Credit Spreads 101: Why They Matter and How to Read Them (No finance degree required!)

Navigating the World of Credit Risk: A Step-by-Step Guide to Understanding Spreads Unlocking the Secrets of Credit Spreads: A Beginner's Guide to Risk Assessment Making Informed Investment Decisions

Worried about jargon-filled finance talk? Ditch the confusion! This presentation cracks the code on credit spreads, breaking down their essentials in crystal-clear terms. Learn why they matter, how to read them, and use them to make informed investment decisions. No finance degree required!

What are the Credit Spreads?

Credit Spreads attempt to capture the difference in credit quality by measuring the return of the credit risk security as a spread to some higher credit quality benchmark, typically either the government (assumed credit risk free) curve or the same maturity Libor swap rate (linked to the funding rate of the AA-rated commercial banking sector).(Sen:2004, 1)

You can see the six spreads in the Bloomberg new Yield and Spread Analysis page. Today I try to explain these spreads.

Yield Spreads over Benchmark Rates :

G-Spread

I-Spread

Asset Swap Spread (ASW)

Yield Spreads over the Benchmark Yield Curve:

Z-Spread

The Option Adjusted Spread (OAS)

What is G-Spread?

"G-spread" typically refers to the Government Spread. The Government Spread is a measure of the yield difference between a specific bond or security and a comparable government bond. It helps assess the credit risk associated with a particular bond by comparing its yield to that of a government bond, which is considered a benchmark for low-risk investments.

Here's how the G-spread is calculated:

Yield of Corporate Bond−Yield of Comparable Government Bond

For example, if you are looking at the G-spread for a corporate bond, you would compare its yield to the yield of a government bond with a similar maturity.

In the Bloomberg Terminal, you can find G-spread information for various bonds and securities by entering the relevant Bloomberg code or using the Bloomberg function for spread analysis. The G-spread is a key metric for fixed-income investors and analysts, providing insights into the additional yield investors demand for taking on the credit risk associated with corporate or non-governmental bonds. It's important to note that G-spread is just one of several measures used to assess credit risk, and investors often consider multiple factors when evaluating the attractiveness of a fixed-income investment.

G-spread measures are only rough measures of return. In no way do they actually measure the realised yield of holding the asset. For these reasons, the yield spread should only be used strictly as a way to express the price of a bond relative to the benchmark, rather than a measure of credit risk.(Sen:2004, 4)

What is I-Spread?

I-Spread is the interpolated spread. The Interpolated Spread or I-spread is the difference between the yield to maturity of the bond and the linearly interpolated yield to the same maturity on an appropriate reference curve.(Sen:2004, 4) The reference curve may refer to government debt securities or interest rate swaps. You can use I-spread against US Treasury yield curve or I-spread relative to US Swap Curve.

I-spread generally is the yield spread of a specific bond over the standard swap rate in that currency of the same tenor.

If the reference curve is upward sloping and the benchmark has a shorter maturity then the I-spread will be less than the G-spread.

If the reference curve is downward sloping and the maturity is shorter than that of the benchmark then the I-spread will be greater than the G-spread.

I-spread does take into account the shape of the term structure of interest rates, but only in a very crude way. (Sen:2004, 6)

