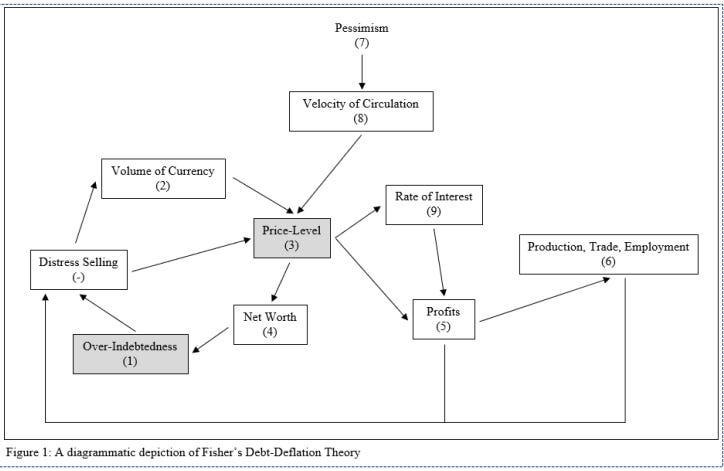

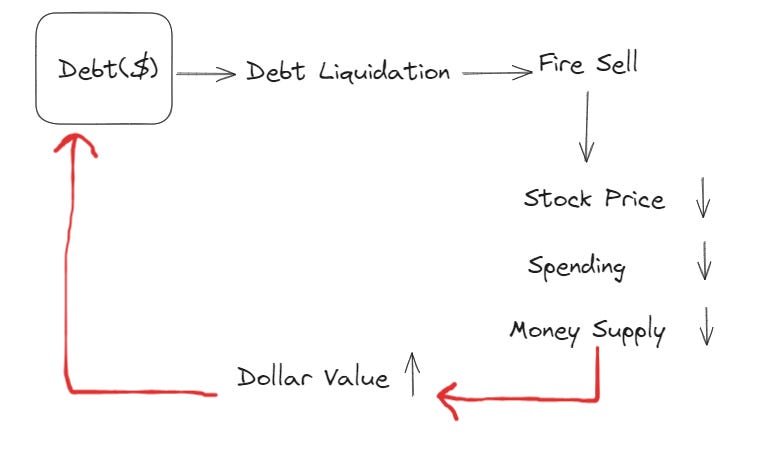

Fisher(1933: 342) summarized how the debt deflation creates the depression in the following nine steps.

Fisher(1933: 343) also gave the detailed explanation of each nine steps in debt-deflation process.

These steps are summarized by Quiviger(2019:3).

Fisher(1933) simplified this vicious circle in the following paragraph:

If the over-indebtedness with which we started was great enough, the liquidation of debts cannot keep up with the fall of prices which it causes. In that case, liquidation defeats itself. While it diminishes the number of dollars owed, it may not do so as fast as it increases the value of each dollar owed. Then, the very effort of individuals to lessen their burden of debts increases it, because of the mass effect of the stampede to liquidate in swelling each dollar owed. Then we have the great paradox which, I submit, is the chief secret of most, if not all, great depressions: The more the debtors pay, the more they owe (Fisher:344)

I try to visualize this vicious circle in the following graph:

The mass effort to get out of debt, sinks us more deeply into debt (Fisher:350)

Enrique Mendoza, professor at the University of Pennsylvania, wrote, comparing Irving Fisher’s debt-deflation mechanism to competing recession theories, that “today, […] there is no doubt that Fisher was right and that the rest are just stories". Mendoza (2010) draws three lessons from Fisher's debt deflation theory to address the challenges posed by the 2008 Global Financial Crisis from its standpoint.

Lesson 1: Fiscal stimulus is a band-aid. We need – now and for the next two years –massive government spending to support the unemployed and prevent the implosion of state and local governments.

Lesson 2: Deflation must be halted and reversed, and the credit system restarted. Today, as in the early 1930s, these two parts of the puzzle are tightly interrelated, as Fisher explained. Deflation will not stop if the collapse of the credit system is not contained, and the collapse of the credit system will not stop until the deflation of asset and goods prices is controlled.

Lesson 3: Prevention. We got into this mess because financial development advanced way ahead of not only regulators and government officials, but the actors in financial markets themselves, including the geniuses who created the innovative financial products that we have now come to know (and fear) by their acronyms – CDOs, MBSs, CMOs, and the greatest villain of all, CDSs!

This post seeks to highlight the significance of private debts, explaining why they are important and demonstrating the economic challenges they can create.

Engin YILMAZ ( Veridelisi )

Source:

Fisher, Irving 1933. ”The Debt-Deflation Theory of Great Depressions”, Econometrica, Vol. 1(4), October 1933, p. 337-57.

Goetz von Peter, 2005. "Debt-deflation: concepts and a stylised model", BIS Working Papers No 176

Quiviger, Zacharie , 2019, "Irving Fisher, the Debt-Deflation Theory, and the Crisis of 2008-2009",https://digitalcommons.iwu.edu/cgi/viewcontent.cgi?article=1529&context=uer

Mankiw, N. Gregory. 2003. Macroeconomics. Worth Publishers, New York, Fifth Edition

Mendoza, Enrique. 2010. "Hire Irving Fisher!",https://cepr.org/voxeu/columns/hire-irving-fisher

Milton Friedman and Anna Schwartz 1963. A Monetary History of the United States, 1867–1960

Reddit,2024, https://www.reddit.com/r/economy/comments/1f4byf5/can_someone_explain_to_me_why_deflation_would_be/