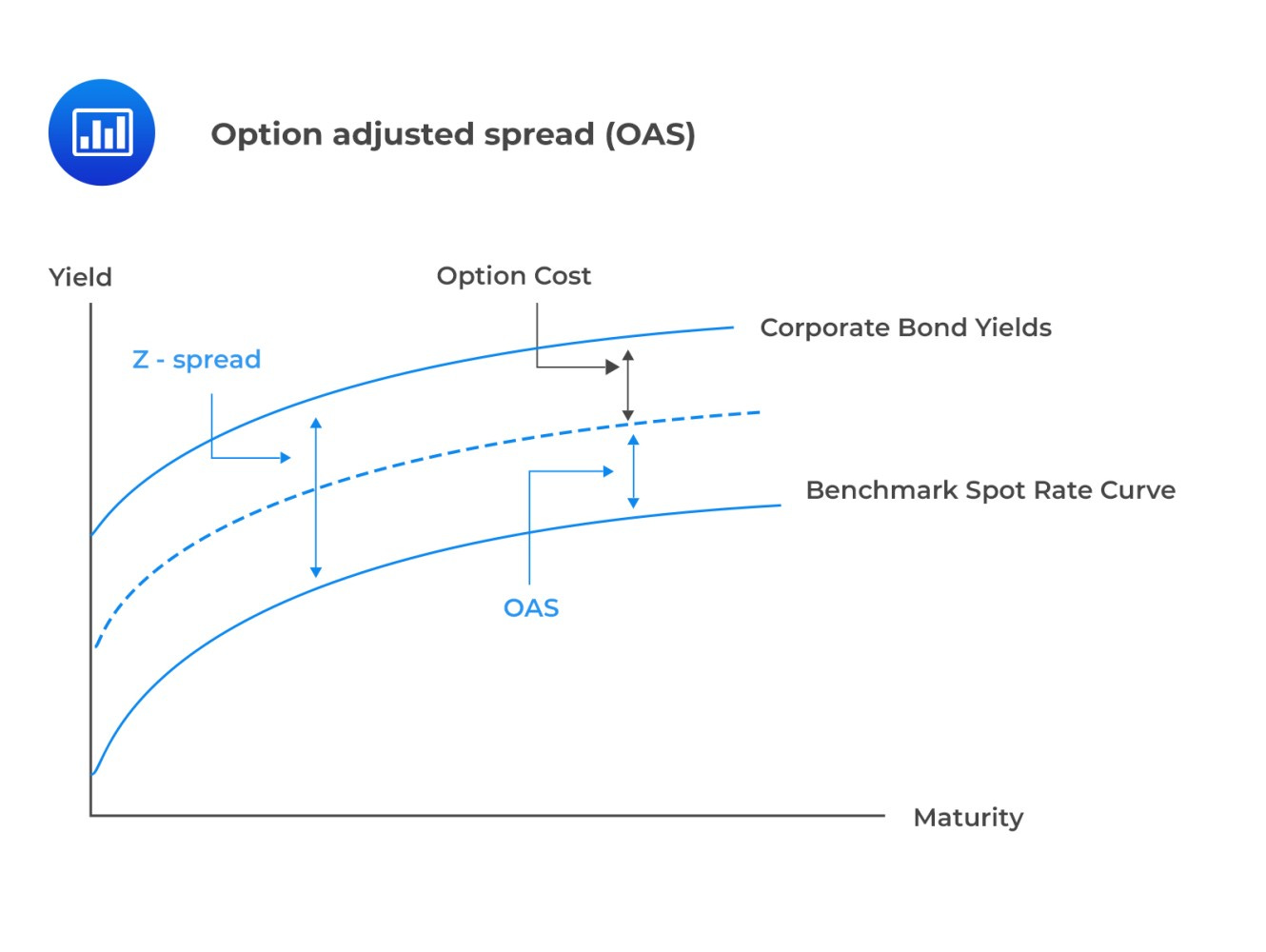

What is OAS?

The OAS is The Option Adjusted Spread The option-adjusted spread (OAS) measures the difference in yield between a bond with an embedded option, such as an MBS or callables, with the yield on Treasuries. The OAS reflects the MBS’ average spread over U.S. Treasury bonds of a similar maturity, taking into account the fact that the MBS may be liquidated early from the exercise of the prepayment option by the underlying mortgagors.

Option adjusted spread (OAS)=Z-Spread–Option cost

What is Z-Spread?

Since the Z-spread uses the entire yield curve to value the individual cash flows of a bond, it provides a more realistic valuation than an interpolated yield spread based on a single point of the curve, such as the bond's final maturity date or weighted-average life.The Z-spread uses the zero-coupon yield curve to calculate spread, so is a more realistic, and effective, spread to use. The zero-coupon curve used in the calculation is derived from the interest-rate swap curve.

However, it does not include the value of the embedded options, which can have a big impact on the present value.

What is Basis?

It means CDS basis.

The Z-spread is widely used as the "cash" benchmark for calculating the CDS basis. The CDS basis is commonly the CDS fee minus the Z-spread for a fixed-rate cash bond of the same issuer and maturity. For instance, if a corporation's 10-year CDS is trading at 200 bp and the Z-spread for the corporation's 10-year cash bond is 287 bp, then its 10-year CDS basis is –87 bp.

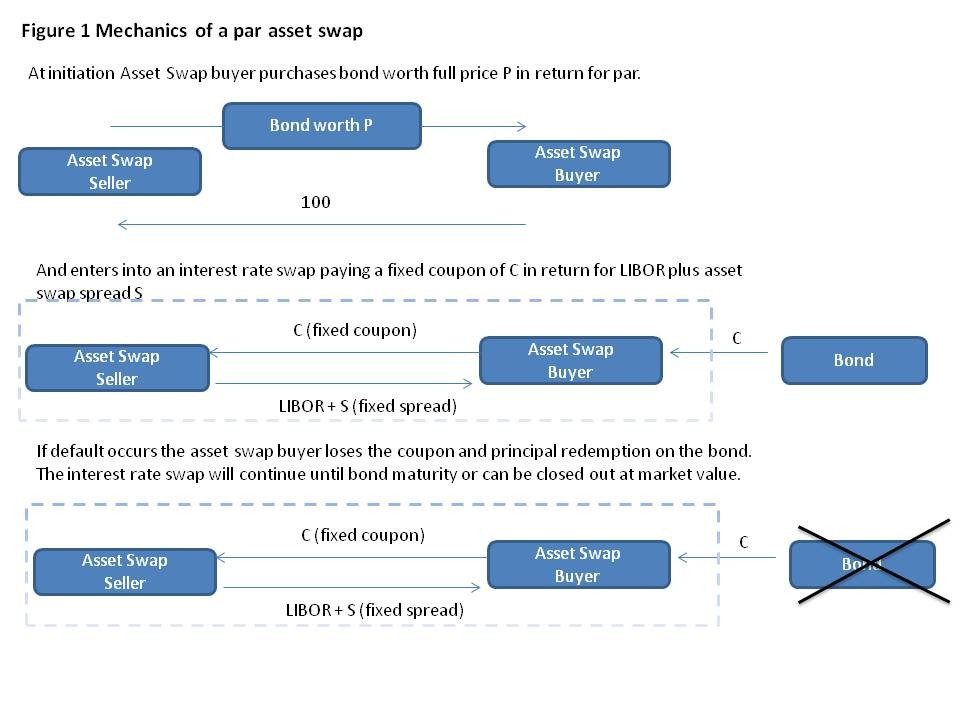

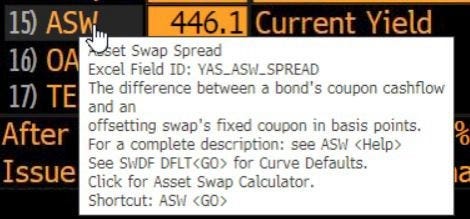

What is ASW?

The Asset swap spread is the spread over LIBOR paid on the floating leg in a par asset swap package.

Thanks to Oğuzhan Avşaroğlu

Engin YILMAZ ( Veridelisi )

Sources:

Dominic O'Kane and Saurav Sen (2004), Credit Spreads Explained, Fixed Income Quantitative Credit Research March 2004, Lehman Brothers

M, Choudhry(2012),The Futures Bond Basis, Relative Value Analysis Bond Spreads